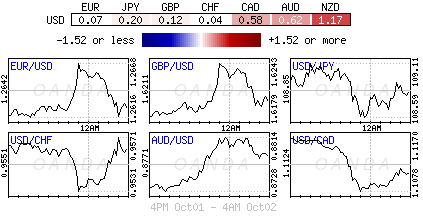

As long as it moves, there is opportunity, and it’s this that the forex asset class has been good for lately. The return of forex market volatility has taken the world’s most coveted currency, the U.S. dollar, on another wild ride in the overnight session ahead of the European Central Bank’s (ECB) rate decision and press conference this morning. According to the recent Commodities Futures Trading Commission reports, investors have made a $35B bet that the dollar is to remain supreme for some time backed by a less dovish Federal Reserve, and the potential for Group of 10 interest rate differentials sooner rather than later. Nevertheless, there will be the odd occasion, similar to the overnight action preceding the ECB decision, when ‘overextended’ USD long positions squeeze the market to swing the other way.

Event Risk Heightens

Following on from the disappointing European purchasing managers’ indexes, a soft Institute for Supply Management manufacturing index released yesterday and a growing sense of disinflation has allowed for some short-term re-pricing of the Fed’s intentions. As U.S. interest rates fall so does investors’ appetites for dollars. With global debt product aggressively rallying (lower yields for Treasurys) over the past session, greenback lovers are recalibrating a portion of their portfolios. The market is also increasingly cautious ahead of this morning’s ECB meeting, the Hong Kong Occupy Central’s deadline for the city’s leader Leung Chung-ying to step down, and the U.S. nonfarm payrolls (NFP) on Friday. Adding to investor worries is the broader economic headwinds from the Ebola scare stateside.

Dollar Volatility Steps Up

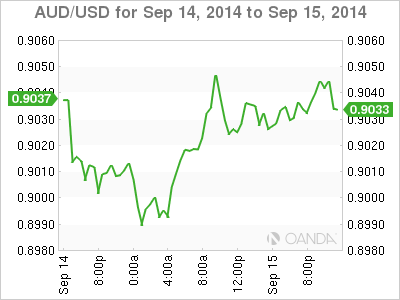

For carry trade enthusiasts, they could have only been breathing a sigh of relief with the AUD’s overnight move. The Antipodean currencies have been in a vortex of late, with the respected AUD and NZD being walked lower by their own central bank rhetoric, and backed by softer commodity prices. Nevertheless, the AUD/USD managed to climb nearly 100-pips from its lows to above the psychological AUD$0.8800, in part helped by a smaller-than-expected trade deficit and a rise in building approvals. The Aussie trade balance narrowed from AUD$1.36B to AUD$787M. Among the notable components was exports to China rose nearly +10% (AUD$8.3B), while shipments of iron ore and coal were also up +20% and +5.6% respectively. Not to be outdone, the Kiwi dollar has been particularly volatile with its own +150-pip rally to settle shy of NZD$0.7920, while USD/JPY is down -70-pips, trading under ¥108.50, while sending the Nikkei 225 down nearly -2%. Fears over the global economy are prompting an adjustment of the greenback following the rapid gains of recent days. However, the dollar’s downside against the yen continues to show some support from Japanese imports and others looking to pick up USDs on dips. After having broken ¥110.00 and now facing a rapid pullback, the dollar’s upward momentum may be dwindling and should be put on hold for the time being.

The market still needs to see how serious the current support is before writing that particular argument off. Global investors should remain wary of the Hong Kong situation. With China’s state media announcing the government will “not give an inch” of compromise over the Occupy Central protest, it could shepherd investors toward the mighty dollar once again. If not, then the market will need to digest in context both the ECB meeting and tomorrow’s NFP for conviction.

ECB Guesses Abound

Many market participants may be underestimating the ECB and President Mario Draghi in particular. Draghi is more than capable of being dovish at Thursday’s meeting. Whether it’s buying Mediterranean debt products in the bank’s asset-backed securities (ABS) program, or stating that it is prepared to expand its balance sheet, the ECB should be considered dovish enough. Consensus is not anticipating that today’s meet will provide any significant new insights. With interest rates unlikely to move any lower, expect most of the attention to be on details of the ABS purchase program. The market is already aware of the potential inclusion of the safer tranches of Greek and Cypriot debt. Draghi will surely highlight the ECB’s aversion to buying the so-called mezzanine tranches (the riskier parts of securitizations) unless governments guarantee any losses. Expect Draghi to shy away from talking about size and instead focus on the ECB’s aim to return the size of its balance sheet to early 2012 levels.

Finally, investors should be looking out for comments on forex and the recent value of the EUR and a “reiteration that European Union policymakers are open to additional unconventional measures.” After yesterday’s disappointing manufacturing PMIs, especially Germany’s, the ECB will need to be very proactive and very innovative to overcome stagnant growth and potential deflation.

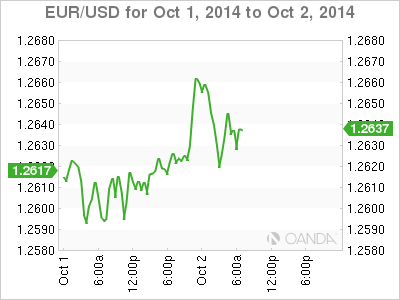

A regurgitation of the script should not be capable of turning around the EUR’s one directional summer play. A lower EUR (€1.2629) continues to be supported by lower a Bund and peripheral bond yields. Nevertheless, during times of uncertainty there will be a squeeze on the weaker long USD positions. With the ECB’s intention to expand its own balance sheet and potentially introduce quantitative easing, any market correction will be brief for the foreseeable future. The EUR’s relatively mild reaction to yesterday’s disappointing data could be pointing to further losses for the 18-member single currency.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.