Market Overview

Greece voted “No” with 61% but the party could be short lived. Yesterday the ECB decided to maintain the Emergency Liquidity Assistance ceiling at €89bn and instead of increasing the ceiling (which would have allowed the banks to open), the ECB increased the collateral requirements on Greek banks. This ramps up the pressure even more meaning Greece needs to come to some sort of deal quickly that would allow the ECB to increase the ELA as the country is beginning to grind to a halt as its banks are close to physically running out of cash. There is a meeting of the Eurogroup (Eurozone finance ministers) today to discuss how to move forward, but Greece is in an increasingly parlous state, if it was not already.

Markets have been fairly sanguine despite the plight of the Greeks. Eurozone bond yields have begun to settle down again after a degree of concern yesterday. German yields are slightly higher, whilst peripheral countries such as Spain have seen yields falling slightly. Major equity markets have also managed to remain relatively calm, as Wall Street recovered into the close to end the day only slightly lower, with the S&P 500 down just 0.4%. Asian markets were also relatively stable (China aside, which continues to fluctuate wildly) with the Nikkei up 1.3%, whilst European markets have started the day in sturdy fashion too.

In forex trading, we are seeing the dollar strengthening across the board today, with a slide in the euro still underway, whilst the lack of buying pressure through the yen would suggest a lack of major concern. The Aussie dollar found little coming out of the Reserve Bank of Australia to help provide support. Whilst it held rates at 2.0%, the RBA continues to focus on the need for a weaker Aussie.

Traders will be looking out for UK industrial production today at 0930BST with an expectation of a year on year improvement to +1.6%. The US trade balance at 1330BST will also be in focus with a slight deterioration to -$42.6bn (from -$40.90bn last month). The JOLTS job openings will also be eyed at 1500BST with an expectation of 5.35m which is only slightly below the 5.38m from last month.

Chart of the Day – Silver

The precious metals have had a negative outlook for a few weeks now as rallies have consistently been deemed a chance to sell. However, is silver possibly showing signs of turning a corner? The signs are still very tentative at this stage, however the downtrend that silver has been trading in since mid-May is being seriously tested. Yesterday’s candle was the third consecutive session that the bears were not in control of and the downtrend is being tested. However there needs to be a lot more done to suggest a recovery is on its way. There has been an appreciable improvement in the Stochastics, however the RSI remains fairly much in negative configuration. Furthermore, watch the falling 21 day moving average (currently overhead at $15.88) which has been the basis of resistance now for the past 3 weeks. Another indicator which I have found interesting are the Bollinger Bands which having been in consistent decline for several weeks are beginning to show signs of flattening off. The hourly chart shows there is a consistent band of resistance (which was an old support) around $15.75 which can also be watched for signs of improvement. It is very early days on silver but there seems to be less selling pressure now. The support between $15.40/$15.50 needs to continue to hold for these arguments to continue.

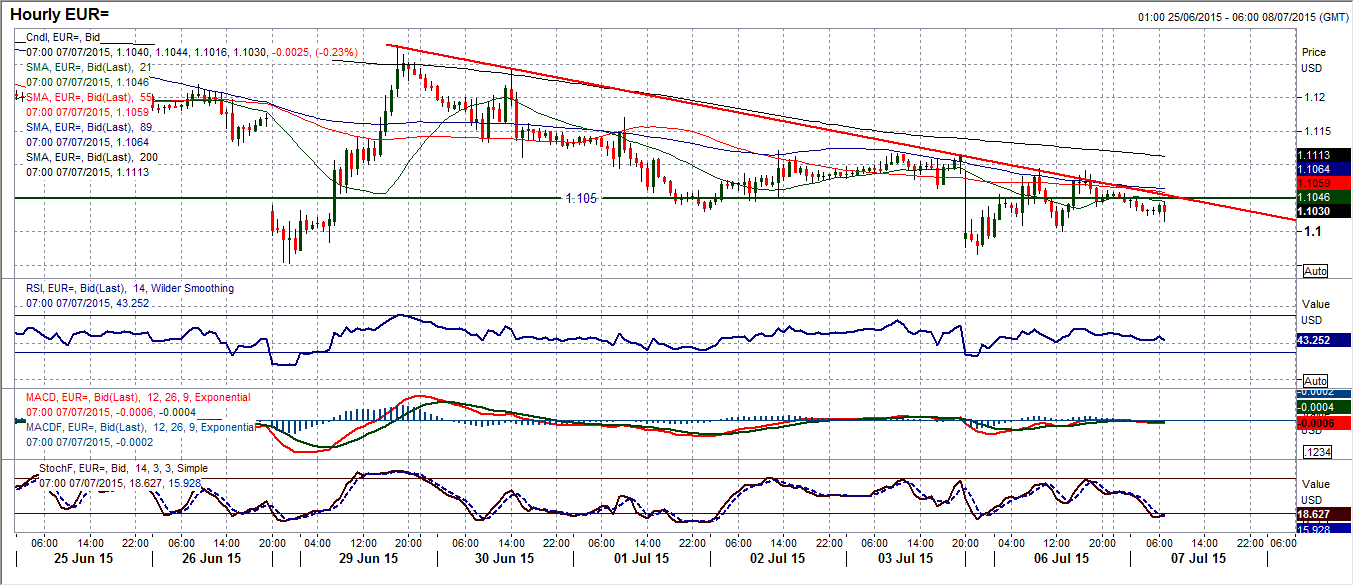

EUR/USD

The euro continues on its downward trajectory but I am still pleasantly surprised as to how well the single currency is holding up amidst all the perceived negativity surrounding the Eurozone currently. From a technical perspective the euro is on a drift lower but is now on the brink of turning more corrective. The spike low of $1.0953 from Monday 29th June remains intact as a basis of support, however my line in the sand, the $1.1050 medium term pivot level has come under significant strain in the past week and looks to now be giving way. The euro spent the majority of yesterday’s session trading below it and with momentum indicators continuing to show corrective signals the near to medium term outlook remains negative. The intraday hourly chart shows a consistent downtrend in the past 6 days now with resistance from yesterday’s rebound high at $1.1095. Hourly moving averages have unwound to renew the near term corrective forces and rallies are still being seen as a chance to sell. Expect move pressure on the intraday low at $1.1000 from yesterday and the key near term low at $1.0953 before a likely drift back towards the key May low at $1.0820.

GBP/USD

Cable has been in correction mode now for over two weeks now, but at some stage soon, if this is simply a bull correction, the buyers will start to return to build some support. The first sign of this was possibly seen yesterday when a sharp gap down at the open was closed and broadly speaking, the buyers were in charge basically all day. This has come in at $1.5530, so the implied downside target from a near term range breakdown at $1.5535 has been hit. I see the daily MACD as an interesting indicator here as Cable has been in a trending medium term play for a couple of months and the MACD lines have simply unwound to neutral suggesting this is around where the buying will resume. It is too early to say whether a key low has been left at $1.5530 but it would be consistent with a bull correction. I am also interested in the rising 55 day moving average being supportive at $1.5490 now. Watch for the resistance at $1.5643 on the hourly chart as this is a key near term reaction high. If this is breached then there could be something in the buying for Cable.

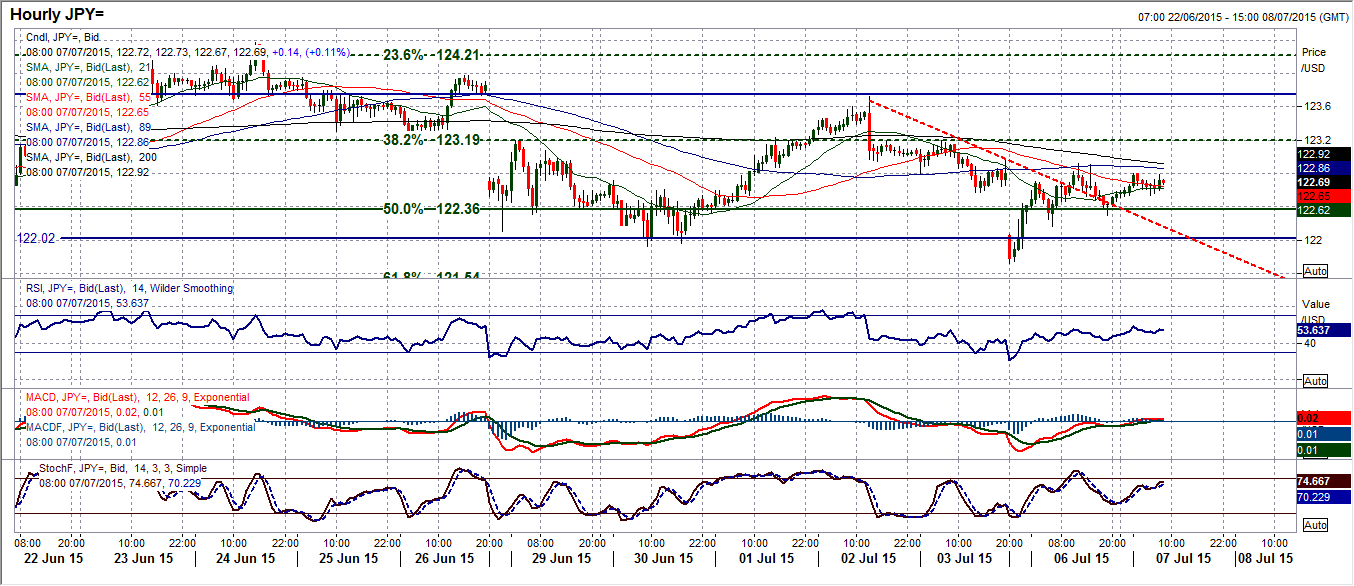

USD/JPY

Yet again we have seen an intraday test of the support around 122.00 being rebuffed and the buyers have been happy to support. The positive elements to this daily chart that suggest this remains a medium term corrective drift to help unwind indicators such as RSI and MACD remain firm and the breakout support around 122.00 is still seen as a basis for the next key low. The intraday hourly chart shows that a 2 day corrective drift downtrend has been broken and the outlook is increasingly neutral again on a near term basis. The Fibonacci retracement levels of the 118.86/125.85 rally continue to act as consolidation/turning points for this chart and should certainly be watched. Latterly, holding above the support now at 50% Fib around 122.35 and with hourly momentum on an improving scale suggests there could once more be a push back on the 38.2% Fib at 123.20. However this remains a chart where the outlook is quick to change on an intraday basis, although I retain my slightly positive bias still whilst it trades consistently above 122.00.

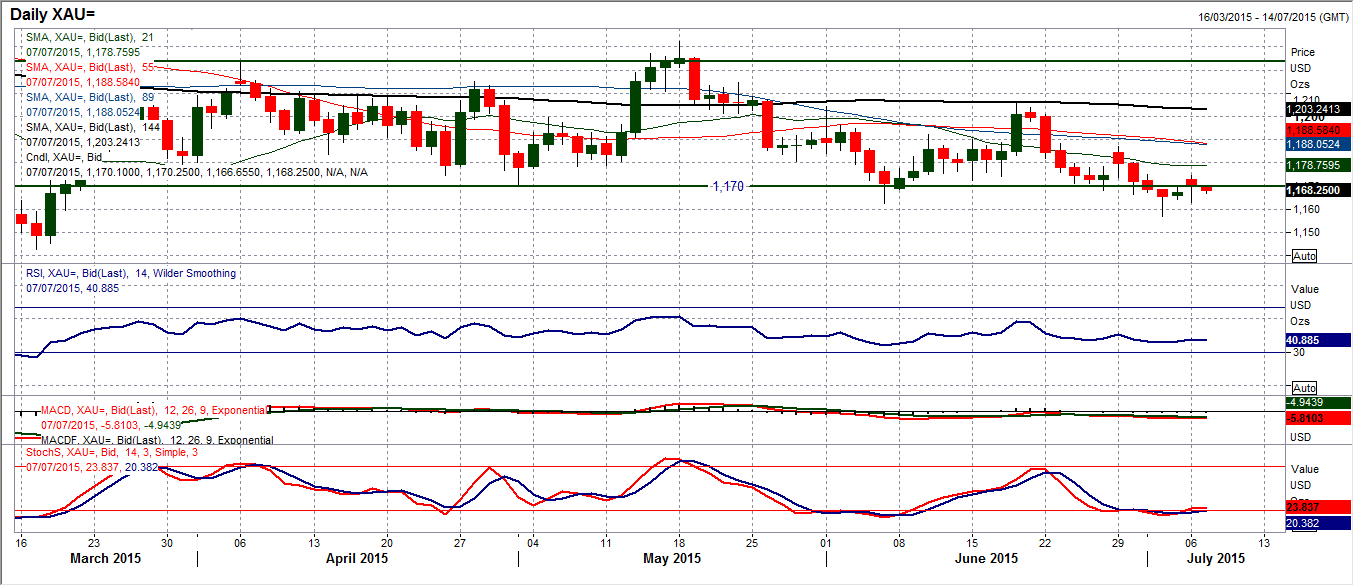

Gold

I am not sure what the fractal analysts will be saying about the trading on the last two Mondays but they seem to have been pretty similar to the naked eye. Once again a gap higher at the open has been filled but yet there is a distinctly disappointing feel to the buying which is once more seeing the price drift lower once more. The daily technical indicators remain negative on momentum and suggest that rallies should continue to be seen as a chance to sell. The intraday hourly chart shows that there has now built up a resistance around $1175 which is holding back the bulls and pressure is seeing the gold price trading fairly consistently under the old support around $1170. This suggests continued pressure on the lows and a retest of yesterday’s intraday low at $1162.80 before $1156.90 again.

WTI Oil

The breakdown of the key support that had been holding up WTI for so many weeks has now opened a flood of selling as the WTI price fell around 8% yesterday. Although there has been an element of a bounce today the little regard that WTI gave to the support of the old neckline of the base pattern at $54.24 is a concern. This level is a basis of resistance today. The ferocity of the selling pressure yesterday does not bode well for the near term outlook as the momentum is clearly now with the bears, having dropped over 14% in just 8 sessions. Daily RSI and Stochastics oscillating indicators are now in bearish configuration and suggest further downside, whilst rallies will be seen as a chance to sell. The next support band below $54.24 comes in around $50. The intraday hourly chart shows initial resistance at $55.34 with yesterday’s rebound high, whilst the old support at $56.50 now becomes a key overhead barrier.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.