Market Overview

The legacy of Friday’s strong Non-farm Payrolls data is still playing out on Monday morning. Friday afternoon saw strong equity market gains and an ever stronger dollar. Wall Street closed with gains of well over 1% higher, and although the Asian markets have given little reliable steer due to thin volume on a raft of public holidays through the region, European indices are trading higher again today.

In forex trading, major pairs are taking a bit of respite from the huge dollar gains on Friday. The dollar is currently trading slightly weaker against al the majors as an element of Friday’s strength is retraced. The move is likely to be short lived though. There is very little to focus on in terms of economic data today, with the Eurozone investor confidence at 09:30BST the only real data, expected to deteriorate to -11 (from -9.8).

Chart of the Day – EUR/AUD

Has the euro rally run its course? A rebound from support around 1.3800 lasted a few weeks but started to hit the buffers around 1.4585 last week which is around the key resistance from the old June/July highs and old May lows. Additionally, the rate is now starting to breach the higher lows built up during the recovery. On Thursday last week there was a breach of 1.4373 which was a higher low within the uptrend. Perhaps importantly also, the momentum indicators are beginning to give negative signals again, with the Stochastics already having given a confirmed crossover sell-signal and the MACD lines in the process of crossing over. There are now key near term supports at 1.4340 and 1.4300 which if they are lost this would confirm the breakdown of support nd open towards an initial 1.4233. Above 1.4500 would question the corrective outlook.

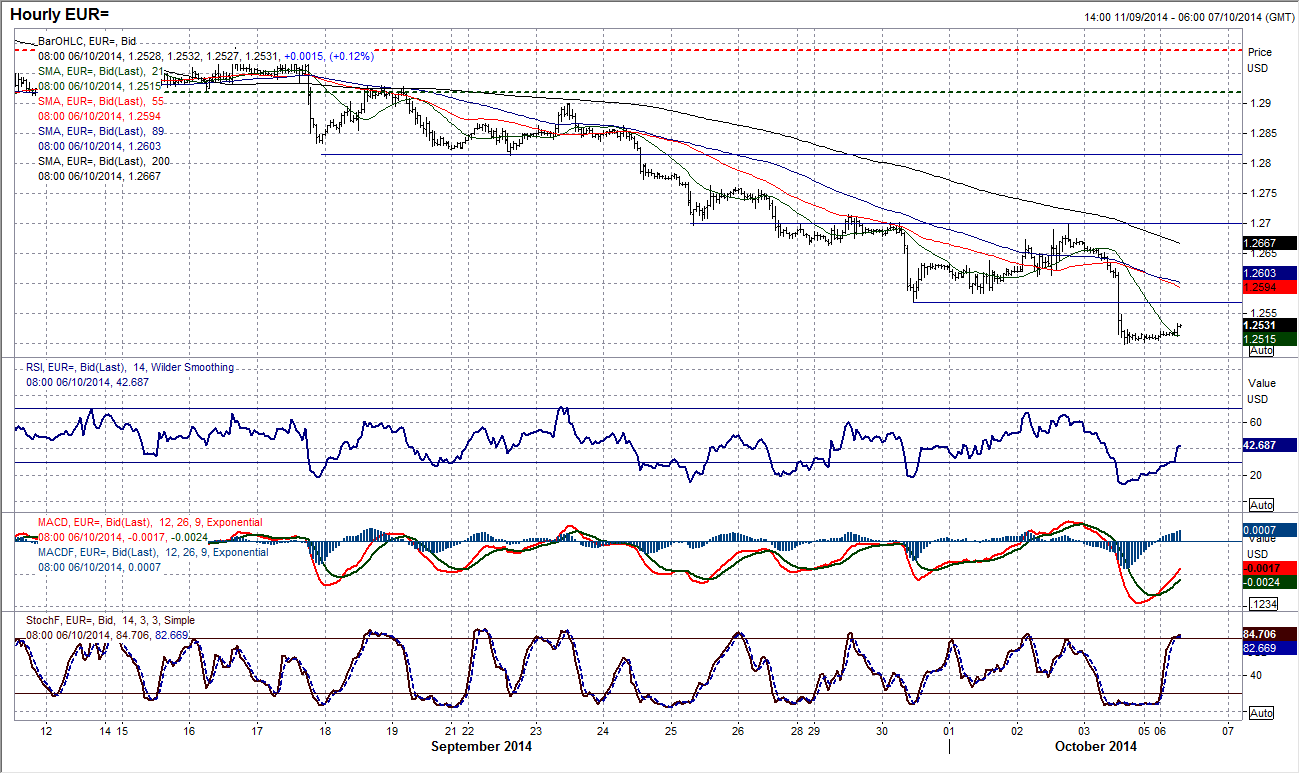

EUR/USD

Yet further weakness in the euro on Friday after the strong Non-farm Payrolls report drove the rate to $1.2500. The only real strategy that is viable is to sell into any intraday rebounds as previous consolidation supports become the new resistance. This would mean that anything back towards $1.2570 (the low from 30th September) should be seen as a chance to sell. This would be in keeping with the intraday rebounds within the sell-off that usually result in a bounce of between 50 to 80 pips before the sellers resume control once more. Daily momentum indicators remain extremely weak and further downside can be expected. There is minor support at $1.2443 but in all honestly there is little real support until the July 2012 low at $1.2040. The first significant resistance is not until $1.2700.

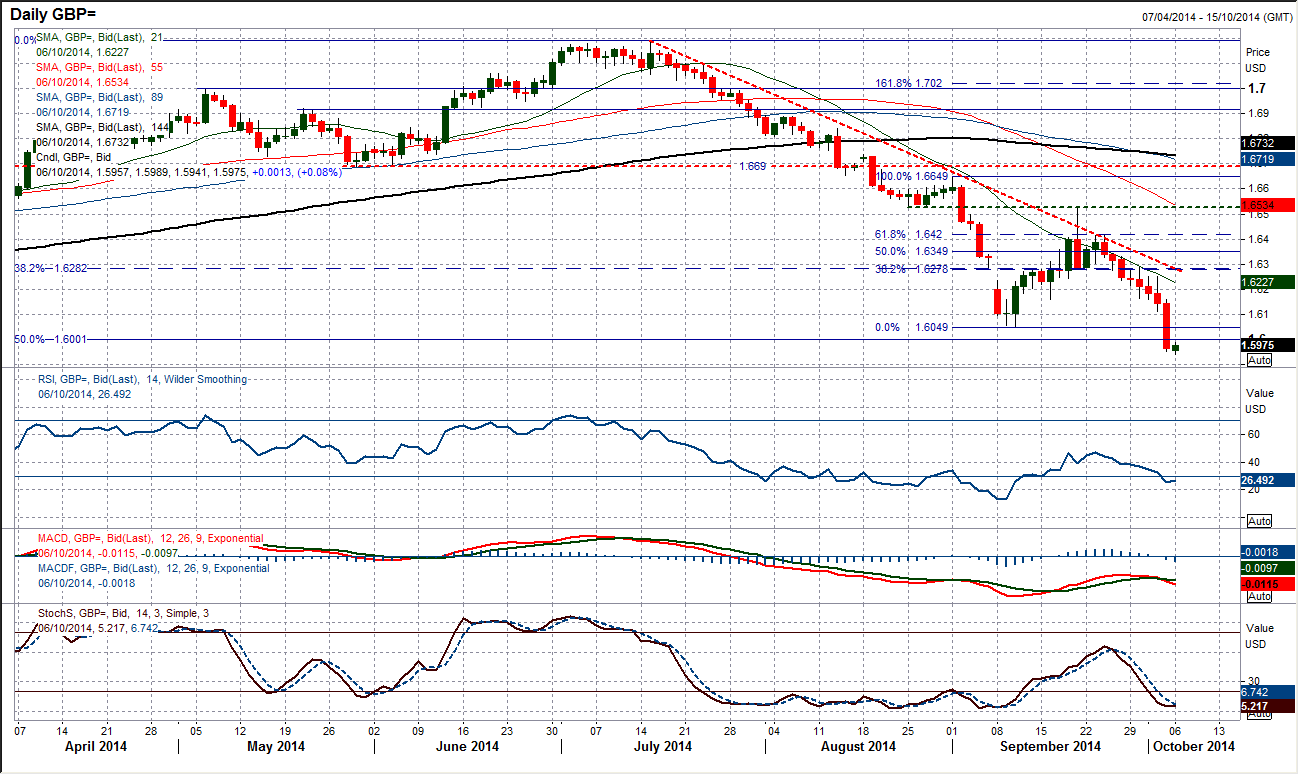

GBP/USD

Even in the context of what has been a volatile few weeks, Friday’s 150 pip sell-off was a big move. Furthermore, it took out two key supports at $1.6050 and $1.6000 (which also now turn into the basis of resistance). The configuration of the momentum indicators suggests further downside potential with the RSI only just below 30 (the early September sell-off saw the RSI at 13) and the MACD lines having just given a negative crossover. There is room for further weakness now to test the key November 2013 low at $1.5850. However the intraday chart shows a bounce in Cable with the hourly momentum indicators just looking to unwind a bit of Friday’s sell-off first and selling into a rebound looks to be an option. The old intraday support at $1.6110 is also now resistance, with the downtrend sitting around $1.6160.

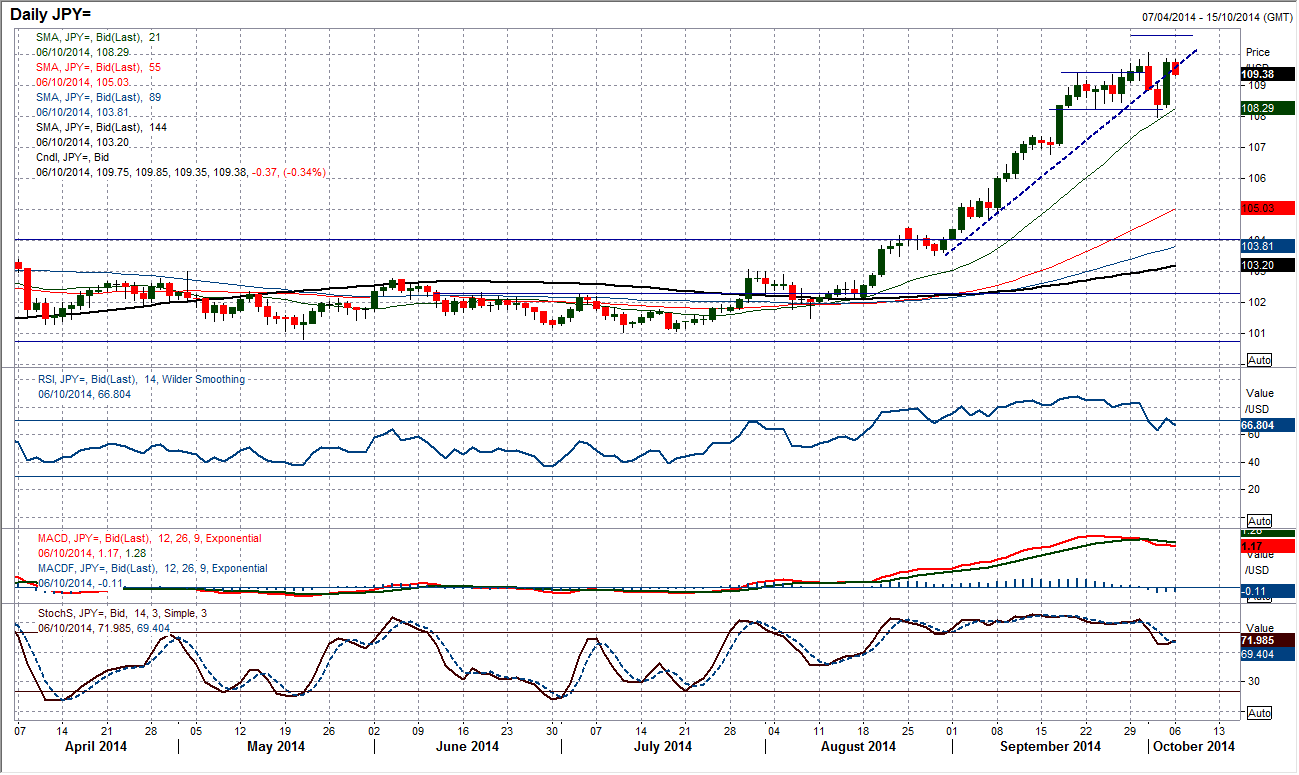

USD/JPY

Calling the end of a bull run can be a difficult and often fruitless game. I talked last week about the fact that Dollar/Yen was losing momentum and giving a range of corrective signals. These signals are still present and relevant for the chart as Friday Non-farm Payrolls related jump for the dollar failed to take out the high at 110.08. The slight dip back in the rate again this morning leaves questions still unanswered. I feel that the failure to breakout is a concern. I would be taking this series of negative momentum signals more as profit triggers for long positions rather than outfight sell signals as ultimately I would be happy to buy back in on a correction (due to the strength of the uptrend now). But I am still concerned of a near term corrective move. This could simply prove to be a consolidation phase above the support now at 108.00 and considering I have been calling for a correction to 107.50 this is not too far away anyway. A close above 110.08 would see the upside momentum resume.

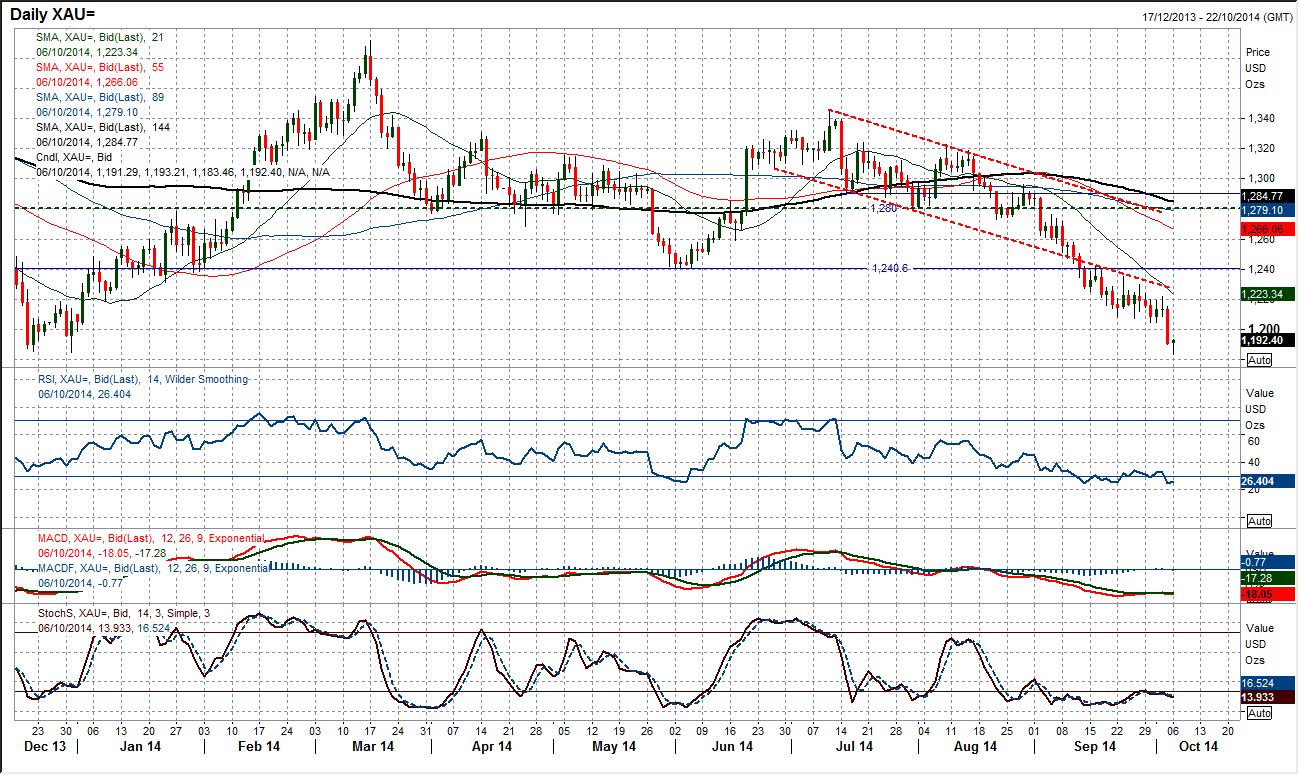

Gold

This is now a key moment for gold. Friday’s sell-off has seen a breach of $1200 but also the key December low at $1184.50 has now been broken this morning. The absolutely critical low is from June 2013 at $1180.70 and is under threat, which is a multi-year low. The next support if that were to be breached is not until $1160 back from July 2010. However momentum is beginning to look stretched again and coming at such a critical support there may be those ready to take a punt around these levels due to the strength of the decline. It would be a risky strategy as the “trend is your friend” and the trend is currently down. However there could be a near term bounce back towards initial resistance at $1204.40 which was the old intraday low. Key near term resistance does not come in until $1221.64 and $1230.

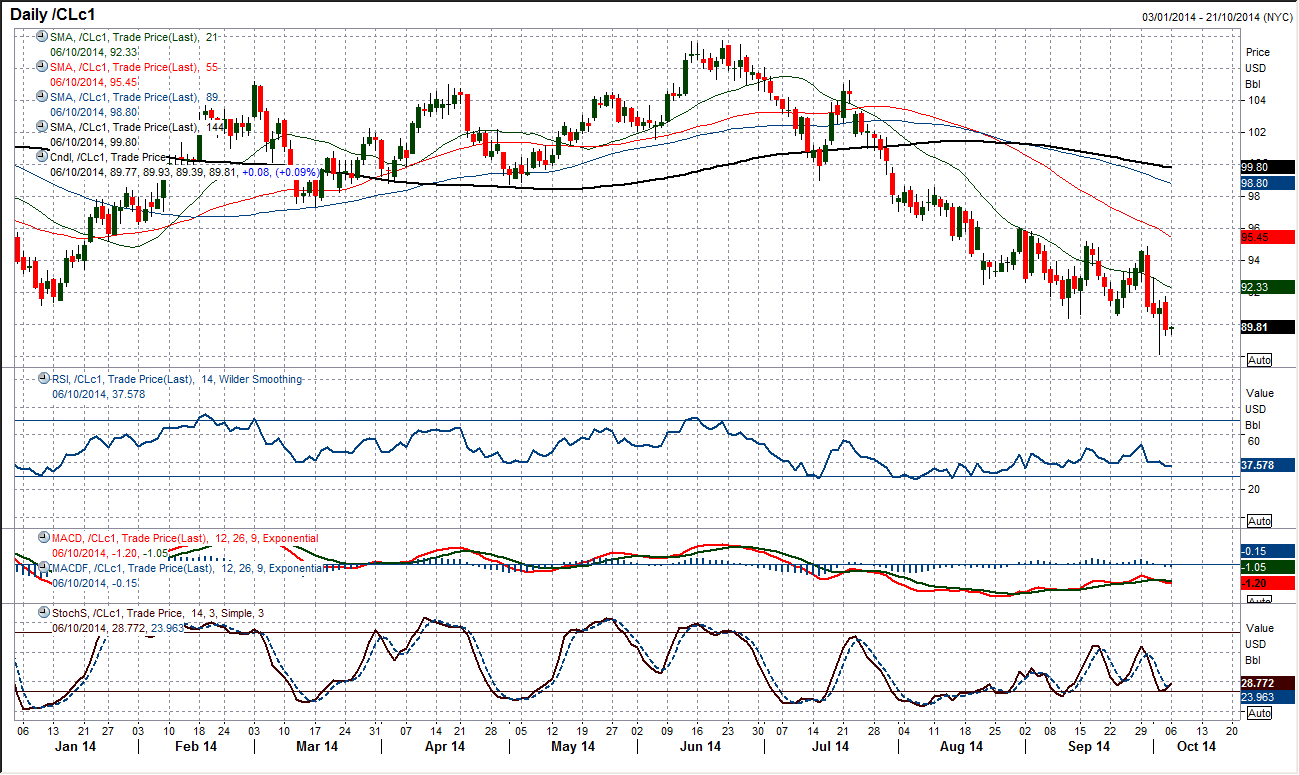

WTI Oil

I spoke on Friday about the bull hammer needing a positive close to validate the pattern and unfortunately the validation was not seen as the downside pressure on WTI resumed once more. Therefore this rebound to form the hammer has the likelihood of being a dead cat bounce as the bears remain in control following the breach of support at $90.43. The fact that Friday’s close was also back below the previous support adds to the bearish outlook. Daily momentum indicators remain weak and with the RSI in bearish configuration the prospect of further weakness to retest the low at $88.18 in the coming sessions is high. The intraday chart shows lower reaction highs at $92.96 and on Friday at $91.79.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.