In its weekly note to clients, Morgan Stanley argues that the cross-currents of negative flow dynamics and upward pressure from risk appetite may keep EUR without a clear trend in the near term.

Here are MS' explanation for some of these cross-currents along with their structural strategy to trade the EUR over the course of their year.

4 cross-currents in play:

"First, EUR inflation rates have continued undershooting expectations. Indeed, inflation momentum itself has fallen fast in recent months, leading some to question whether the ECB’s recent stimulus efforts will be enough. Of the G4, Europe faces the slowest core inflation momentum as pointed out by our inflation strategists Global Inflation Monitor. 5 year inflation swaps have declined by almost 20bps taking inflation expectations back to levels last traded in October. Nominal rate expectations have come down in line with falling inflation rates increasing opportunity costs of holding EUR liquidity.

Second, while the ECB disappointed markets by failing to increase monthly asset purchases, it did cut interest rates even further into negative territory. We think reserve managers are particularly sensitive to negative rates as they violate the principle of capital preservation. The IMF’s latest COFER data show that reserve managers continue to bring the EUR share of their portfolios down. The start of the new year and fresh liquidity has given reserve managers a window to resume their structural diversification out of EUR.

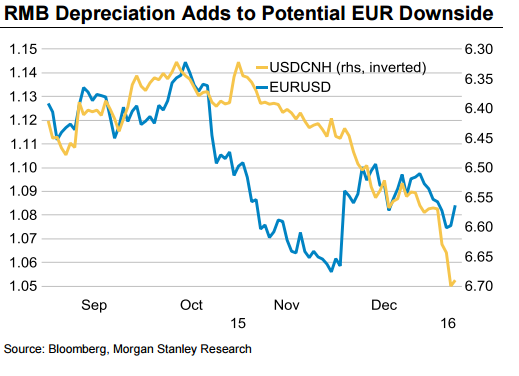

Third, the RMB has declined not only against the USD, but as well in TWI terms. This has increased global deflationary pressures where trade to China is significant and where there are open economies impacted by the evolution of global trade. EMU falls in these categories, so when the RMB moves the EUR tends to follow.

Finally, the EUR is now better suited for funding. On the funding side we differentiate between maturity neutral funding and what is widely understood as the carry trade. Carry trade funding involves investors monetising interest rate differentials but accepting maturity mismatches between generally shorter funding and longer investment time horizons. Hence carry trades are less stable than maturity-neutral funding situations," MS clarifies.

What is the trade?

MS likes short EURJPY as a structural trade over the course of the year.

"In the the end, we would not go so far as to say that the EUR’s lower beta to risk is permanent; it has only been a few days of activity. But there are certainly structural weights on the EUR that are not apparent in JPY. For this reason our forecasts still imply another 10% of downside in EURJPY this year," MS projects.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.