Last week saw global markets fluctuate between corporate earning's and geopolitical conflicts. There was an excess of negative news out of Israel and eastern Ukraine, with each regions headline's countering much of the decent US and Euro quarterly earnings reports. On the whole, the reports were relatively good, despite the odd 'curve ball' been thrown from a usually consistent heavy hitter (Amazon, McDonalds). US housing data continues to be mixed, inflation subdued, while weekly claims took a massive dip, perhaps due to seasonality factors, but certainly sets up the markets eagerness for NFP headlines this week.

In Europe, UK growth plods along surprisingly well and this despite domestic retail sales now a noted soft spot. Asian bourses handily outperformed their Euro/US counterparts on the back of China's July flash PMI prints being rather strong. The Asian theme continues into this week, with China's markets surging overnight over optimism that government stimulus measures were supporting the economy. No matter what, this week promises to be a busy one with investors having a plethora of data to chew on and the highlight being the "granddaddy" of economic releases - non-farm payrolls.

In Asia, Japan releases June data for industrial production, unemployment, retail sales and household spending. Final PMI readings for July are also on tap for China, Japan, the US and the Eurozone and its members. July flash HICP and June unemployment for the Eurozone will be released as well. And the US Federal Reserve announces its policy decision midweek with "no" press conference.

FOMC Clashes with US growth

Currently Ms. Yellen and company are taking refuge behind US inflation numbers. The Fed is set to stay its course with another $10b taper of its QE program this week, but its expected to tweak its language on the US economy to reflect the recent bout of strong payrolls growth. Another $10b reductions take us to $25b per month, and on the way to a complete stop in October. Friday's jobs numbers have become so important to the future timing of any Fed hike. Expect the Fed to highlight the significance of a strong jobs environment, especially now that Ms. Yellen has already signaled that a "continued flow of such robust data could affect its monetary policy plans."

If the labor market continues to improve then the fixed income dealers will be busily pricing in a much earlier rate hike from the Fed (currently the end of 2015). To date, the market has been pricing in a much later rise in interest rates than the FOMC own published projections. This is based on two reasons, first, the market has not brought into the Fed's growth forecasts and second, the belief that Ms. Yellen is more dovish than her committee. This Wednesday, and in the middle of the FOMC meeting, the market gets some US growth numbers. Will the economy have bounced back from a dismal start? The consensus is for an annual growth rate of +3.1% - but the range is wide. Would it not be very difficult for the Fed to deliver an upbeat report after a weak growth number?

Investors look for strong NFP

For NFP, the markets early thought is looking to build on June's headline print (+288k). The Jolts (Job opening and labor turnover survey) and aggregate average for initial claims points to U.S unemployment rate falling again. Current US weekly claims are straddling the lowest levels in eight-years. Initial estimates are for a +6.1% (unchanged) next Friday, but could easily see +6.0%. A fall below +6.0% will be a huge psychological breach. Historically, the participation rate in July tends to be stable/lower if you look over last 14-yrs. A miss either way in the headline numbers should keep all asset classes very interested. The jobs report will be followed by the Fed's preferred measure of inflation - the price index for personal consumption expenditures - it's expected to shown another +0.2% rise m/m and in line with Fed's below target inflation expectations for this year.

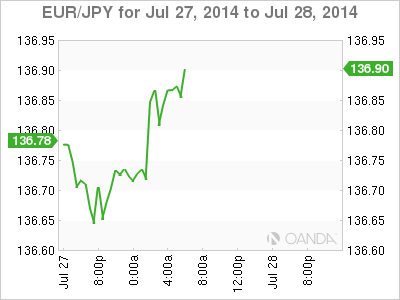

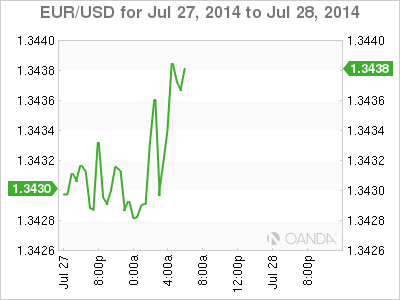

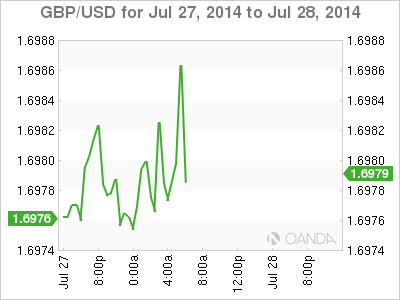

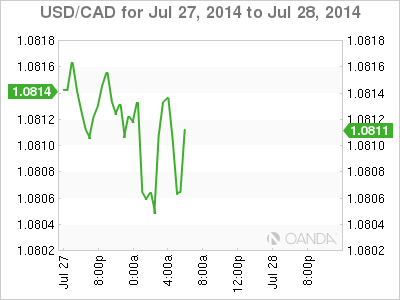

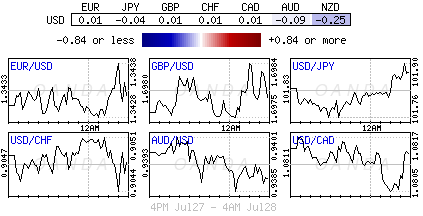

The USD was up against all of its major counterparts last week including the EUR, GBP, JPY, CHF and CAD. It was unchanged against the Aussie. The 'mighty buck' climbed to its highest level in a more than a month amid signs that its own economy is outperforming all its major peers. Rate divergence is finally beginning to gain some traction. Rate divergence is badly needed, as it will play a massive forex role for both "volume and volatility." The dollar rose to yearly highs against the EUR (€1.3426) as funding measures and monetary policies between the two economies diverge. The pound weakened after the Bank of England MPC minutes of its meeting held earlier this month indicated continued caution regarding a possible interest rate increase. The market has been backing Governor Carney at the BoE to the first of the major CBanks to hike (maybe as soon as this year).

CFTC: Record Euro shorts

The 18-member single currency remains vulnerable; retreating last week after the July Ifo German business climate index reported on the soft side for a third consecutive month. This is allowing leveraged funds to increase their negative bets against the EUR to the largest position since November 2012 as reported by the CFTC. Large shorts do not always want to go down straight away - a few nervous positions could spook the market to be taken higher before going lower. Nevertheless, investors should understand that such a weighted position takes time to play out and are rather slow moving - this could attract a few head fakes and minor corrections. Look to Thursday Eurozone's flash HICP (+0.5%) for help in direction. Another low in inflation should help to cement the bearishness on the EUR and bullishness on Bunds/carry trades, as the ECB rates should stay lower for longer!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.