Forex is beginning to buckle, commodities looks like bending, while equities are doing their best not to snap as investors and dealers rebalance their portfolios over global tensions and questionable growth. Only day's ago, the IMF commented that capital markets have been underpricing geopolitical ramifications and that the macroeconomic repercussions have yet to be felt - is the market finally beginning to heed their warning?

To date, safety trades have been the order of play as Russia steps up the tit-for-tat sanction war with the EU/US, the ceasefire between Israel and Hamas ended, and President Obama has authorized potential airstrikes against ISIS in Iraq. Obama's orders itself would only be capable of driving markets for a short period, nevertheless the combination of all the various geopolitical risks (Ukraine, Russia-West) and poor market headlines (Argentina default, BES, governance issues at various EM banks, WHO declaring Ebola a global risk), coupled with historically thin liquidity in August, is making the outlook rather uncertain with investor's very nervous and trigger happy.

Traditional safe haven asset in demand

The market has been seeking and now has got it - an uptick in 'intraday' volatility. Dealers are not worried in what direction market prices go. All they want is price movement; it equates to opportunity, and something in short supply ever since CBanks handcuffed the forex market with its low interest rate policy business model. Traders flourish in this environment and will do their utmost to make "hay while the sun shines."

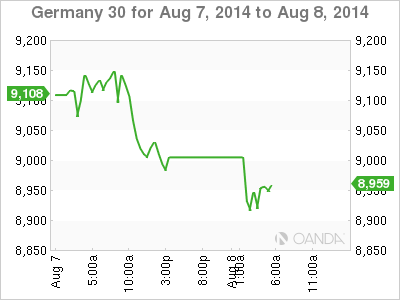

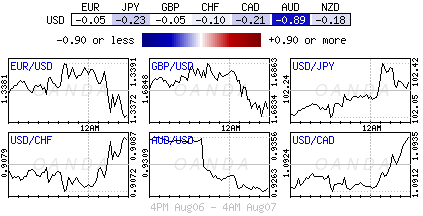

Short covering and panicky stop-losses are dominating trading with relatively little real money flows going through the various asset classes. In FX, it's no surprise to see JPY and CHF garner a safety bid with fresh five-month lows for EUR/CHF (€1.2123) and eight-month-lows for EUR/JPY (€135.85). In stocks, equities have slumped, with the DOW and S&P's shredding -0.5% in Thursday action, the Nikkei closing down -3% earlier this morning, while Euro bourses start in the red in this Friday's session. On yields, the German 10-year bund has sunk to fresh new low yield (+1.02%), while US 10's are trading south of +2.4% for the first time in nearly two-months. Commodities, the yellow metal in knocking on its recent highs ($1,317) while crude remains better bid on supply concerns with an Iraqi airstrike.

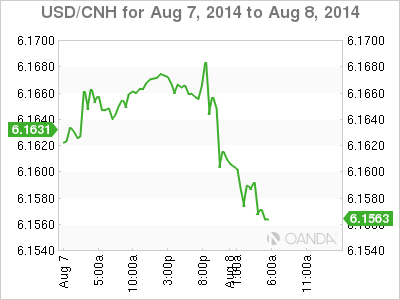

Yuan to up trading volatility

Now, add a few fundamental release events overnight and you have a market on the edge. The Shanghai Composite is the only regional index with mild declines thus far, erasing post Obama-conference losses on much stronger than expected China trade data. A $47b surplus for July is a record high, and even though imports surprisingly fell -1.6%, double-digit rise in exports more than made up for that decline. Shipments to Europe were particularly strong, up about +17%, y/y, while exports to Japan reversed last month's drop with a +3% increase. The danger is that the trend may not last long. With Europe under economic pressure, how can China sustain double-digit export headlines? Mind you, with Russia out of the picture will certainly help their cause. The poor import reading was driven mostly by lower iron ore prices. No matter what, the pressure on the Yuan to strengthen will only increase. Align that with Beijing's new measures to promote private capital outflows should be capable of increasing the volatility of the Yuan's exchange rate.

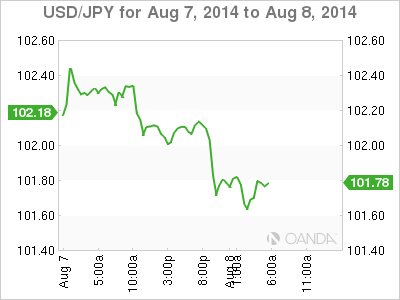

The BoJ is the last of the CBank to show their hand this week. Governor Kuroda's accompanying statement saw the central bank maintain its overall economic assessment, unchanged for the 12th consecutive meeting. Nonetheless, as rumored, the BoJ has downgraded its view on exports and industrial output. In his press conference, Governor Kuroda remains optimistic about Japan's economic outlook noting the employment and income situation is improving steadily. He will be disappointed by the Yen strengthening, as they see no reason to do so - USD/JPY (¥101.77) is grinding lower because of 'risk trades' unwinding and not on Japanese fundamentals.

RBA adjusts growth

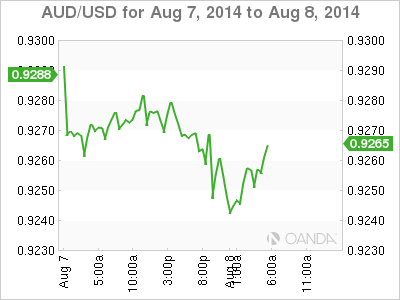

Of the major currency pairs, the Aussie dollar is the biggest loser (AUD$0.9260), driven by risk-off sentiment on Iraq announcement as well as concurrently released RBA quarterly policy statement.

The RBA has cut its 2014 and 2015 GDP targets by -0.25pts to +2.5% and +2.75% respectively, and also narrowed lower its 2016 growth projection. On inflation, the RBA has lowered 2014 core-CPI target to +2.25% v 2.5% prior, but has risen next years to +2.75%. Following the release of 12-year high unemployment rate from Australia earlier this week, RBA said the jobless rate is likely to remain elevated for some time yet and might not decline substantially for another 18-months. The Aussie has been trading heavy all week and managed to print a new two-month low outright ($0.9240), while continuing to struggle badly on the crosses (AUD/JPY ¥94.30).

The current market noise across all asset classes is not seeing relative new money being deployed, its old been repositioned. When it comes to de-risking, global equities have been leading the charge. Thus far, it remains an orderly trimming of riskier positions and not a rabid lemming dash to the exit doors. Nevertheless, the lack of market liquidity could very much speed up the whole process.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.