Dollar Gains NFP Losses; Nasdaq Annual Gains Turned Positive; Gold Holds Gains

The U.S. dollar was traded marginally lower against the most of the major currencies on the weakness revealed in services growth, and business conditions in the non-manufacturing sector in September. The Markit Services PMI fell at 55.1 below expectations to have risen slightly. Meanwhile, the ISM Non-Manufacturing PMI fell to a three-month low. The Labour Market Conditions Index came out zero in September, the lowest figure of the last five months. Traders looking forward to the FOMC Minutes on Thursday. However, in my opinion, after the poor Non-Farm Payrolls report most of the comments in the minutes have been reconsidered by Fed policymakers.

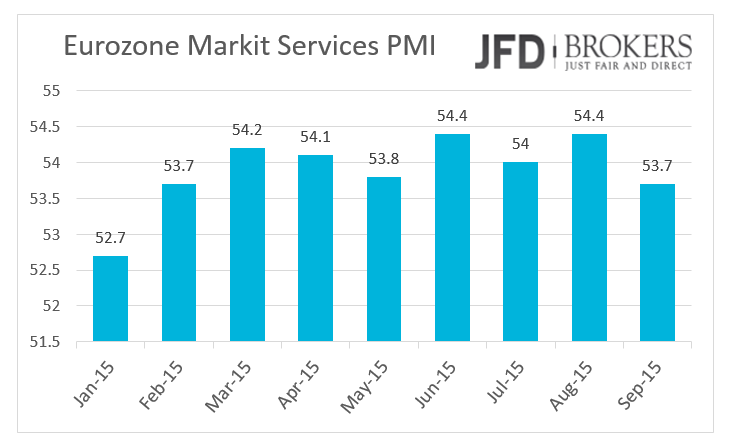

Euro slightly lower on soft services growth

The shared currency closed Monday’s trading session slightly lower versus the G10 currencies following the weakness in the services sector across the Eurozone. The Markit Services PMI, as well as the composite index, fell short of forecasts in September in Germany, UK and Eurozone as a whole. The Retail Sales in August have also slowed down but remained above the market expectations. The Sentix Investor Confidence for the current month was also expected to have declined but came out above forecast, an optimistic sign for October.

EUR/USD – Technical Outlook

The dollar recovered all of its NFP losses against the euro but didn’t manage to maintain its temporary momentum and returned to the same levels where it opened the week. The EUR/USD pair is moving in a tight range between the psychological and strong level of 1.1300 and the 1.1130 barrier. The former is a significant level since it coincides with the 23.6% Fibonacci retracement level as well as the 50-SMA on the weekly chart. I would be fairly neutral though on any directional move and we could yet see the euro come under further pressure, with much depending on the lead coming from Europe.

Pound widely lower ahead of a very promising week

The pound was widely lower against is major counterparts on Monday’s trading session. The economic calendar sends a signal for greater volatility than usual in the GBP pairs as there is important economic news scheduled from Wednesday and later in the week. The NIESR GDP estimate for the three months to September is coming out and the Monetary Policy Committee of the BoE will have a policy meeting to revise the current policy. The market may not expect a rate hike in October but an increase of the BoE benchmark interest rate before Fed is a possible scenario that could drive the GBP/USD higher.

GBP/USD – Technical Outlook

We have seen further selling in the pound during yesterday’s session following a consolidation period the last couple of days above the psychological level of 1.5100. The GBP/USD pair has returned in the same range that it was trading in before we saw the spike in volatility following the U.S. NFP report. Market participants will be focused on significant data coming from the UK, including the NIESR GDP Estimate for September and the BoE policy meeting for October. Technically, following last week’s false breakout above the 1.5238 level there is little real change to the outlook and for the time being, with the short term charts giving little hint in either direction, a neutral stance is required.

USD/JPY – Technical Outlook

On the daily timeframe, the USD/JPY pair is still traded in a perfect triangle pattern that has not been completed by a breakout. For the moment, we expect the prices to be traded in a tight range between the key support level of 118.50 and the 121.75 barrier. Both the MACD and the Momentum lie near their neutral levels confirming the validity of the formation, while the stochastic is moving near the 50 level, reaffirming the disagreement between investors.

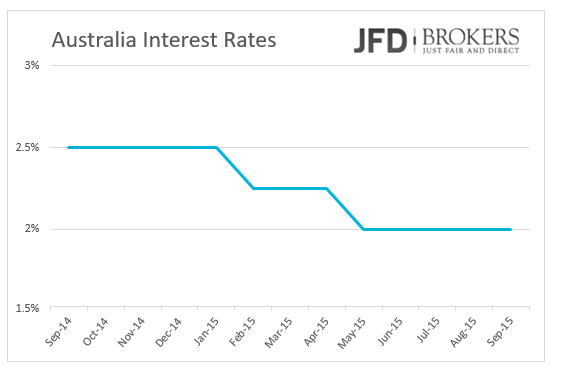

RBA left interest rated on hold at 2%

Commodity currencies such as the Australian, the New Zealand and the Canadian dollars strengthened against the U.S. dollar, with the AUD recording the biggest gains against the USD. The AUD edged higher early Tuesday, extending its gains from earlier in the session and recording a five-session winning streak against the dollar after the Reserve Bank of Australia (RBA) left interest rates unchanged at their record low of 2 percent. Technically, the 50-SMA on the daily chart is providing a significant resistance to the AUD/USD pair near the 0.7120 level. Overall, we maintain our negative view on the AUD and seek selling opportunities in the rise. A break below the 0.7060 confirms the downward outlook while only a break above the 0.7300 is a concern for a further serious correction towards 0.7500.

Gold – Technical Outlook

The precious metal is continuing to push higher following the failed attempt to break below the strong support level of $1,130. Around there, the 4-hour 50-SMA and the 200-SMA, both are ready to provide a further support to the metal while the daily 50-SMA is ready to prevent any bearish move below the $1,127 level (from the daily chart). The next obstacles for the gold bulls will be the $1,156 level and then the $1,168 barrier. The MACD oscillator remains above its trigger and zero lines, confirming the bullish momentum of the price action. All in all, I remain bullish on the XAU/USD!

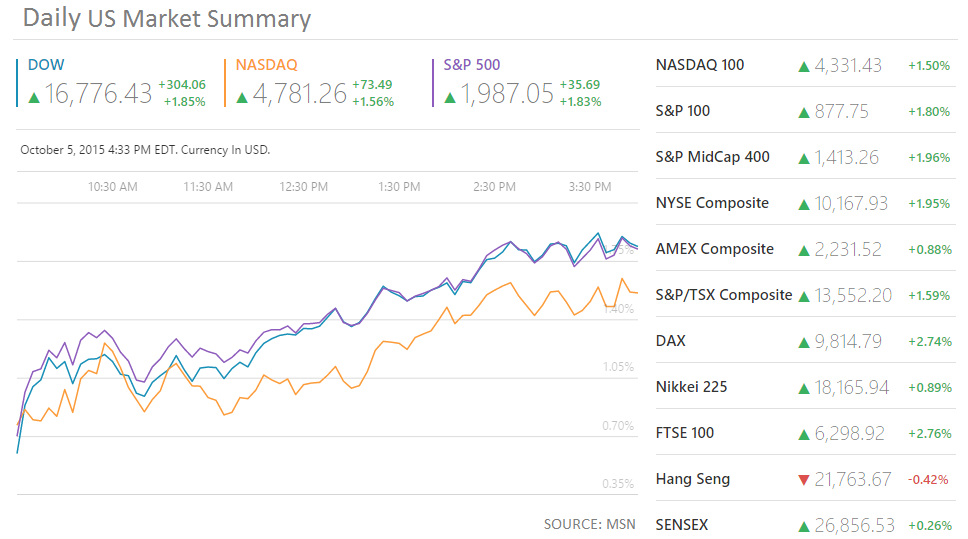

U.S. Indices surprise on the upside!

While market digests the Friday’s disappointment Non-Farm Payrolls report, the U.S. indices surprised us positively! The Dow Jones Industrial Average recorded gains of +1.85%, +304 points with only one contained stock posting loss. General Electric Co (NYSE: GE) and Caterpillar Inc. (NYSE: CAT) recorded gains more than 5%.

The S&P 500 rose for the fifth consecutive day by +1.83%, but it still has negative yearly performance, contrary to the Nasdaq Composite index that after last week’s gains and yesterday’s +1.56%, its annual performance turned green with gains of +1.67%!

Economic Indicators

Today, the EcoFin meeting will take place. Beyond that, the only market driver event of the day is the speech from the ECB president Mario Draghi at the afternoon. In Switzerland, September’s inflation rate will be announced. In US, the Trade balance for August will also be out as well as the IBD/TIPP Economic Optimism for October. Canada’s Ivey Purchasing Managers Index for August will be out. Overnight, Bank of Japan will release its Monetary Policy Statement, followed from a press conference that explains their decision.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.