S&P 500 threat of a short-term top

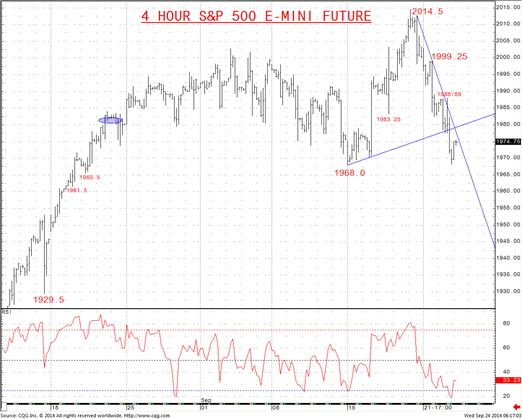

We stated in our last report that “”the risk for Tuesday is now through this lower level, 1983.25, for a shift to a range theme, but with a negative bias”.

The firm push below 1983.25 has signalled a shift to a range theme, defined by 1968.0 and 1999.25.

The push already through next support at 1976/75 places risk next to 1968.0.

We still look for the key 1968.0 level to try hold to avoid a more bearish shift, but the mounting threat for latter September is through here.

Back above 1999.25 is needed for a more bullish tone to resume.

WHAT CHANGES THIS?

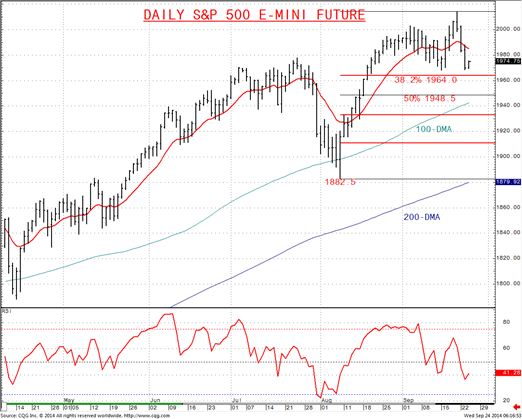

Downside: Below 1968.0 sees risk lower for 1964.0 and 1950.0/48.5.

Upside: Above 1999.25 aims higher for 2006.5 and 2014.5.

4 Hour S&P 500 E-mini December Future Chart

Daily S&P 500 Future Adjusted Continuation Chart

THERE IS SUBSTANTIAL RISK OF LOSS IN TRADING FUTURES, OPTIONS AND FX PRODUCTS. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.