The Dollar Index made significant fluctuations on Friday, but as a result remained almost unchanged. The U.S. labor market economic data in February proved to be controversial. The number of jobs in the non-agricultural sector (Nonfarm Payrolls) increased by 175 thousand people. This is better than expected. At the same time, unemployment still rose to 6.7%, which is worse than the forecast. According to futures quotations on interest rates, the probability of their improvement is 54% by June next year .

This week, we expect the most important economic data from the U.S. to be released on Thursday/ as well as (retail sales) in the EZ an (industrial production) on Wednesday. Since most of market participants expect another decline in U.S. government bonds redemption at the end of the Fed meeting on March 19, we do not exclude the growth of the Dollar Index in case of good economic performance.

Exports from China in February unexpectedly fell by 18.1% compared to February of the last year. Since most of market participants expect it to be larger quotation were influenced. Imports increased by 10.1%. As a result, the trade deficit in China totaled $ 23 billion in February. This information caused the strengthening of the Japanese yen (USDJPY), weakening of the Australian dollar (AUDUSD), and a marked drop in Copper prices.

The important economic data will be released in Australia on Tuesday, Wednesday and Thursday. In particular the business confidence index for February is coming out tomorrow at 00-30 GMT.

Note that there was a noticeable weakening of the Japanese yen (rise on the chart) on Friday due to weak macroeconomic information. The GDP growth in the fourth quarter was worse than expected and amounted to 0.7% in annual terms. The current account deficit was also weaker than expectations. This is especially negative for export-oriented Japanese economy. However, the data from China have caused change in direction of the Yen and it strengthened today (fall in the chart ). Investors see the Yen as a safe heaven currency in the case of economic problems in China. This week, will bring the macroeconomic data from Japan everyday, so the Yen can be quite volatile. Now market participants are focused on the results of the BOJ meeting, which will be announced on Tuesday. It is expected to continue easing the monetary policy aimed at weakening the exchange rate: emission 60-70 trillion Yen per year to redeem Japanese government bonds and the sales tax increase from 5% to 8% since April 1st.

Because of the fall in Chinese exports, the Copper price in Shanghai on Friday fell by 5 % to its lowest level in more than four years. Meanwhile, imports of Copper to China in January -February 2014 increased by 41.2 % to 915 thousand tons compared to the previous year. Therefore, we believe that falling prices may be short-lived. China consumes 45% of world Copper production. It is not excluded that the quotations were also affected by the first corporate default on the bonds in China in addition to weak exports. The solar energy equipment manufacturer, Solar Shaori did not pay any percentage on its debt securities. The copper is actively used in the industry.

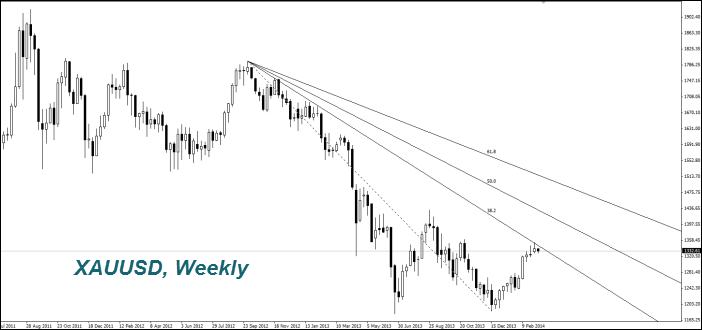

Gold (XAUUSD) comes cheaper for the second consecutive day. Investors believe the U.S. labor market data to be acceptable for further economic growth. The political situation has stabilized around Crimea partly on anticipation of a general referendum of its residents on March 16. It will decide the future status of the peninsula. An additional factor of reducing the Gold price are the signs of a slowdown in the Chinese economy. Meanwhile, according to the U.S. Commission on Commodity Futures Trading (CFTC), the number of net long positions on Gold (net-long) last week increased by 3.8% to the highest level since December 2012, 118.2 thousand contracts. In this regard we can not exclude the resumption of growth in Gold prices after the correction.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.