World markets were traded lower on Friday. Average Hourly Earnings in December, released in the United States, indicated unexpected decrease and affected investor’s sentiment. Non-Farm Employment Change outperformed the outlook, Unemployment Rate dropped to the lowest level over 6.5 years (5.6%). In general, 2.95 million new jobs were created in the US in 2014, the highest level since 1999. However, stocks were traded lower along with the US dollar index. The stocks that posted the biggest losses were JPMorgan Chase (-1,7%) and Wells Fargo (-1,6%). Investors are concerned that next week these companies may publish weak Q4 earnings reports. The volume traded on US exchanges was 12% lower than the weekly average and amounted to 6.3 billion shares. We don’t expect any significant US statistics released today.

Today European indices are advancing on US stock futures lead. Crude oil prices hit new low. Investors deem that cheap hydrocarbons would accelerate the economies of western countries. Amid additional positive news from the EU we would like to note that pharmaceutical company Shire bought NPS Pharmaceuticals for $5.2 billion. This was the reason why other stocks in medical sector rose as well. Today macroeconomic reports in the EU are not expected.

Japanese markets are closed due to the Bank holiday, Coming-of-Age Day. Note that tomorrow morning a few economic indicators will be released in Japan. They have little chances to affect markets. Trade Balance in December will be published in China: it may have a strong impact on commodity futures prices.

Crude oil prices have continued dipping as the investment bank Goldman Sachs cut its WTI price outlook from $70 to $41 a barrel in the first half of the year, and down to $47 for the entire 2015. According to Goldman Sachs, the average Brent crude oil price would be $50.4 a barrel this year. The bank expects that WTI-Brent spread could increase up to $5, from $1,5-2 .

Precious metals continued to go up. The weekly rise in gold prices was the largest since July. SPDR Gold Trust reserves upped 0.4%, to 707.8 tons. According to U.S. Commodity Futures Trading Commission (CFTC), gold net log positions rose 8.5% over the week and hit the five-month high.

Coffee prices have boosted amid information about drought forecasts in Brazil published by Somar Meteorologia and MDA Weather Services. So 40% of the crop is in jeopardy. The weekly increase in coffee prices was the highest over 11 months. According to CFTC, net long positions rose 6.6% over the week, the largest increase since October.The majority of other commodities sagged on fallen oil prices. Oil makes up a significant part of their production.

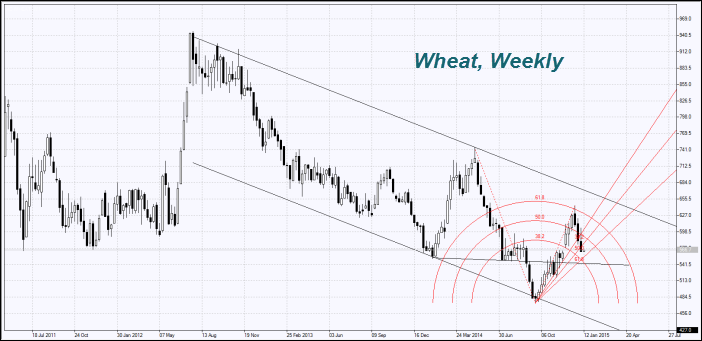

Today at 17:00 CET USDA is expected to release the quarterly report revealing the data on global grain supply and demand, and the amount of grain inventories in the US. Moreover, winter wheat crop in the US will be assessed. The data may affect strongly the price. Most market participants expect wheat-cultivated areas would expand. Prices hit six-week lows on Friday. According to CFTC, wheat accounted for net short positions, meanwhile soybeans – net long positions.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.