Eurogroup reports progress in bailout negotiations with Greece

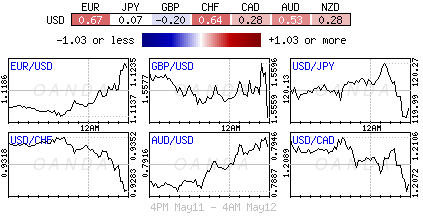

Market chasing EUR stops of recent spec bets

Fed wants markets to adjust to rate uncertainty

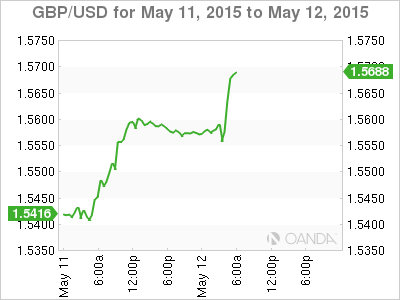

Sterling bears are whipped

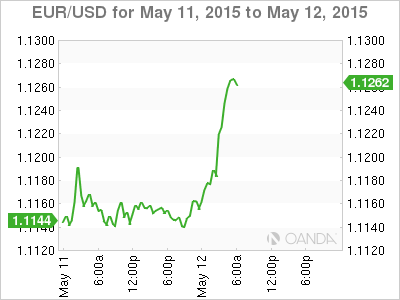

Yesterday, the EUR bear was on the cusp of recording a major win. The 19-member single currency stood on the verge of rolling deep into negativity territory, only to be rescued by plummeting bond prices and rising yields, and some timely Federal Reserve member comments.

A somewhat productive Eurogroup meeting on Monday, and Greece completing a €750 million loan repayment to the International Monetary Fund a day early, has also managed to squeeze the plethora of short EUR positions that continue to be unsuccessful in speculating on picking a EUR top (€1.1267). Athens appears to have given the European Central Bank a reason to maintain the life support for Greece’s financial system by persuading their German-led creditors that they will deliver the policies needed to escape a default, but only time will tell.

Market Chases EUR Stops

The 10-year U.S. Treasury yield hit a fresh six-month high overnight (+2.31%), but that was not enough to stop the USD slipping back as German bund yields have rallied (+0.68%) more aggressively, tightening the U.S.-bund spread (+163 basis points), which is also aiding the EUR. Receding deflation concerns, upcoming supply issues, and worries about trading liquidity have all been cited as reasons behind the recent selloff of U.S. debt product. Not to be underestimated, the market is also chasing the weaker stops of the most recent speculative bets now that the EUR has penetrated key speculative levels (€1.1219 and €1.1257), supported by liquidity issues.

The Fed Will Not Telegraph Its Decision

Key EUR stop-loss levels were taken on because of New York Fed President William Dudley’s comments earlier this morning. He indicated that the market should not be surprised when the Fed gets around to raising short-term interest rates. The conditions that will determine the timing of the first rate hike are “well specified” (improved job market and inflation back up to its +2% price goal) and “market participants should be able to think right along with policymakers, adjusting their views about the prospect for normalization in response to incoming data.” He gave no firm guidance about when rates would go up — last month he said that “hopefully” it can happen this year. In fact, he said he is unsure when the Fed would hike rates. The market is using Dudley’s comments as an excuse to squeeze the vulnerable EUR short side.

The EUR bear will be required to keep taps on the Treasury-bund spread for directional guidance. If that spread tightens it tends to favor the EUR, but if it eases or remains unchanged, it would suggest that the most recent of FX moves would not be sustainable.

Sterling Bulls on a Rampage

It was supposed to be so different, but the U.K. conservatives’ majority win last week has upset many speculators’ plans. The pound was supposed to keel over on a hung election result, but that did not come to fruition. Instead, sterling this morning has pushed into new 2015 outright highs, just shy of £1.57, and threatening to barrel on to unprecedented heights topside supported by the technicals and stronger data. The bears continue to cite specific strong resistance levels (£1.5710, 25, and 50), and mentioned unclosed technical gaps below (£1.5274 and £1.5335 remains unclosed) that need to fill as reason enough why the GBP bull party could be coming to an end.

This morning, U.K. manufacturing and industrial production data for March beat forecasts, propelling sterling’s rise. It was the unexpected revival in North Sea oil and gas production that supported the +0.5% production increase on the month. The market was expecting only a +0.1% increase. Manufacturing output came in +0.4% on the month, +1.1% on the year against +0.3% and +1% expected. The surprise increase means the Office for National Statistics now estimates industrial sector output increased +0.1% in the first quarter, compared with the estimated -0.1% fall in output in its original estimate of overall first-quarter gross domestic product (first quarter growth remains at +0.3% for now).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.