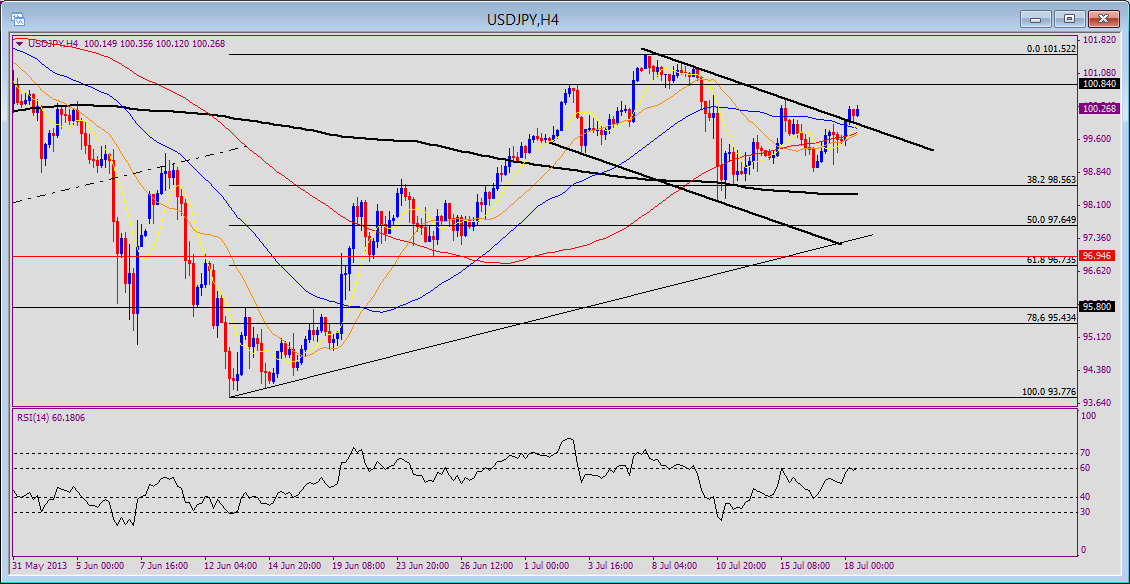

USD/JPY 4H chart 7/18/2013 8:45AM EDT

Consolidation: The USD/JPY has been in consolidation since hitting a high early July, at 101.52. The market retreated almost to the 98.00 handle before finding support. This consolidation has been held below a falling trendline that goes back to the 101.52 high. However price action going into the 7/18 US session appears to have broken this line, exposing the 101.52 high.

RSI, SMA: The RSI shows some initial bearish momentum as the reading fell below 30. This bearish momentum is being challenged now as the the reading tries to break above 60. If it can hold below 60, or come right back below 60 after a brief violation, the bearish momentum can be considered maintained.

The 200-4H SMA is flat, reflecting a sideways market in this time-frame. Price is above this 200SMA so there is a slight bullish bias. The other MAs are all converged, reflecting the consolidation so far in July.

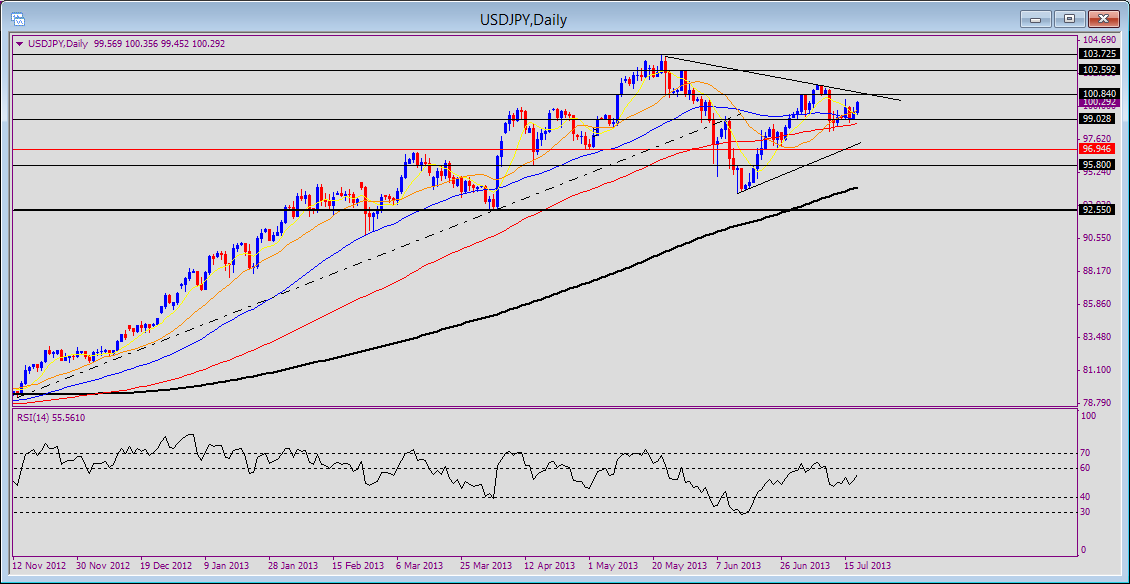

Upside: Because of non-trending conditions, we can anticipate some resistance around 101.50, but only for the very short-term. If you look at the daily chart, we can see that there is still some further upside toward the 2013-high around 103.73, especially because the bullish mode in the daily chart is still strong, though it has flattened relative to the pace before April, back to Oct. 2012.

USD/JPY daily chart 7/18/2013 8:50AM ET

The information used by ForexMinute.com including any opinions, charts, prices, news, data, Buy/Sell signals, research and analysis is provided as general market commentary and does not constitute any investment advice. ForexMnute.com is not liable for any damage or loss, including but not limited to, any loss of investment, which may be based either directly or indirectly on the use of or reliance on such information. Before deciding whether or not to take part in foreign exchange or financial markets or any other type of financial instrument, please carefully consider your investment objectives, level of experience and risk appetite. Do not invest more money than you can afford to lose.

Note that the high level of leverage in forex trading may work against you as well as for you. Please seek advice of an independent financial advisor if you are not fully aware about the risks associated with foreign exchange trading. Forex trading on margin involves considerable exposure to high risk, and may not be suitable for all investors. Global Invest does not endorse any companies, products or services which are represented on Forexminute.com The information on this website is subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.