Key Highlights

Australian Dollar remains in a downtrend, and might continue to weaken against the Japanese Yen in the short term.

There are many hurdles for buyers around 91.20-40, stalling the upside in the AUDJPY pair.

Australian Foreign Exchange Transaction released by the Reserve Bank of Australia came in at 674M, which was lower compared with the last 2,922M.

Japanese Securities investment, released by Ministry of Finance came in at ¥600.3B, more than the last reading ¥110.8B.

AUDJPY Technical Analysis

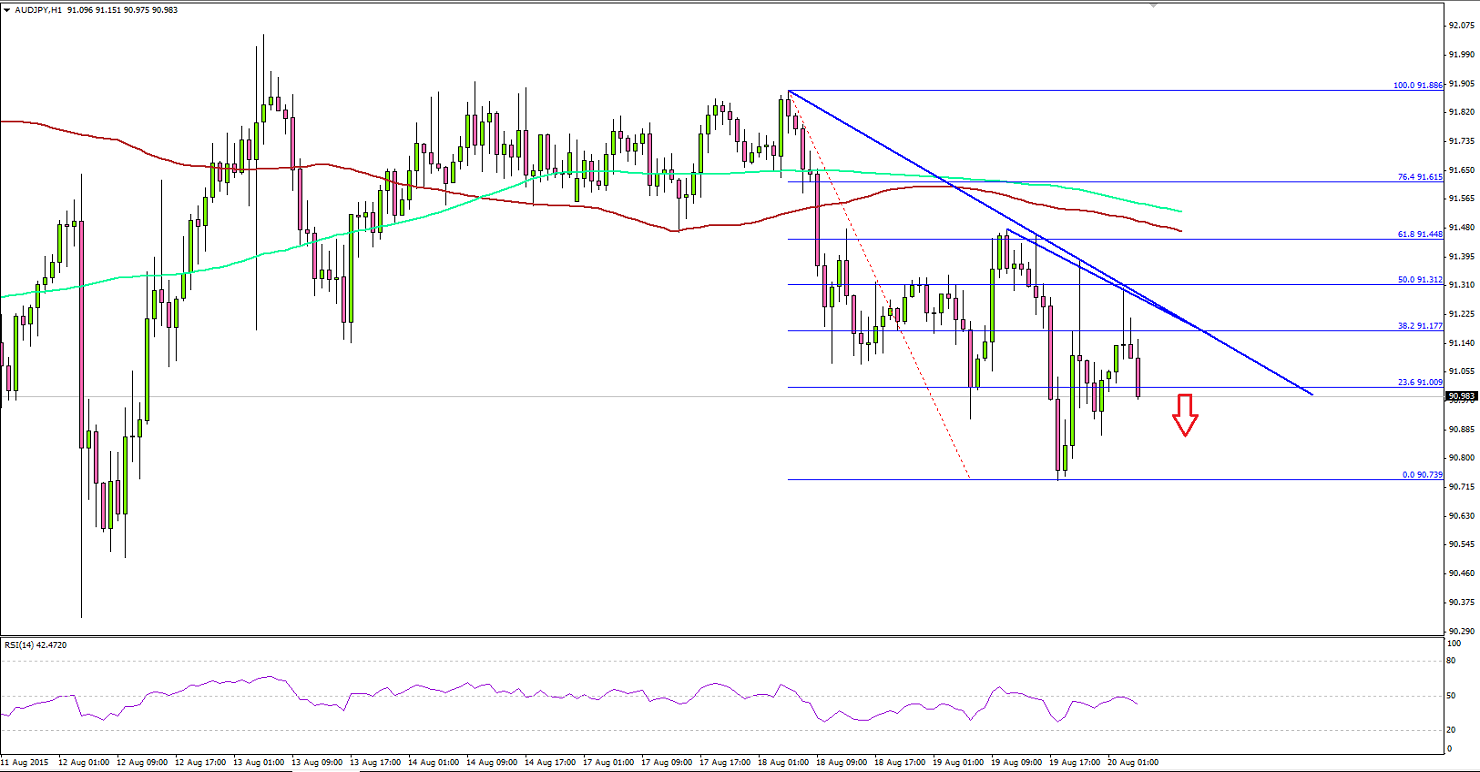

The AUDJPY pair is under bearish pressure, as there are a couple of bearish trend lines formed on the hourly chart. The highlighted trend lines are acting as a barrier for buyers, and might push the pair further lower in the near term. The most interesting thing is that the pair is below the 100 and 200 hourly simple moving averages, which is a negative sign. The hourly RSI is struggling to clear the 50 levels, suggesting the amount of bearish pressure on the AUDJPY pair.

Moreover, the 50% Fib retracement level of the last leg from the 91.88 high to 90.73 low is also on the upside to act as a resistance. As long as the pair is below the highlighted trend line and resistance zone, more losses are possible.

On the downside, an initial support can be seen around 90.50, followed by the last swing low of 90.73. A break below it might call for a new low moving ahead.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.