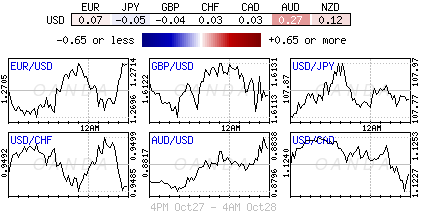

With central banks continuing to pull the strings it’s not too much of a surprise to see limited forex movement ahead of and around most monetary policy announcements. The Federal Open Market Committee (FOMC) begins its two-day meeting today and most expect the committee to make the final taper, ending bond purchases ($15B) and beginning the countdown to interest rate hikes. It was only a couple of weeks ago that one of the members, Federal Reserve Bank of St. Louis Governor James Bullard, indicated that the FOMC should consider delaying the end of the quantitative easing (QE) taper this month to help stem the slide in inflation expectations, but the market does not seem to be buying into his opinions.

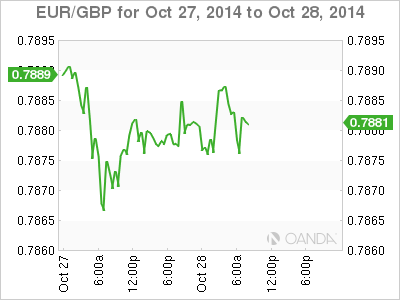

What the market wants to know is whether this week’s FOMC meet will provide the trigger for further big dollar gains in the near-term. No matter what, investors should be expecting volatility to remain subdued ahead of tomorrow’s afternoon announcement. It’s only when there is a surprise that volatility will pick up, just like this morning’s Swedish Riksbank announcement. Most expect the Fed to maintain its commitment to keeping low rates for a “considerable” time, while acknowledging the weaker outlook for global growth – a near prerequisite for every central banker these days. This, coupled with QE finally coming to an end, should be working to limit the U.S. dollar’s rise in the medium-term.

Sweden Joins the ZIRP Club

Even in a subdued trading range something always moves. The trick is to seek out that one potential currency pair that will provide an opportunity trade. While most investors have been focused on waiting for the FOMC meet, it was the Swedish central bank that provided this morning’s market opportunity by slashing interest rates to a record low of zero percent.

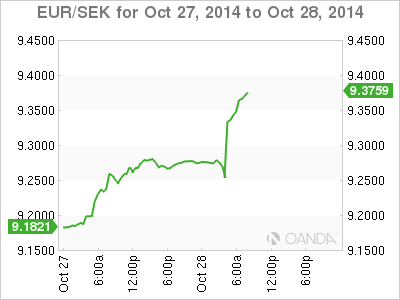

The SEK (kroner) is sharply lower after the Riksbank cuts its repo rate by -25bps to zero and pushed back its view of the first potential rate hike out until mid-2016. The market had been expecting a smaller trim, to +0.05%. The EUR/SEK surged from €9.27 to test near the €9.35 level, while USD/SEK is trading near its four-year high. Swedish policymakers have provided the market with forward guidance that will most likely keep their repo rate at these levels until inflation does pick up. This was more dovish than the market was expecting and it’s the reason why there has been a 17-big handle change on the currency pair since the European open.

Central Banks Have Markets by the Throat

For the next 10 days, monetary policy decisions dominate the asset class landscape. The FOMC and Reserve Bank of New Zealand (Oct. 29), Bank of Japan (Oct. 30), Reserve Bank of Australia (Nov. 3), and the Bank of England and European Central Bank (Nov. 6) will all be making public statements. Even in a low-rate environment it’s difficult to anticipate “the” extraordinary move, just like the one made by Sweden’s Riksbank. But being aware of the potential to act accordingly is a big part of the battle. Traders are mostly interested in price movement — either up or down — to provide opportunity. Investors, on the other hand, are concerned with returns and price appreciation or depreciation.

The Central Bank of Russia (CBR) is widely expected to raise interest rates at its regular meeting this Friday. Why? The country’s annual inflation has already exceeded this year’s ceiling. Nevertheless, market consensus believes that a tighter monetary policy may not be strong enough to stem the rouble’s (RUB) rapid depreciation. Year-to-date, the RUB has lost -21% against the dollar. Currently the CBR has been initiating massive intervention to stem the RUB’s slide. Nearly +40% of total daily volume can be attributed to the CBR. Therefore, a +50 or +100bps hike is unlikely to stop the bleeding. The CBR needs to be more innovative in its approach as it’s the market that is doing all the squeezing and not Russian policymakers.

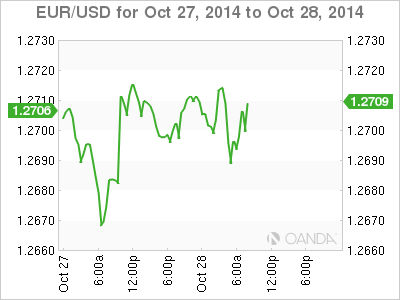

Common Currency Consolidation Afoot

It’s difficult for the market to get too excited ahead of the FOMC announcement. Even the EUR continues to consolidate around optioned rate trigger points (€1.2700). Further consolidation for the 18-member single currency is expected around this psychological handle, especially given the whispered “several yards” of €1.2700 expiries this week, mostly reported for Thursday. Implied volumes are under pressure over the recent sessions. Nevertheless, risk reversals are still bid for EUR puts (implies general bias is still down), but what transpires at the FOMC will trump most expectations. There is a possibility that the market will want to retest the pre-spike volume lows before recalibrating the EUR’s next substantial move. Investors still have some U.S. data to chew on including durable goods orders, Redbook retail sales, and a consumer confidence report. Most are unlikely to have the impetus to break the monotony of major forex ranges.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.