Market Overview

Can the improvement in market sentiment continue amid disappointing China data and a weaker oil price? Perhaps we will find out today, as we are seeing markets trading slightly higher in Europe with the impact of the easier monetary policy from the Bank of Japan on Friday continuing to resonate. However the economic data overnight from China was weak and the oil price is trading lower again, so there is a big test for the bulls to see if they can keep this up now. I remain sceptical if it is possible. China continues to slowdown, with both the official and unofficial (Caixin) manufacturing PMI showing readings well below 50 (at 49.4 and 48.4), with the official data contracting for a sixth consecutive month. However the slightly better than expected Caixin data may be helping sentiment and if the Eurozone data early today continues to show an improving outlook, then perhaps the outlook can improve. After Wall Street closed very strongly on Friday (S&P 500 up 2.5%), Asaian markets have been mixed overnight (although the Nikkei continues to benefit from the weaker yen, trading up 2%). European markets are also higher in early mores.

There is a mixed outlook on forex markets today, oddly with a slight bias towards a riskier mind-set. The euro and sterling are showing minor gains, whilst the Japanese yen has been unable to claw back any meaningful growth lost on the dollar on Friday. The commodity currencies are also showing a mixed performance today. However then looking at the commodities, the caution begins to set in, with gold trading higher again and the oil price around 2% weaker. Furthermore, Treasury yields are also lower, with the US 10 year yield testing lows from October and August last year.

Traders will be concentrating on growth today as the PMIs from around the world will be announced. The China data has already disappointed so we turn to the Eurozone which is announced at 0900GMT and is expected to stay around the flash reading with 52.3. The UK is at 0930GMT and is expected to dip very slightly to 51.8 (from 51.9 last month). The IS Manufacturing is released at 1500GMT and is expected to show a very slight pickup to 48.6 (last 48.2). Aside from the PMI data, traders will also be looking out for the key Personal Consumption Expenditure data which is again expected to stay at +0.1% for the month for the core data amid no real sign of any inflation improvement in the US. There is also a speech from the FOMC’s vice chair Stanley Fischer today in which the market will be on the lookout for any monetary policy hints.

Chart of the Day – DAX Xetra

I continue to be impressed as to how well the DAX is conforming to Fibonacci analysis. Once again the Fibonacci retracements of the 8355/12,390 rally have come in to act as key turning points for the market. This time the 61.8% Fib level has acted as the basis of resistance at 9897 (following the 76.4% Fib at 9308 catching the bottom). The bearish engulfing candle on Thursday is a concern for the bull for the recovery, and despite Friday’s strong candle that saw a closing price basically at the high of the day, the legacy of the resistance is still in place. This resistance needs to be taken out soon otherwise the momentum in the recovery will be lost and once more the rally will be sold into. The support around 9600 is again key, but the bulls will be eying Thursday’s 9905 high in the coming days. A closing breakout would re-open the next resistance which is another pivot range between 10,122/10,165.

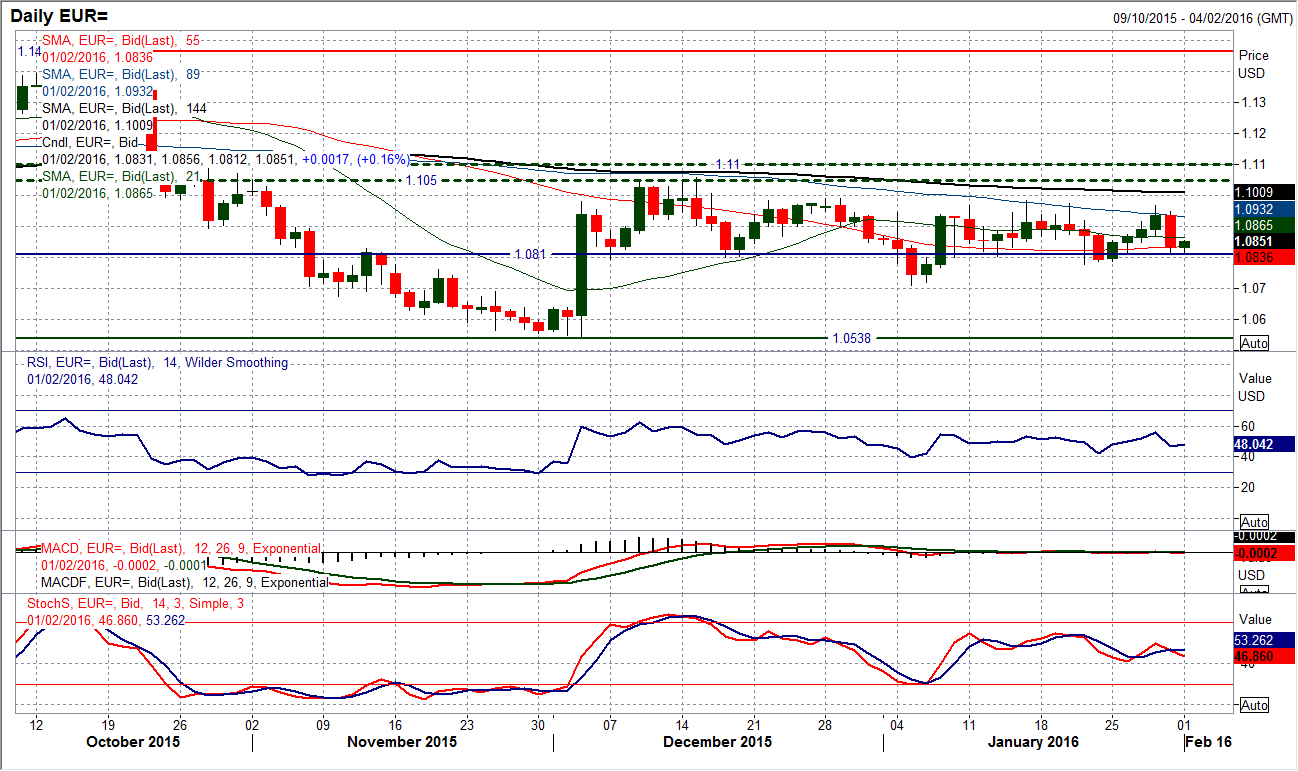

EUR/USD

The chart of the euro has given once more a prime reason why positions should continue to be taken on a short term horizon as again the lack of trend has resulted in a retracement. The first four candles of last week were perfectly decent before Friday’s sharp reversal takes us back to square one again. I continue to see that there is a slight bearish bias that is gravitating the euro back towards the key medium term support band around $1.0810, with Friday’s low almost there to the pip before the support kicks in again. The concern for me is that the more this support gets tested the more significant the breakdown would be if it were to be breached. The technical indicators remain broadly neutral but I am aware that there is also a slight sequence of lower highs (the latest at $1.0967). the pair is also once more back below the near term pivot at $1.0860.

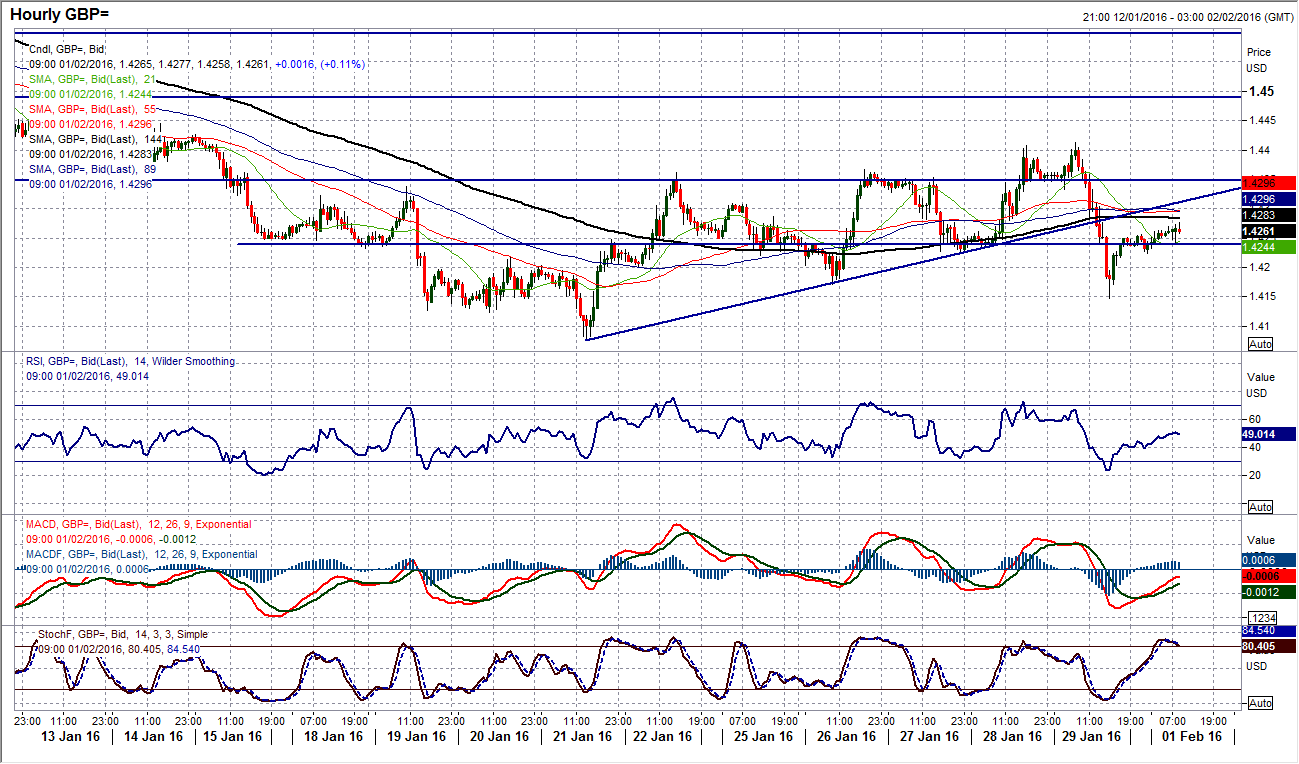

GBP/USD

The daily chart shows a quite remarkable sequence of candles that have fluctuated between strongly positive and strongly negative, but with Friday’s strong negative reversal the latest, the legacy into the new week is once which the bears form slight control. The seven week downtrend may have been broken but the outlook for a recovery is far from certain. The momentum indicators continue to unwind but the recovery configuration is being tested. The hourly chart shows the volatility of the past few days has now resulted in the base pattern being technically aborted by Friday’s sharp 250 pip intraday decline. The inference is that the bulls have lost control again, with the 7 day uptrend on the hourly chart broken and moving averages rolling over and momentum indicators more correctively configured. With a move back above the pivot at $1.4235 the uncertain choppy outlook again continues, but a failure under minor resistance around $1.4280 will add pressure to the downside again. Support around $1.4150.

USD/JPY

The bulls seem to be accepting the new trading levels following Friday’s sharp rebound in the wake of the Bank of Japan’s move into negative interest rates. The daily momentum signals continue to move improve however the signals on the hourly chart suggest these current moves are more consolidation. Friday’s high at 121.68 s the initial line of resistance, whilst the 76.4% Fibonacci retracement resistance of the 123.67/115.96 sell-off is also a possible consolidation point at 121.85. As the hourly momentum continues to settle down we will get more of an idea over the next direction. Near term support comes in at 120.60/120.90.

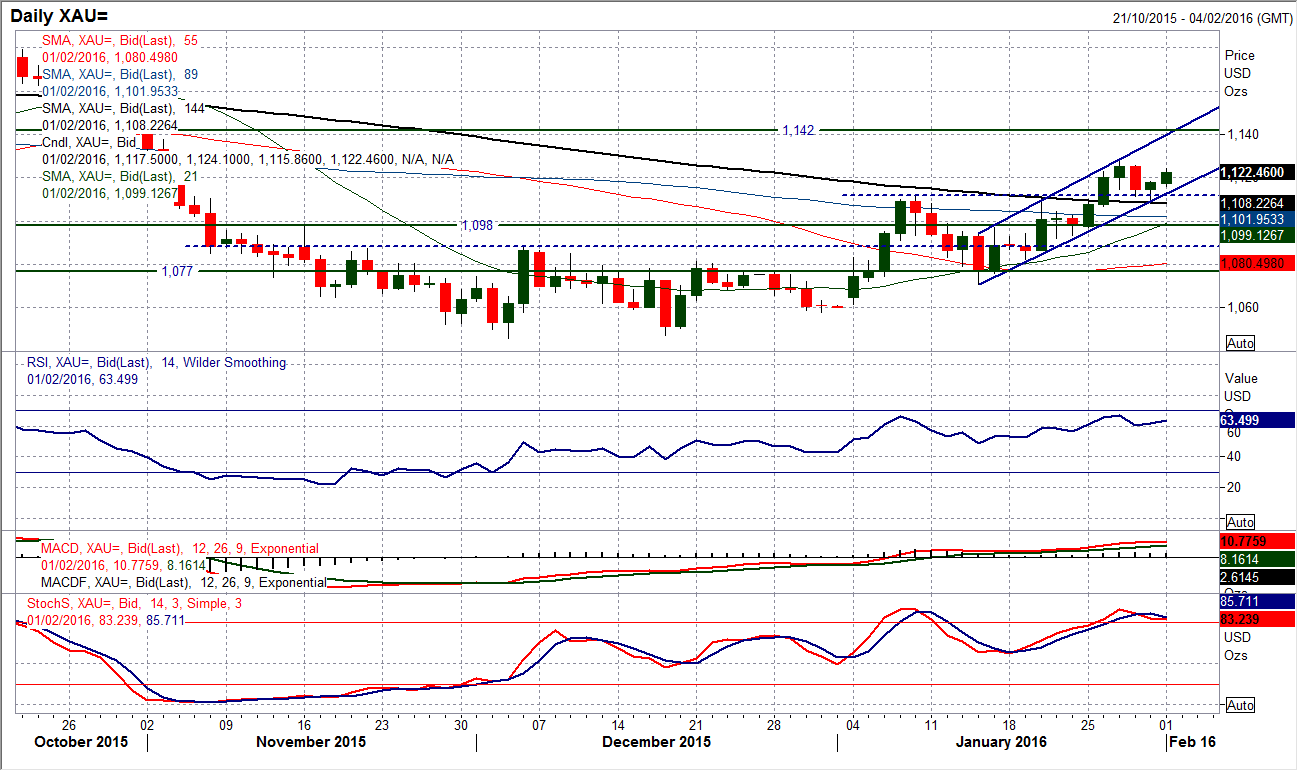

Gold

The uptrend channel that has been in place for the past couple of weeks continues to drag the gold price higher. The intraday dip to $1108.50 initially threatened the positive outlook, but the support held firm and with momentum remaining strong the recovery can continue. The intraday hourly chart shows the increasing importance of the support around $1110 as the dip to $1108.50 was a brief spike, whilst the serious near term support continues around the pivot of old support at $1110. The near term resistance around $1122 is now being tested and a move above would re-open the reaction high at $1127.80. With the uptrend channel intact, buying into weakness is still a viable strategy.

WTI Oil

In these days of such great volatility it comes as little surprise that the oil price can quickly turn on a sixpence. The sell-off on Friday afternoon has resulted in a “spinning top candle” with a slight negative bias and this could now threaten the recovery. Whilst this is an “inside day” session, the fact that is comes as the RSI is back at 50 is a concern as this is where the recent rallies have fallen over in the past few months. Therefore , the performance of today’s session could be key to the near term outlook. There is a breakout pivot at $32.80 which is being tested and could be a trigger signal today for further correction. The volatility means that Thursday’s low down at $31.75 is the key near term support to watch, being one which would mean the rally had come to an end. There is further support at $30.15 and the bears are back in control below $29.25. For now this is a near term blip in the rally but the warning signs are there. Resistance is now in at $34.40 and $34.80.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.