"In like a lion and out like a lamb" aptly describes how the month of March is playing out in respect to forex market activity. Volumes in the currency markets are to have likely tumbled this month.

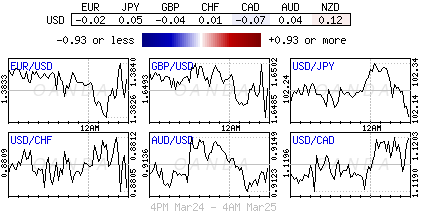

Activity to data remains subdued and lacks true conviction, particularly amongst the majors. The obvious reasons include the possibility of escalation of the Ukraine crisis into another cold war. This will have a knock on effect and there are consequences, all which could have a long-term impact on global growth - which so far is tenuous at best. Also, probably not on too many individuals radars are the ongoing FX 'colluding' investigations in the US and UK. They are expected to last awhile and are having a major impact amongst the dealers, with many being sidelined and unable to compete in the markets place. Next week is a new month, bringing with it a plethora of significant economic data that should up the market participation levels significantly.

If we do look harder there is some noise and the bulk of that has come from 'down under.' For the past eighteen months the RBA has been on a crusade to talk down its own currency. Last year it was the worst performer amongst the developed pairs, falling just shy of -15% to the dollar.

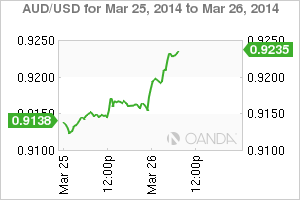

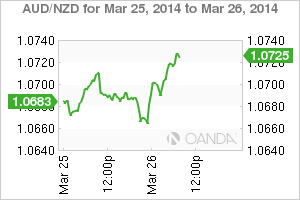

Governor Stevens' remains in a frustrating position as neutral overnight remarks have allowed the Aussie to print fresh 4-month highs above $0.9225. Up until now the market had seemingly become familiar to dependable jawboning of the currency by the central bank. The noted absence of any meaningful verbal intervention surely indicates that policy makers are 'firmly' comfortable with the +2.50% Official Cash Rate. Moreover, in addition to reiterated expectations of recovering growth and the handover from mining to consumption sector of the economy being underway, Stevens and company remain wary of Aussies 'hot' property market. Individuals are beginning to wonder that the banks overtly concerns could give rise to speculation that the RBA may actually surprise the market with a rate hike as early as late-2014.

Real money has been the persistent AUD buyer in the overnight session with many speculators continuing to pare back their outright AUD shorts, especially after stop run outs above $0.9200. From the techie perspective there are good size offers hovering just below the psychological midway point of the $0.92 handle - this was a pivotal level last November (then 100-DMA). Dealers are beginning to report more AUD/cross buy stops, which would reverse many of those weak short AUD positions that had been expecting further negative currency momentum below $0.90c.

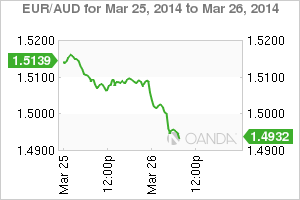

Verbal intervention by the various monetary authorities is having a diminishing effect on various currencies in recent days. ECB officials confirmed that the central bank was discussing the possibility of additional stimulus and yet the 18-single currency remains confined to a tight trading range where corporations and reserve managers remain active buyers on dips (along with a few oligarchs). The bulk of the EUR sellers continue to be leveraged, model and prop traders. The EUR/crosses have been a popular sell on ECB remarks, with higher yielding currencies been the net beneficiary. Given the low market volatility most dealers will look at the EUR favorably as funding for 'carry' trades. With many still short the EUR, due to a mass of dovish ECB comments, next Monday will be important day with the release of the euro-zones HICP data. What the ECB will do should be set by the CPI data. Since the last meeting little has changed with inflation a tad softer and growth a wee bit stronger. However, dovish ECB policymakers and short EUR positions need to see evidence of lower inflation and Monday could end up being the swing day for the EUR ahead of the ECB meet.

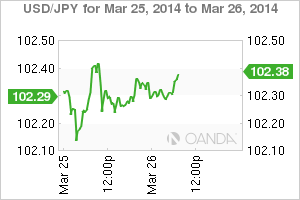

The next few weeks for Japan will become rather interesting. Will there be a fall out from the introduction of the new consumption tax? If so, the market will be trying to anticipate the BoJ next move, and how proactive and aggressive they can be. Japan PM Abe's economic advisor Honda reiterated and supported earlier remarks of perhaps the need to push the BoJ into further policy easing - with an announcement as early as mid-May - if the upcoming consumption tax increase derails the fragile progress of Abenomics. Prudently, Abe's government continues to look at alternatives that would offset next weeks sales tax hike.

This morning Stateside we get durable goods orders for last month (exp. +0.8%). The market is looking for a better showing that January's -1% fall. If we do not get one we should expect most analysts again to write it off as a weather casualty, and again having no influence on the Feds modest actions.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.