Market Overview

Selling pressure is taking hold on global equity markets, as Wall Street had its worst session since 31st July. The S&P 500 fell 1.6% leaving it at a 5 week low and at risk of further correction back towards its band of support 1945/1955. The move was driven by a series of shocks which included problems for Apple’s software and devices which resulted in a 4% drop in the shares. Further concerns over potential counter sanctions from Russia and the prospect of an earlier Fed rate hike all added to the fears for investors. The VIX Index of S&P 500 options volatility spiked 17% higher as fund managers scrambled for portfolio protection.

The Asian markets were also very weak with the sell off on Wall Street leaving a bearish legacy, whilst the slight rebound in the Japanese yen also impacted to leave the Nikkei 225 just under a percent lower. European markets had already been hit hard yesterday and are only slightly lower in early trading.

Once more, in forex trading, the dollar is trading strongly against major pairs this morning, with the commodity currencies of the Aussie and Kiwi dollars again being especially hit. There is little significant data for traders to go on today, although there are a few loose ends to be tied up. The final reading of US Q2 GDP is at 13:30BST and is expected to show a slight improvement to an annualised 4.6% from 4.2%, whilst there is also the final reading of the University of Michigan consumer sentiment at 14:55BST with a slight improvement expected to 84.8 on the flash number of 84.6.

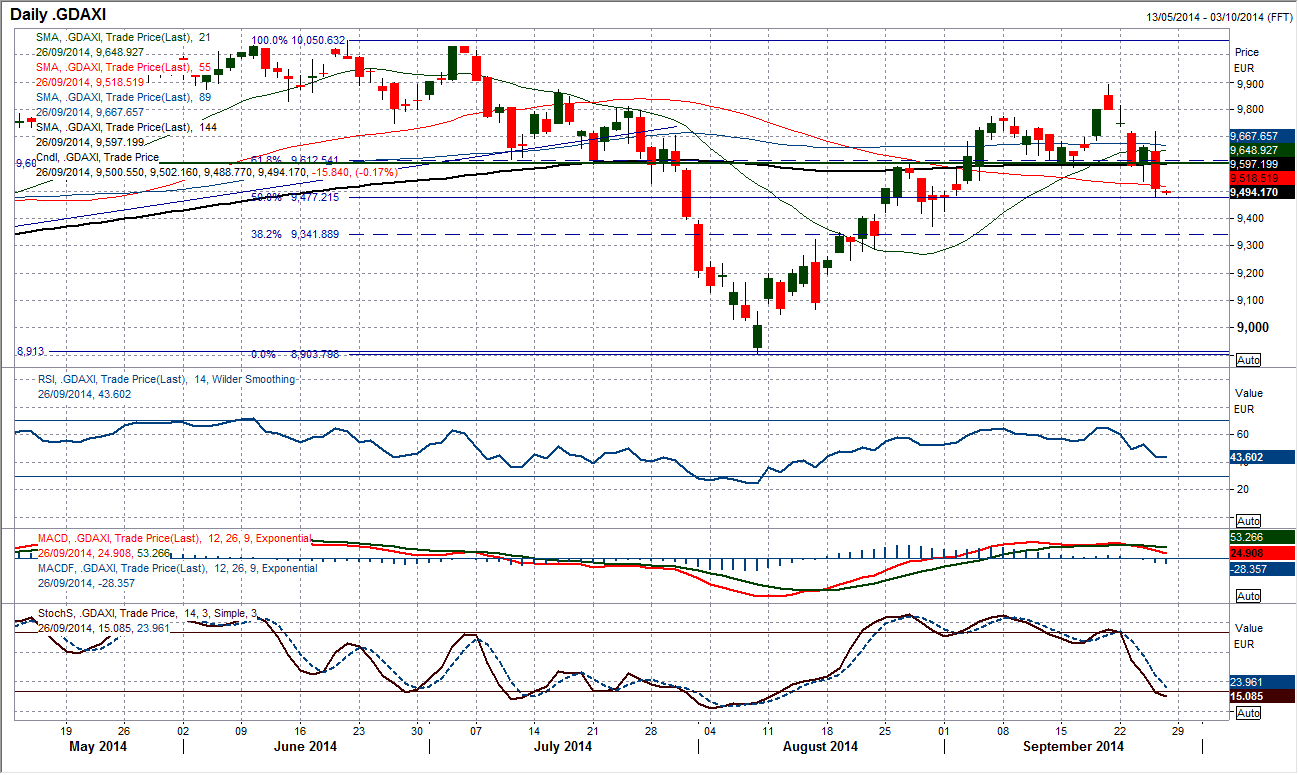

Chart of the Day – DAX Xetra

In an especially volatile and also messy period of trading the DAX is becoming bearish again. The initial rebound back above the pivot support at 9600 proved to be short lived and a significantly strong bearish outside day posted yesterday puts the sellers seemingly in control once more. The completed close below 9600 has also formed a near term double top pattern that gives the DAX a downside target of 9427 minimum (but could be as bad as 9320 if the bears really take off). The momentum indicators confirm the bearish move with the RSI now in decline, Stochastics sharply reversing and the MACD lines having recent given a bearish crossover. If the 50% Fibonacci retracement of the 10050/8904 sell-off at 9477 is breached today then the move could be quite quick. The next support is not until the reaction low at 9369. The pivot level at 9600 is now the resistance for a pullback rally, but the bearish near/medium term outlook is in place until yesterday’s high is taken out at 9718.

EUR/USD

It is beginning to become difficult to write a new comment on the euro every day as the same old process happens almost on a daily basis now. There is a downside break that sees some form of intraday retracement. There may be some form of consolidation, whether it last for just a matter of hours or even a couple of days. However the consolidation subsequently is sold into and we see further downside for the euro. Yesterday’s move resulted in the breakdown of some key supports. First of all the 61.8% Fibonacci retracement of $1.2040/$1.3991 was beached at $1.2786 and I believe this now means that if this move is confirmed we could easily see a full retracement back to $1.2040 in the medium/longer term. Also the key July and April 2013 lows at $1.2745/50 were breached which opens the next key low at $1.2660. I still see the rally from yesterday afternoon as a chance to sell, with the resistance already coming back in around $1.2770. A move back below yesterday’s low at $1.2696 would begin the whole process again.

GBP/USD

The battle is heating up again as Cable continues to flirt with the support around $1.6280. This was the old gap resistance that has now become the new support and in my opinion, could be a key line in the sand. The recent Cable recovery seems to have stalled around the old 10 week downtrend. Although the downtrend has been slightly breached, its legacy still remains and this rebound over the past three weeks could just turn out to be another chance to sell. That is what the momentum indicators are suggesting, with the RSI falling over just under 50, the MACD lines unwinding a bearish position and now the Stochastics also turning lower. However it is the support at $1.6280 which has held now for over a week (within a few pips) that is becoming key. If we begin to see Cable with a consistent $1.627 or even $1.626 handle then this will be the bulls rejecting the recovery. A loss of $1.6250 would then confirm the breakdown and a move back towards $1.6160 would ensue. Initial resistance is at $1.6350, with a move above $1.6415 needed to reinvigorate the recovery.

USD/JPY

The price has been consolidating now between 108.24/109.45 for over a week. We should wait to see where the breakout moves, but with the bulls in control and momentum just unwinding an overbought position, the expectation remains for an upside break. The support of a 4 week uptrend is approaching and there no real signals suggesting an imminent correction. This would suggest that even if there were to be a slight breach of the support that the bulls remain in control and are likely to come in to buy once more. I still see the ideal entry point for long positions around 107.50, but this may begin to move higher as the consolidation runs. The intraday chart shows little real selling pressure and the old support around 108.50 is being used once more over the past couple of days. Ultimately I expect to see 110.65 tested in due course.

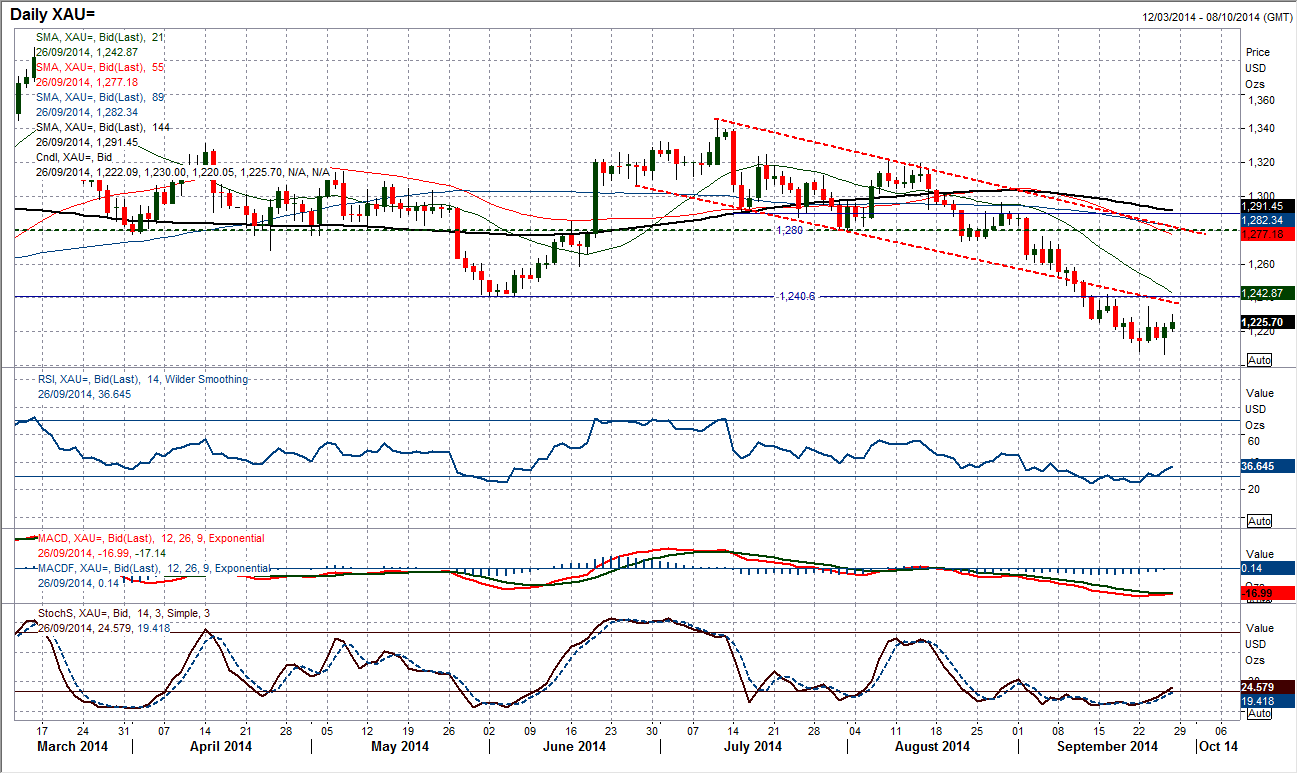

Gold

The gold price has become a little bit choppy in recent days as some uncertain price action has resulted in a near term rebound. Yesterday’s session was a good one for the recovery bulls, with a move today towards the initial resistance at $1234.80. However I am still of the belief that rallies will be sold into and this could be the latest opportunity. The Key overhead resistance comes with the old June low at $1240.60, whilst the overhead barrier of the old downtrend channel is looming at $1237. Momentum indicators are just showing signs of unwinding, but it is important to remember the strength of the bear run suggests that rebounds are simply unwinding oversold momentum before the next leg lower. I would be looking upon this latest bounce as a chance to sell again for a test of the $1200 breakdown target.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.