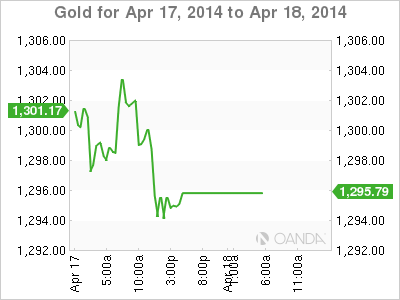

Gold prices dipped on Thursday, falling below the key $1300 level, as excellent readings from Unemployment Claims and the Philly Fed Manufacturing Index helped push down the precious metal. On Good Friday, gold is trading quietly, with a spot price of $1294.80. We can expect thin trading during the day, with no releases out of the US.

US releases ended the week on a high note, as employment and manufacturing numbers were strong. The all-important Unemployment Claims was up slightly to 304 thousand, but had no trouble beating the estimate of 316 thousand. With the Federal Reserve planning another trim to its QE program at the end of the month and speculation rising about a possible interest rate increase next year, every employment release is under the market microscope. Meanwhile, the Philly Fed Manufacturing Index soared to 16.6 points, its best showing since September. This was well above the estimate of 9.6 points.

Comments by Federal Reserve chair Janet Yellen on Wednesday continue to weigh on the US dollar. Yellen said there is little inflationary pressure on the economy, and it was unlikely that the Fed's inflation target of 2% would be met. She added that although the economy has showed signs of recovery, unemployment remains a sore spot. The Fed has abandoned its promise to maintain interest rates at least as long as the unemployment rate is above 6.5%, but the dovish stance we are seeing from Yellen means that a rate hike is unlikely in the near future.

The crisis in the Ukraine continues to simmer, as Russian President Vladimir Putin threatened to act his "right" to attack Ukraine. There have been several skirmishes between pro-Russian militiamen and Ukrainian forces, and casualties have been reported on both sides. Secretary of State John Kerry and his Russian counterpart met on Thursday, but a quick resolution is unlikely. Western Europe is dependent on Russian oil and gas, so we can expect the markets to react if the crisis intensifies.

XAU/USD 1294.80 H: 1294.80 L: 1292.80

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.