USD/CHF has been rising since early May from around 0.87. In the last week it reached 0.94, so while there's no doubt the trend is up, we're looking for one more rise after which we'd likely expect a significant correction. We'll discuss the details of one last long USD/CHF trade (for a little while).

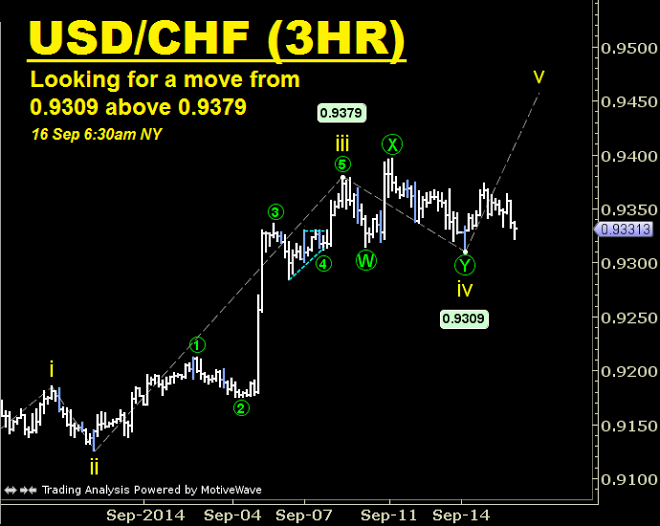

This three-hour chart includes a simple Elliott Wave count from late August low of 0.9125. The wave count shows the recent pullback to 0.9309 as a likely completed fourth wave correction. Therefore, we're looking for a fifth wave higher with likely targets towards 0.95. Overnight euro-related news has pushed price lower into the 0.9330s.

The concern here is how far the final wave may go. With USD/CHF overbought, we'd prefer to err on the conservative side. A typical minimum target the for fifth wave would be 61.8% the size of the first wave. That level is 0.9413, so for this setup, we'll look to set a target slightly below this.

Therefore, we’d look to buy USD/CHF at (or below) 0.9350. Our stop will be at 0.9308, a pip below the fourth wave low. As this is a 42 pip stop, our target needs to be at least 42 pips above entry and that is satisfied by our conservative upside target of 0.9410. This setup looks to gain 60 pips while risking 42 pips with a risk/reward of 1.43. While this trade can be entered above 0.9350, the problem is that it quickly (and significantly) reduces the risk/reward.

Long Setup for USD/CHF

Trade: Buy at (or below) 0.9350.

Stop Loss: Place the stop at 0.9308.

Take Profit: The single ‘take profit’ level is 0.9410.

Trade Management: If price reaches 0.94 without triggering the entry, cancel all orders.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.