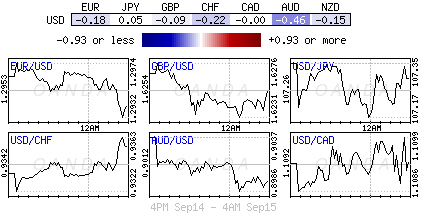

Strap in and be prepared for opportunities, as this is a big week for investors and capital markets. Geopolitical events, a few central bank meetings, and the Scottish referendum are supporting the recent uptick to both volume and volatility, especially in the forex asset class. The US dollar remains king, as both the currency and global yields rise ahead of the Fed's two-day meeting. Market consensus expects this week's FOMC meet will be a Ms. Yellen hawkish event, especially following Friday's solid US retail sales data (+0.6%) for August that was supported by positive revisions to previous months. Even better than expected University of Michigan sentiment data has added to the markets conviction (84.6).

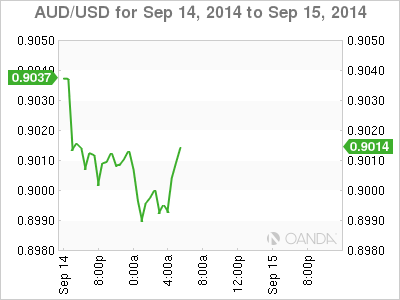

Later today, the Reserve Bank of Australia will kick-start the week with its Monetary Policy Meeting minutes being released this evening. The RBA held its benchmark steady at a record +2.5% for the thirteenth consecutive month at its last meeting. Many believe that it was a mistake, arguing that Governor Stevens should be more aggressively confronting the weakness in the Aussie economy and its high unemployment rate. A less dovish Fed has been persecuting the "carry" trades despite a supporting Aussie jobs number last week. Aiming to guide the Aussie lower (AUD$0.9008) is China's industrial output slowing (+6.9%) to six-year low over the weekend, the depth of the global financial crisis renewing fears of a hard landing from the world's second largest economy. Even retail sales slowed to a four-month low while fixed investment growth are down at a multi-year low rate.

Yen weakness helps BoJ

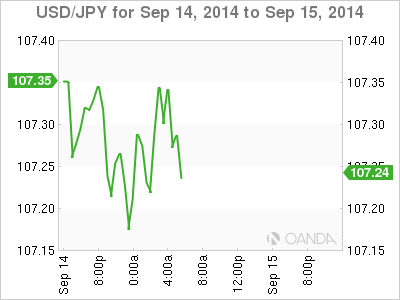

On Tuesday, investors will also attempt to decipher interest rate clues from a speech the Bank of Japan Governor Haruhiko Kuroda will make. Currently, they are looking for any sign that Prime Minister Shinzo Abe is pushing for further monetary stimulus. Many have been expecting the BoJ to ramp up its stimulus program in the face of revived deflationary pressures and amid an economic slowdown worsened by a drag caused by a hike in the sales tax. However, with the Yen undergoing its own sharp decline (¥107.24) is certainly doing some of the stimulus work for Governor Kuroda.

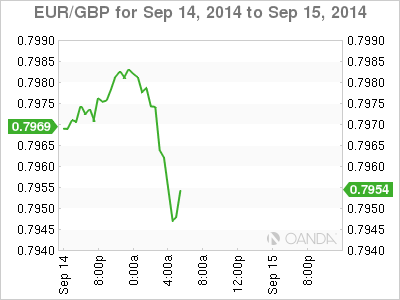

Last month's German ZEW index of economic sentiment hit a 20-month low, and on Tuesday morning the market forecasts are for an even bigger drop. This would suggest that the mood amongst the German population is only getting worse to domestic deteriorating growth, mounting Euro deflationary pressures and the general squeeze caused by further EU/US sanction on Russia over Ukraine. The EUR received solid support last week from heavy unwinding of EUR-funded "carry" trades and by Friday close was the best performing currency for the week (+3.75%) against the AUD and up +0.15% vs. the USD. The market should be expecting the single currency to see some further consolidation ahead of Wednesday's FOMC decision where the market expects the Fed to be "less" dovish.

Payrolls to influence Fed

Wednesday is another data laden day. Investor's get a peek at the BoE's MPC minutes. On September 4 the BoE left policy unchanged, but the vote was split 7-2. If there is any hint that anyone of the seven are leaning towards tightening then the market will be quickly recalibrating the "tightening" bias, and this despite Carney's latest efforts to talk down any near-term UK rate increases (£1.6246). In hot pursuit will be the Eurozone's CPI for August. It's one of the biggest influences on ECB policymaking. Recently, it's been on an alarming slide towards deflation and reason enough why Draghi and company acted so earlier this month by cutting rates further and introducing a bond-buying program.

A fear of the Fed taking a more hawkish stance at its two-day meeting that ends next Wednesday is keeping both European and U.S. bond yields elevated. U.S. policymakers are expected to shed some light on plans to raise interest rates. The market will be focusing intently on the FOMC press conference after the federal-funds rate decision. Before this meeting, the market has an especially disappointing payrolls report (+142k), which is expected to support Ms. Yellen's hesitance to rush towards a rate increase next year. However, there are other signs of US robust growth, so there is a chance that US policy makers could firm up its signal on that. It should keep the market on its toes.

Scots need Braveheart

Just like the Scottish sovereignty vote has been doing especially over the past ten-days. Scottish referendum fever continues to grip market price action, and though the odds for the country to vote to leave the U.K. has lessened, sterling's fate rests on next Thursday's Scottish independence vote (results on Friday) as the vote outcome remains too close to call. Sterling, which last week plummeted to a new ten-month low (£1.6035) after poll slightly favored independence, is trading in a tight range as we start the week (£1.6245). Expects things to heat up again as the week progresses.

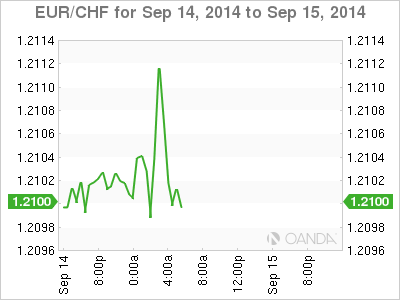

Also on Thursday, the Swiss National Bank (SNB) will set its Libor (London Interbank Offered Rate) though no changes are expected. However, Swiss authorities could be put to the test if the EUR's downfall escalates and encroaches on the two-year-old EUR/CHF floor at €1.2000. There is no reason to assume the appetite for SNB intervention is diminished at this point. In fact, the pressure for action has intensified.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.