Trading yesterday was not for the faint of heart. Global markets were shaken by continued weak growth readings in China and Europe coupled with the Reserve Bank of Australia (RBA) surprise decision to lower rates.

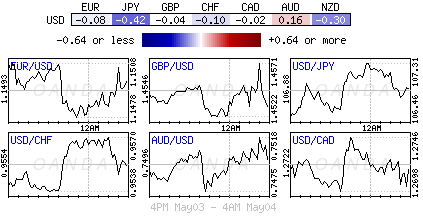

The various asset price moves were complemented by a significant reversal to the ‘mighty’ buck.

As we head to the open stateside, the mood is somewhat subdued, but investors concerns are the same as the market gears itself up for the granddaddy of all economic indicators, Friday’s non-farm payroll (NFP).

1. Dollars dominates proceedings

It seems that the dollar ‘bear’ can never afford to get too comfortable for too long. The recent pressure applied to the world’s reserve currency has been slow and persistent. A reversal in dollar positioning tends to quick, painful and unabated. Despite the above-mentioned reasons why the dollars rise, this week’s turn can also be attributed to further Fed talk.

Yesterday’s comments from Fed officials Lockhart and Williams suggesting a rate hike in June was still a possibility continue to help the ‘buck’ recover some of its recent steep losses. The depth of the sharp moves would suggest that dealers and investors have massively under-priced for a June Fed move.

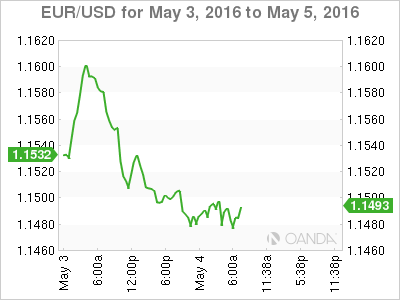

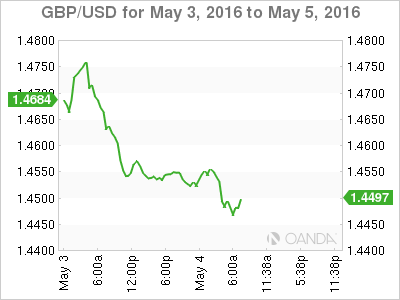

USD/JPY trades up +0.2% at 106.86, well above its 18-month low print yesterday (¥105.55). EUR/USD is down -0.1% at $1.1481, off an eight-month peak above $1.16 on Tuesday, while GBP/USD trades down -0.4% at $1.4490 after having hit a peak around $1.4771.

2. Brexit Polls

It was only yesterday that the pound was able to achieve wiping out all of this year’s losses against the dollar (£1.4771). Since then, the near -300-pip drop can be attributed to the combination of the dollars strength, disappointing fundamentals and some strong technicals.

At new yearly highs, any Brexit fears would only naturally come back to haunt the pound. Another ICM poll yesterday revealed a slight lead for those in favour of leaving the EU at +45%, against +44% to remain. On Tuesday, an unexpectedly weak survey on U.K. manufacturing activity suggested uncertainty ahead of the referendum was already highlighting the vulnerability of the U.K economy if there were a vote to leave.

For sterling watchers, their focus will now shift to tomorrows PMI survey on the key services sector.

3. Crude price slump

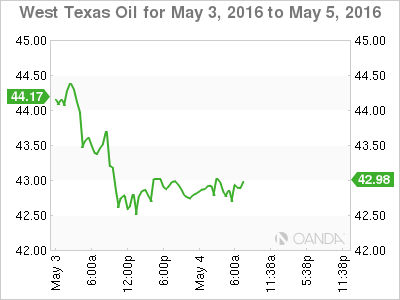

A sharp drop in oil prices is buoying the dollar against the currencies of commodity producing countries (CAD, AUD and NOK), including a broad band of emerging markets (MXN, BRL and RUB).

As we head to the open stateside, oil prices continue their slump. WTI has now fallen to trade around $43.50, atop of their one-week lows. After peaking last week above $48, Brent has fallen to $44.80, down another -2.3% in the last 24-hours. The instigator? There are more reports about squabbling between Saudi Arabia and Iran over OPEC strategy and on global growth fears.

Yesterday’s weekly API data saw another, not surprising build of inventories – +1.3m vs. -1.1m prior. Dealers are now waiting for this morning’s weekly DOE crude oil inventories print to justify their next direction stance.

4. Treasury sentiment most bearish since mid-March

Month-end April data (JP Morgan client survey) suggests that market sentiment has turned the most bearish toward Treasuries since mid-March. Be forewarned, yesterday’s gains in U.S bond prices, driven mostly by safer haven demand, should remind all the ‘bears’ that they might need to tread carefully.

Investors who expect bond prices to rise fell to +14% during the week ended Monday from +18% a week earlier, while those expecting a decline rose to +22% from +21%.

The 10-year yield is at +1.793% vs. +1.865% Monday’s close.

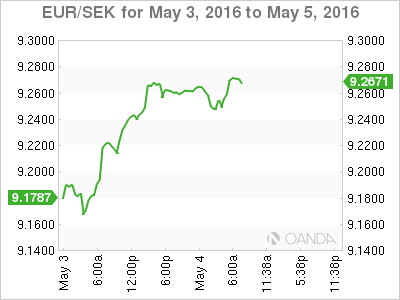

5. Sweden’s Riksbank Minutes reinstates readiness to act on FX

Out earlier today, the minutes of the Swedish central bank’s most recent policy meeting revealed no new surprises, but the central message is clear – the Riksbank remains ready to act if the currency strengthens (€9.2680).

Deputy Governor Per Jansson described the risk of the krona strengthening too quickly as “overhanging”. The Deputy Governor insisted that the extension to the Riksbank bond-buying program, which was agreed at the latest meeting, was the right call to signal that the bank remains as committed as ever to its +2% inflation target.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.