Last Update At 20 Oct 2014 00:03GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning down

21 HR EMA

0.9455

55 HR EMA

0.9454

Trend Hourly Chart

Sideways

Hourly Indicators

Rising

13 HR RSI

58

14 HR DMI

+ve

Daily Analysis

Consolidation with upside bias

Resistance

0.9563 - Wed's high

0.9525 - 50% r of 0.9690-0.9360

0.9491 - Last Thur's high

Support

0.9405 - Last Thur's low

0.9360 - Last Wed's fresh 3-week low

0.9301 - Sep 16 low

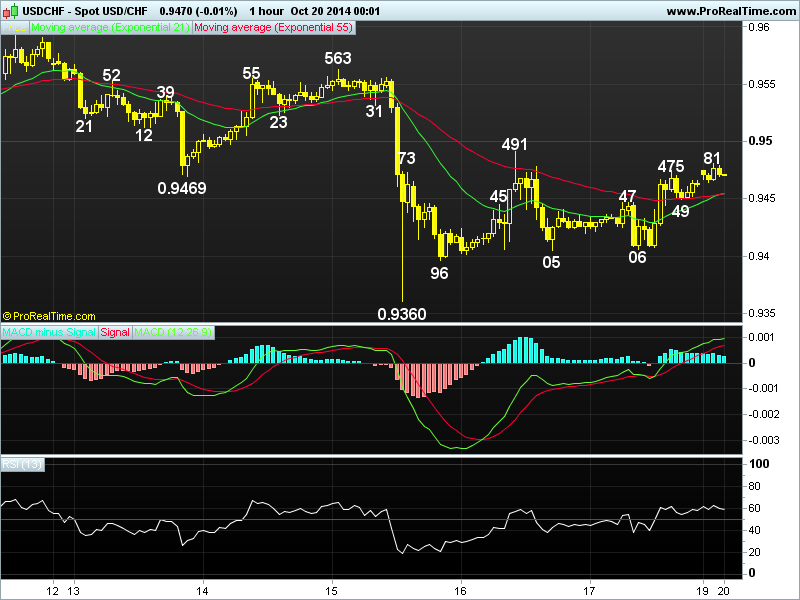

. USD/CHF - 0.9469...The greenback also swung wildly in opposite direction to euro last week. Despite initial weakness to 0.9469 on Mon, price recovered to 0.9563 Wed but only to tank to a near 3-week trough of 0.9360 after downbeat US retail sales, price later bounced back to 0.9491 Thur n moved sideways on Fri.

. Let's look at daily picture 1st, dlr's erratic decline fm Oct's fresh 1-year peak at 0.9670 n then last week's breach of 0.9470 sup to 0.9360 confirms MT rise fm 2014 near 2-1/2 year trough at 0.8698 (Mar) has indeed formed a tempo rary top at 0.9690 n consolidation with downside bias is seen for further weakness to 0.9311, this is a 'minimum' 38.2% r of aforesaid upmove fm 0.8698, a daily close below daily sup at 0.9301 is needed to bring stronger correction twd 0.9194 (50% r). As daily technical are turning down, suggesting consolidation with downside bias is in store this week. On the upside, only a daily clsoe abv0.9563 (last week's high on Wed) wud dampen present bearish bias on dlr.

. Today, dlr's erratic rise fm 0.9360 to 0.9491 signals 1st leg of said correction fm 0.9690 has ended, abv 0.9491 wud add credence to this view n bring stronger gain to 0.9525 (50% r) but res at 0.9563 shud cap upside.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.