Thin Trading Conditions Dominate Holiday

Greece: No “Mula” for the IMF

Rising Prices Makes Fed Hike Timing Difficult

Fixed Income Looks to September for First Hike

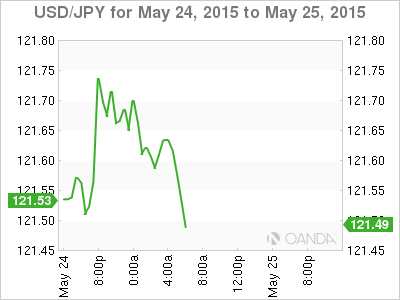

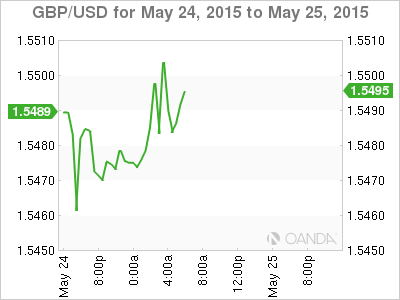

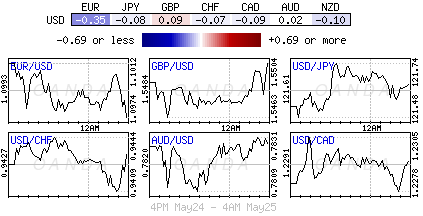

Over the past few weeks the dollar bull had been trading with their backs against the wall, pressured by the spike in global sovereign bond yields, and the questionable timing of the Fed’s first-rate hike that seemed to have been pushed further out the curve due to soft U.S data.

However, dollar bulls can breathe a little easier, supported by Friday’s upbeat U.S inflation data and comments by Fed Chairwomen Janet Yellen have managed to push the USD higher against G10 currencies. The dollar is looking to build upon its gains last week in which it saw it best weekly performance in four-years.

With U.S markets and most of Europe on holiday today, the thinned trading conditions will have most investors looking ahead to tomorrow’s forward-looking U.S durables data and Friday’s release of second estimate of U.S GDP as key fundamental touch points for the dollars direction. Obviously, any in-between Greek or Grexit sound bites is expected to have an immediate impact on the EUR, similar to what happened in the overnight session in Asia.

Greece’s Cupboard is Bare

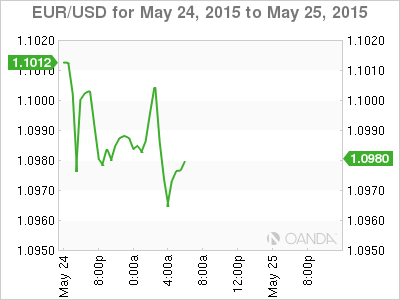

The single currency (€1.0970) saw some early session weakness, as the standoff between Athens and European creditors appears to have gone from bad to worse with Greece announcing that they will not have the money to repay the €1.6b to the IMF next month unless a new deal with creditors is reached. Greece remains steadfast with PM Tsipras reiterating that there is a limit to what the Greek government is prepared to accept from the creditors. Even if the standoff does result in a stalemate, a national referendum is not likely to break the situation – a weekend poll shows that +59% support the government’s position, but +71% still want to keep the EUR. The rest of Europe doesn’t want to talk alternatives, as Athens needs to deliver what it promised.

Investors should expect the EUR to remain vulnerable to Greek rhetoric; at least until there is clarity around what’s real or not. The currency is likely to trade with risks to the downside this week as long as the EUR/USD stay’s below Friday’s high of €1.1208. A breach through €1.0920 on the downside would expose the single unit to last months low of €1.0819.

Rising U.S Core-Inflation Makes Fed’s Job Harder

The +0.3% month-over-month increase in core-consumer prices in April, which pushed the three-month annualized rate of core-inflation up to a four-year high of +2.6%, leaves Yellen and company with less scope to delay raising interest rates until it sees more evidence of a rebound in ‘real’ activity.

With the employment cost index suggesting that U.S wage growth is accelerating and the CPI indicating that underlying price inflation is rising, the Fed really cannot wait forever before beginning to raise interest rates from near zero.

Since the FOMC’s late April meeting, U.S. economic news has been generally mixed, keeping rate hike odds favoring a September liftoff and possibly as late as December. Last week’s FOMC minutes noted that there was a lengthy discussion about the possibility that the recent weakness in the economic pace may persist. A number of Fed officials suggested that the earlier impact of the dollar’s strength and weak oil prices could be longer lasting than anticipated.

However. Friday’s data has influenced a number of fixed income traders to consider pulling in the timing of the first Fed hike. September is still the most likely lift-off date, but July is not out of the question, particularly not if there are another couple of robust rises in core-consumer prices.

Fixed Income Hangs on Yellen’s Every Word

On Friday, Fed Chair Janet Yellen argued that the slowdown in Q1 GDP growth was “largely” due to temporary factors, such as the record cold weather and port dispute. The market took “largely” as being more important/convincing than Ms. Yellen’s “in part” used in the most recent FOMC statement (there will be a rebound in growth in the Q2).

Ms. Yellen also seems to be warming up to the idea that some of this “apparent” Q1 slowdown “may just be statistical noise”. The market is looking to the U.S Bureau of Economic Analysis to revise the GDP figures to eradicate any “residual seasonality.”

Yellen repeated her assessment that “it will be appropriate at some point this year to take the initial step to raise the federal funds target.” Not a very transparent statement on timing, but, if you include rebounding economic growth, plus a pick up in consumer prices, supported by wage growth and you have a fixed income market now pricing in a rate hike no later than this September.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.