After September’s FOMC meeting that ended with unchanged interest rates, Fed Chairwoman Janet Yellen said that interest rate hike in 2015 is still on the table if employment maximize and inflation rate picks up towards Fed’s target. These hawkish comments turn the attention on today’s Non-Farm Payrolls report three-and-a-half-weeks before the next FOMC meeting in October. The headline of the employment report, the NFP number, is forecasted to show that the U.S. economy added more than 200K jobs in September, specifically 203k vs 173k before.

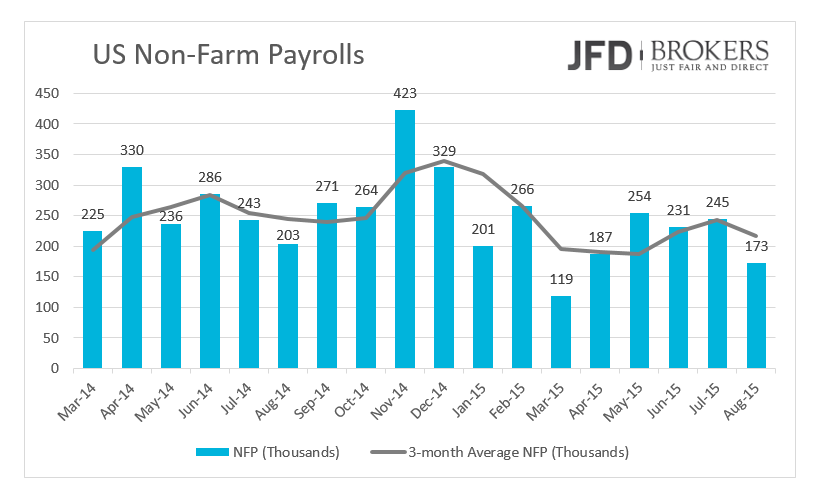

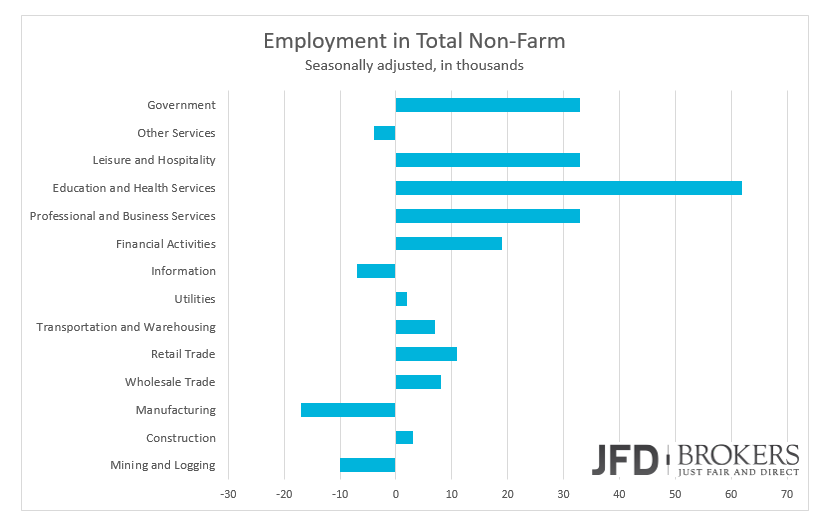

The labour market faced a weak month in August, only 173k people employed, far below the three month average and the average of the twelve last months of 216k and 243k respectively. However, the aforementioned averages, which are more reliable indications from the monthly figures, as they remove temporary fluctuations, are well above 200k indicating a healthy economy. In August, the education and health services added the larger number of jobs while the Manufacturing, Mining and Logging lost jobs.

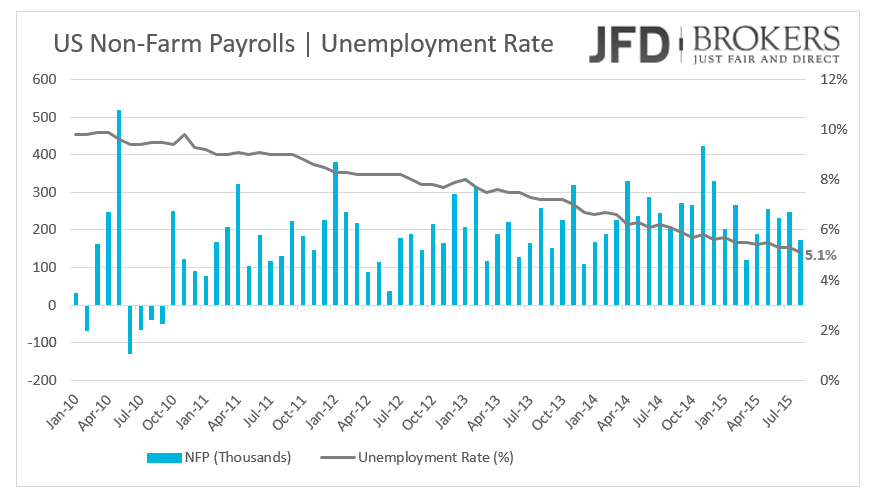

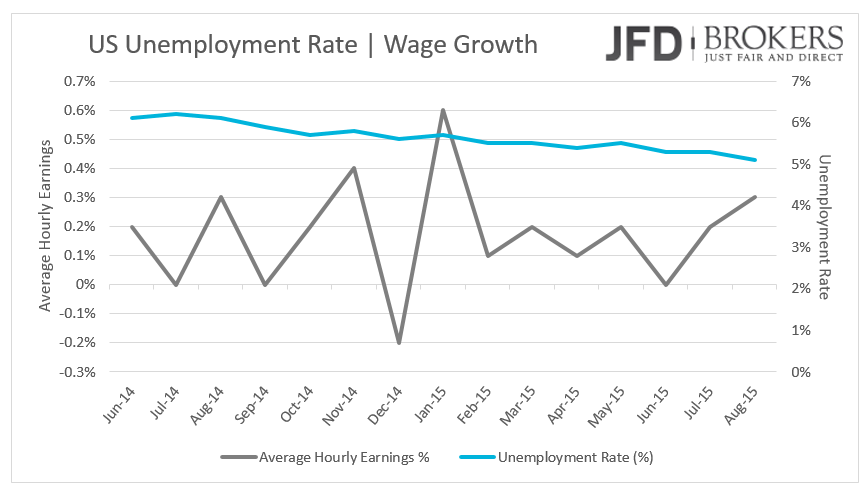

Currently, the unemployment rate stands at a more than 7-year low at 5.1% and the market expects it to remain the same. The average hourly wages are growing slowly but steadily the last couple of years, overpassing US $10.50 per hour. At September’s job report economists expect hourly earnings to have increased by 0.2%, a slower pace than in August that grew by 0.3%.

A below-forecast wage growth could fade a strong NFP number and renew concerns that Fed will delay its initial interest rate raise. On the other hand, a strong NFP report could boost by far the opinion that rate hike is near the corner!

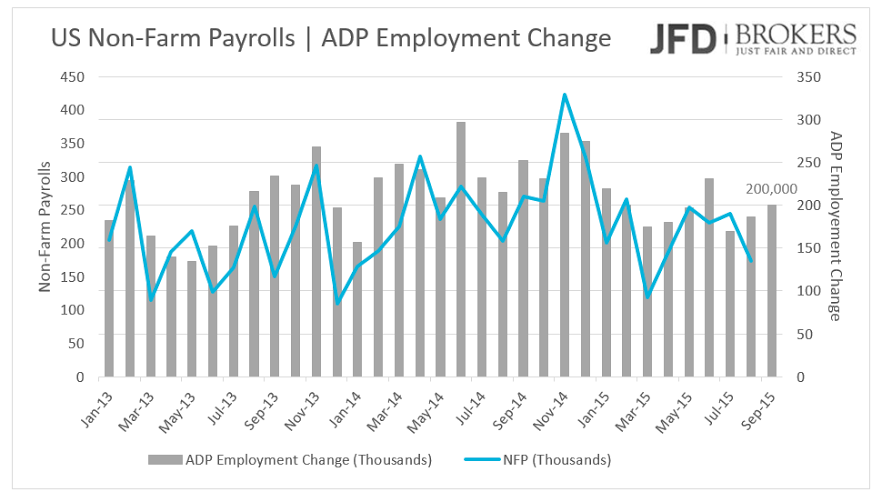

ADP Employment Surpassed Expectations

The Non-Farm Payrolls figure represents the number of jobs added in both the public and private sector while the ADP Employment Change is the number of jobs added to the private sector with some lags of the NFP report. The methodology to measure the ADP employment change uses lags from the non-farm payroll report, however, despite the weak August’s NFP figure – below 200k – the ADP number surpassed expectations of 195k and came out 200k! A good signal for the NFP.

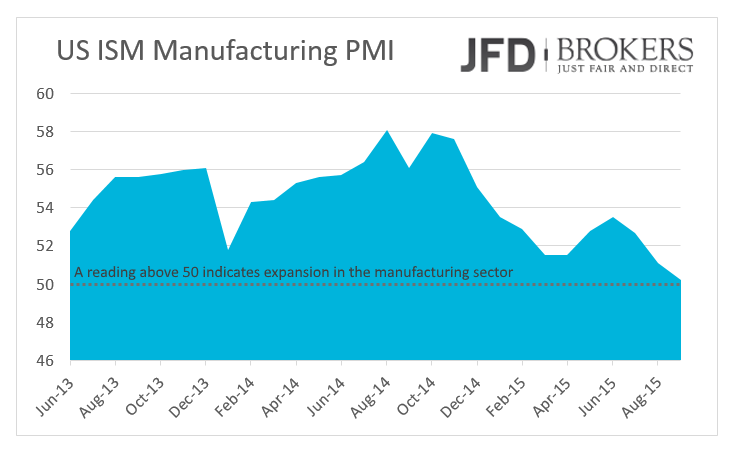

ISM Manufacturing PMI at a more than 2-year low

U.S. factory activity fell slightly in September at its slowest pace for more than two years, a sign that turmoil overseas and a strong dollar are restraining the domestic economy. The Institute for Supply Management’s manufacturing purchasing managers’ index, released yesterday, fell to 50.2 in September from 51.1 in October. A reading above 50 indicates expansion in the manufacturing sector. The major industries that contributed to the expansion in the economy included textile mills and furniture-related products while the industries that contracted included primary metals and apparel.

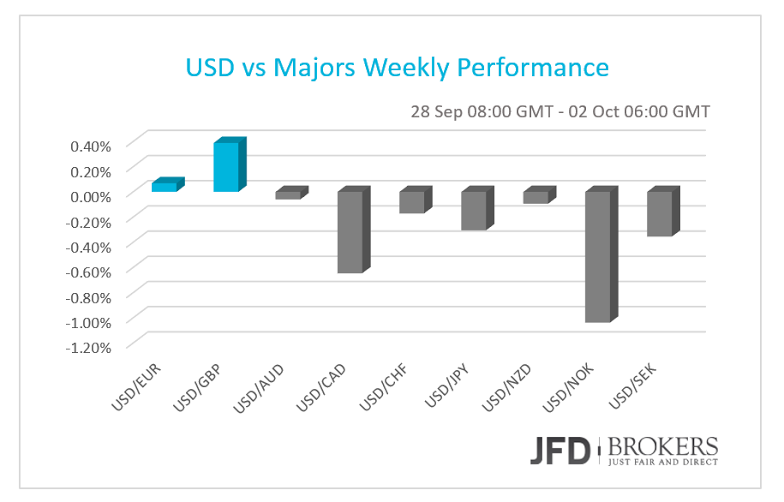

U.S. Dollar Weekly Performance

It has been a fairly steady week, with the U.S. dollar mildly firmer against the euro and the pound, underpinned by the U.S. ADP employment report which showed 200k growth in private sector jobs in September, slightly above the expectation of 195k, showing steady growth ahead of the NFP figure due today. The greenback recorded losses against the other G10 currencies during the week, as traders expect Friday for the NFP report.

At the release of the previous NFP report in August, when the figure came out below the market's expectations, the dollar plunged versus its other G10 counterparts but a few minutes later recovered completely.

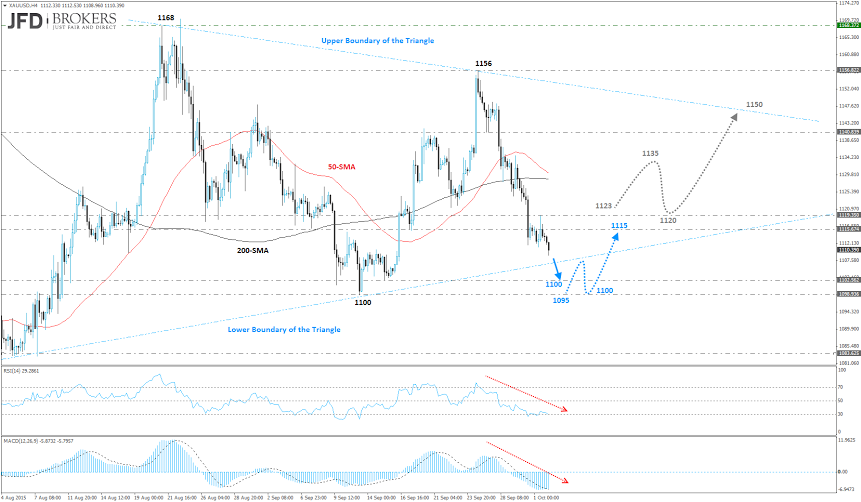

EUR/USD - Technical Outlook

During the last couple of days, the EUR/USD pair is moving in a tight range roughly around the 1.1200 with most traders adopting a wait and see mode ahead of the all-important Non-farm payrolls. The sell-off seen the previous week in the pair has brought us back into a key support level which coincides with the 50-SMA on both the 4-hour chart and the daily chart. Going forward, there is a clear battle going on between the 1.1100 barrier and the 1.1290, as highlighted on the 4-hour chart, but it’s not clear at this stage who has the upper hand, the bulls or the bears. If we see a close outside of this range, it should give us a big clue about what the bias in the market actually is

Today’s U.S. NFP might be the catalyst EUR/USD needs to make a move above or below the triangle formation that the pair has been trapped the last month. Therefore, for the greenback to rally on the NFP report, we need job growth to exceed 200k and it will be even better if it exceeds the consensus which is at 203k. Furthermore, average hourly earnings will need to rise by more than 0.3%. If any part of this equation is off, investors will be reluctant to buy dollars.

In terms of levels today, the pair is currently finding support from the 50-SMA around 1.1170. Below this level it should find further support around 1.1140 (intraday level). However, the key to watch will be the 1.1090 – 1.1100 zone. On the upside, the 200-SMA, the upper boundary of the triangle, as well as, the 23.6% Fibonacci retracement level around the 1.1300 level, are ready to prevent any bullish moves. Only a break of these obstacles would suggest the bias has become more bullish in the markets.

GBP/USD - Technical Outlook

The GBP/USD has seen a period of consolidation the last few days, after a poor week for the pound, ahead of the NFP report. The strength seen in the British pound the last couple of days and the bulls to maintain the price above the key support level of 1.5100, has brought some signs for a recovery and thus the 1.5600 level will be a significant one for the pound bulls. The daily chart shows that the pair has been in a clear downtrend since June 2014, despite the correction that took place following the strong rebound from the 1.4560.

With the above in mind, a break above the 1.5160 should see the bulls attempt to once again break above the psychological level of 1.5200, a key resistance level that it failed to break on its last attempt. On the other hand, if the bulls fail to push the price higher, then it should add further pressure on the psychological level of 1.5100, with a break prompting a move back towards a significant support and psychological level at 1.5000.

Gold - Technical Outlook

The precious metal is looking pretty weak, having broken below the key level of $1,115, a previous level of support. The XAU/USD fell for five consecutive gains, depreciated more than 3.0%. The next test for the metal will be whether it can hold above the strong support level of $1,100, which coincides with the lower boundary of the triangle which started back in mid-August. It has failed to break below here quite a few times, which highlights how big a level it is for the bulls. Going forward, if it does continue to edge lower from here towards that level, it should find support along the way around $1,105. Alternatively, only a break above the $1,120 will confirm the continuation of the upward correction and negate any bearish scenarios.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.