Market Overview

Wall Street has begun the week with a couple of nervous days as the important earnings season comes into view. A second day of declines has set equity investors around the world on the back foot. Yesterday both the Dow and S&P 500 closed around 0.7% lower with the NASDAQ off around 1.4%. This corrective attitude spilled into Asia, where markets fell. The Nikkei was slightly lower despite a weakening of the yen, whilst China was also lower. This came despite the Chinese CPI dropping more than expected to 2.3% from 2.5% (a drop to 2.4% had been forecast). Alcoa has unofficially kicked off US earnings season in style with a beat of expectations on earnings. With the announcement coming after the closing bell, the shares were up 2% in after-hours trading and the impact of this will not be felt until markets open this afternoon. European markets have opened with slight gains, with perhaps the DAX bulled by an incredible result last night for the German football team in the World Cup.

There is little real moves in any of the major currencies overnight, with a mixed performance against the dollar in forex trading. The only real move of any note has been the New Zealand dollar which is gaining on the back of ratings agency Fitch revising its sovereign outlook from AA rating from stable to positive.

Traders will be watching out for the release of the Federal Open Market Committee meeting minutes. With Janet Yellen maintaining a dovish stance in the recent press conference it will be interesting to see if the dissenting voices looking for a tightening of rates to begin sooner than the middle of 2015 are beginning to swell.

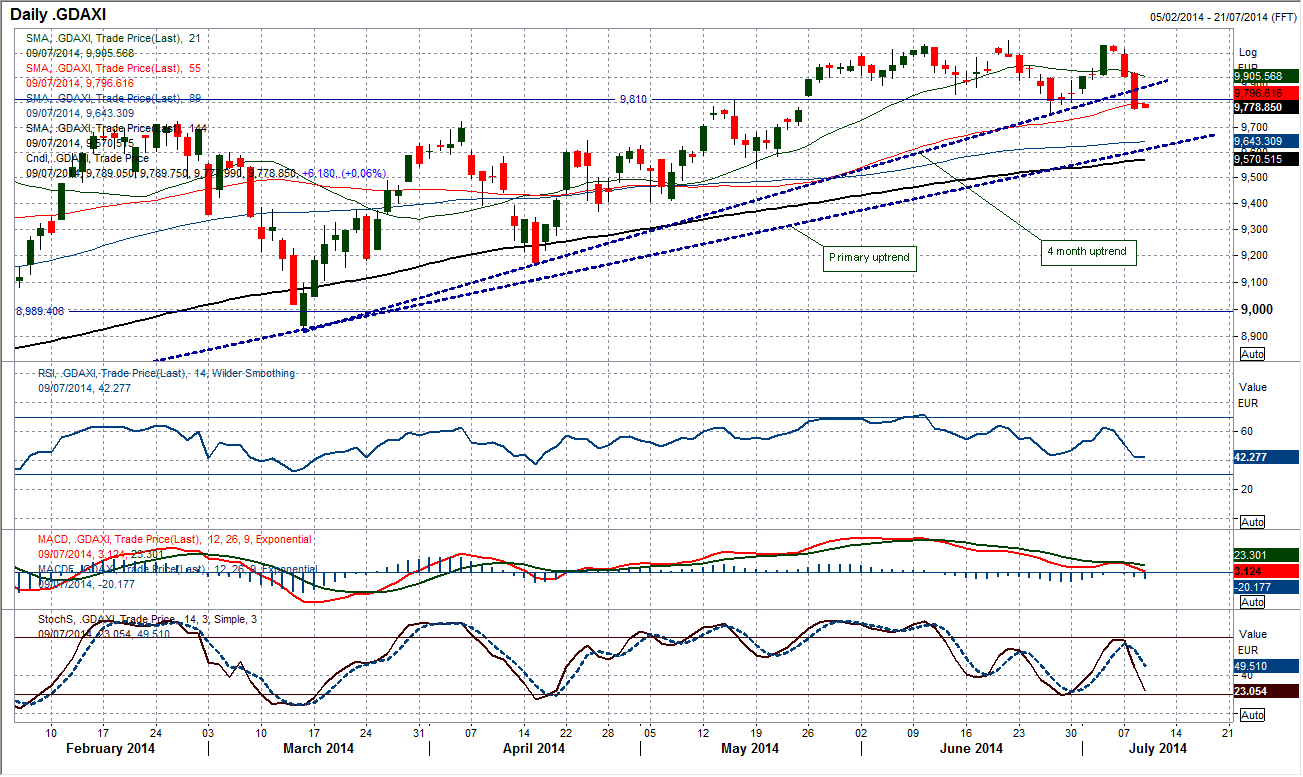

Chart of the Day – DAX Xetra

The bears have been in control for the past two days and the outlook for the DAX is now deteriorating. The sell-off from yesterday has now broken a 4 month uptrend, with the index closing below the 55 day moving average for the first time since 28th April. Formerly strong momentum indicators are also under pressure, with a negative crossover on the Stochastics and a bearish kiss on the MACD lines. The price is also now retreating back to a key medium term support. Already at a 6 week closing low which is also below support at 9810, Today will put the key support at 9750 in direct pressure. A breach of the support would complete a 6 week double top pattern that would imply a correction towards 9470. The macro trend remains bullish and currently arrives at 9610 but there could be a quick decline towards the primary uptrend (which would ultimately probably be a good opportunity to buy). The intraday chart shows resistance in the 9840/9870 band.

EUR/USD

The Euro bulls have been fighting to hold on to the support in the band $13574/$13585 for the past few days, and yesterday’s second consecutive positive candle suggests there could be a near term rally. However this is likely to be short-lived with daily moving averages in bearish formation overhead to provide a barrier to gains (especially the 55 day moving average at $1.3678) and momentum indicators still weak. The intraday hourly chart shows the sizeable overhead resistance in the band $1.3640/$1.3670, and any strength towards this band should be viewed as a chance to sell. A move above $1.3700 would be needed to defer this outlook.

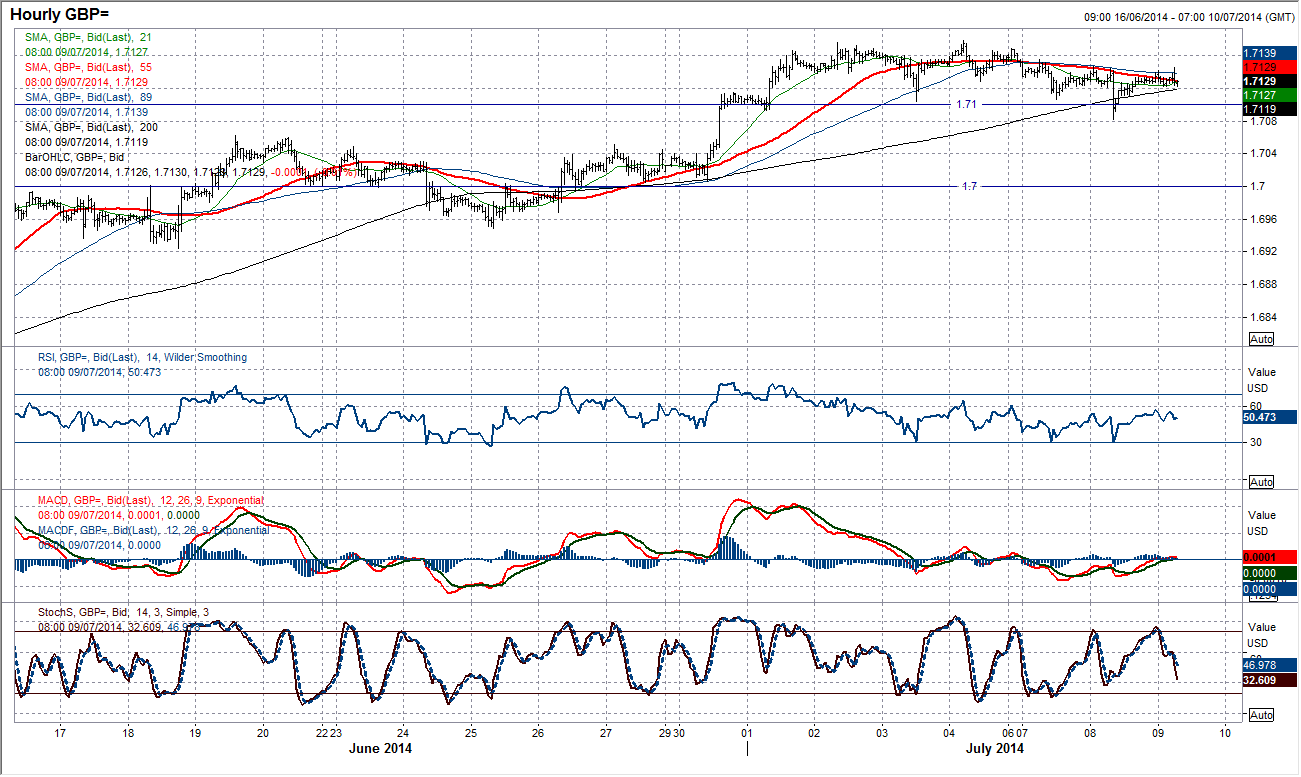

GBP/USD

Cable had a minor wobble yesterday after the disappointing UK manufacturing data. This resulted in a slight dip below the key near term support at $1.7100. However, the move was quickly retraced and Cable ended by posting a candle firmly within the support. The fact that the buyers refused to accept the loss of $1.7100 despite the disappointing data just shows how strong sterling remains. I have been calling for a minor correction at least back towards $1.7060, but this may not be seen if this strength continues. Daily momentum indicators remain positive although the consolidation is causing the MACD and Stochastics to take on a more conservative outlook. The price reaction overnight in Asia has reaffirmed the near term support which is now at $1.7082. It is possible now that this consolidation is what we can expect instead of correction before the next leg higher above $1.7179.

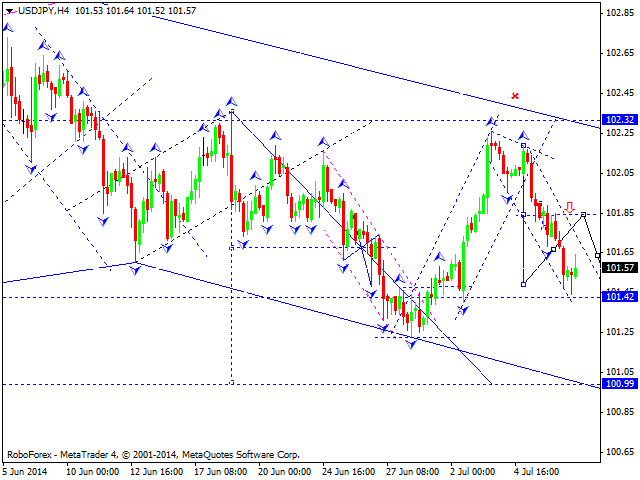

USD/JPY

After a three day decline which has merely reinforced the perception of Dollar/Yen being a choppy range trade, the support appears to be coming in just above 101.40 overnight. This comes with the momentum indicators increasingly neutral and suggesting that the key closing low support area around 101.30 remains a viable floor to use. With little to go on for the daily chart, the intraday hourly chart gives us little more other than suggesting there could be a near term recovery following a crossover buy signal on the hourly MACD and slight bull divergence on the hourly RSI. We now look towards the upside resistance levels once again, with 101.80 and 102.00 in immediate sight.

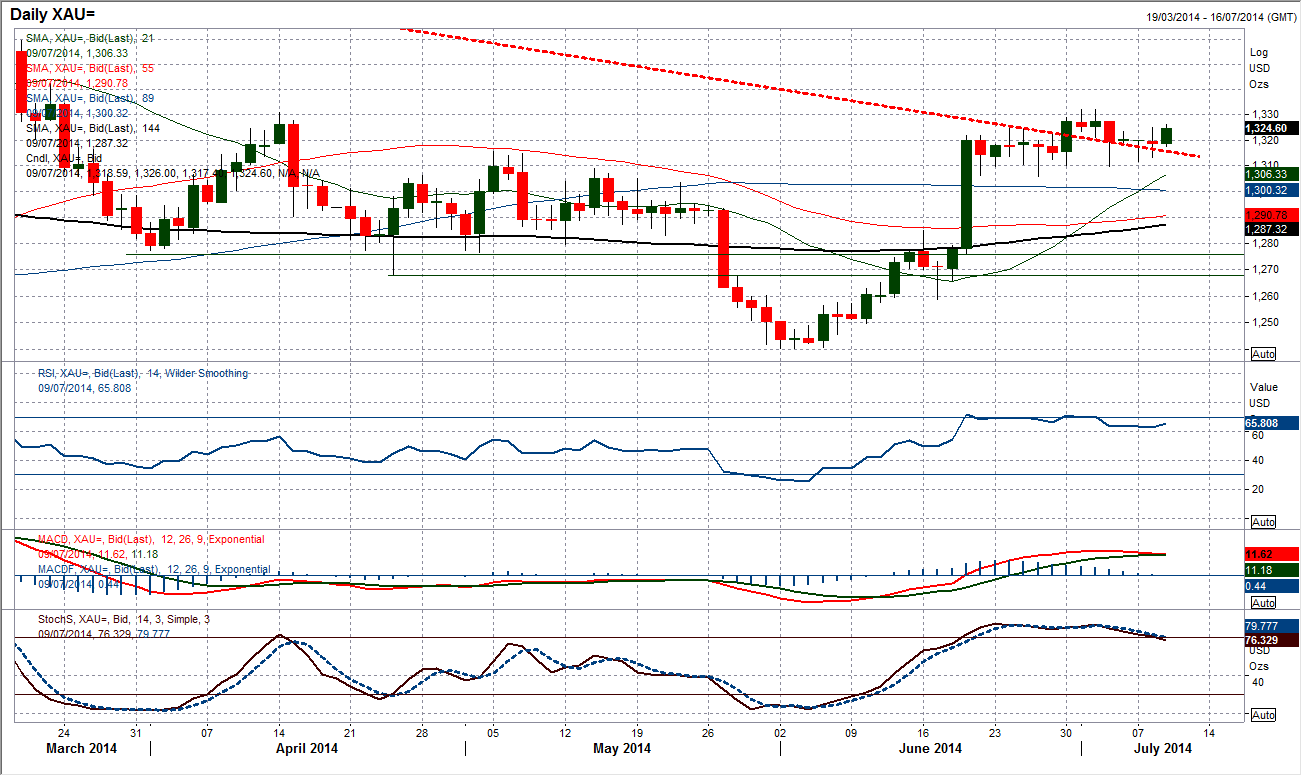

Gold

The price continues to consolidate in the band $1306 to $1332, however exactly how the breakout will come is less clear. Uncertainty is high, with the number of “doji” candlesticks posted over the past three weeks increasing by the day. The momentum indicators are threatening to take on a corrective configuration, but once again are failing to show much conviction either, especially if the support that has been formed overnight in Asian trading continues. The intraday hourly chart gives us little further information, with hourly moving averages basically flat and little to be garnered from the momentum. Unfortunately we can do little else other than play the range for now until we see a break above $1332 or below $1306. Neither seems to be imminent either.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.