Market Overview

The pick-up in the US ISM manufacturing data resulted in Wall Street pushing to another new intraday all time high yesterday as traders backed a continued economic recovery. The sentiment flowed through to the Asian session which also posted strong gains. The weakness of the yen (Dollar/Yen hitting its highest since late January) allowed the Nikkei to push strongly higher with gains of 1.7%.

The European session is also starting with a positive skew, with indices higher and forex trading currency pairs looking higher again. There is little market moving data due to be announced this morning but traders may perhaps have one eye on the UK construction PMI (at 09:30BST) and the Eurozone Producer Prices Index (at 10:00BST).

However the main focus of today will be with the ADP employment report released at 13:15BST. This is the private payrolls which are announced two days prior to Non-farm Payrolls and can give traders a steer as to what Friday’s crucial jobs numbers might be. The ADP number is forecast to come in at 203,000 up from last month’s 139,000 jobs. This level of improvement would certainly have traders hoping for a strong Non-farms number and should help boost the prospects of the dollar.

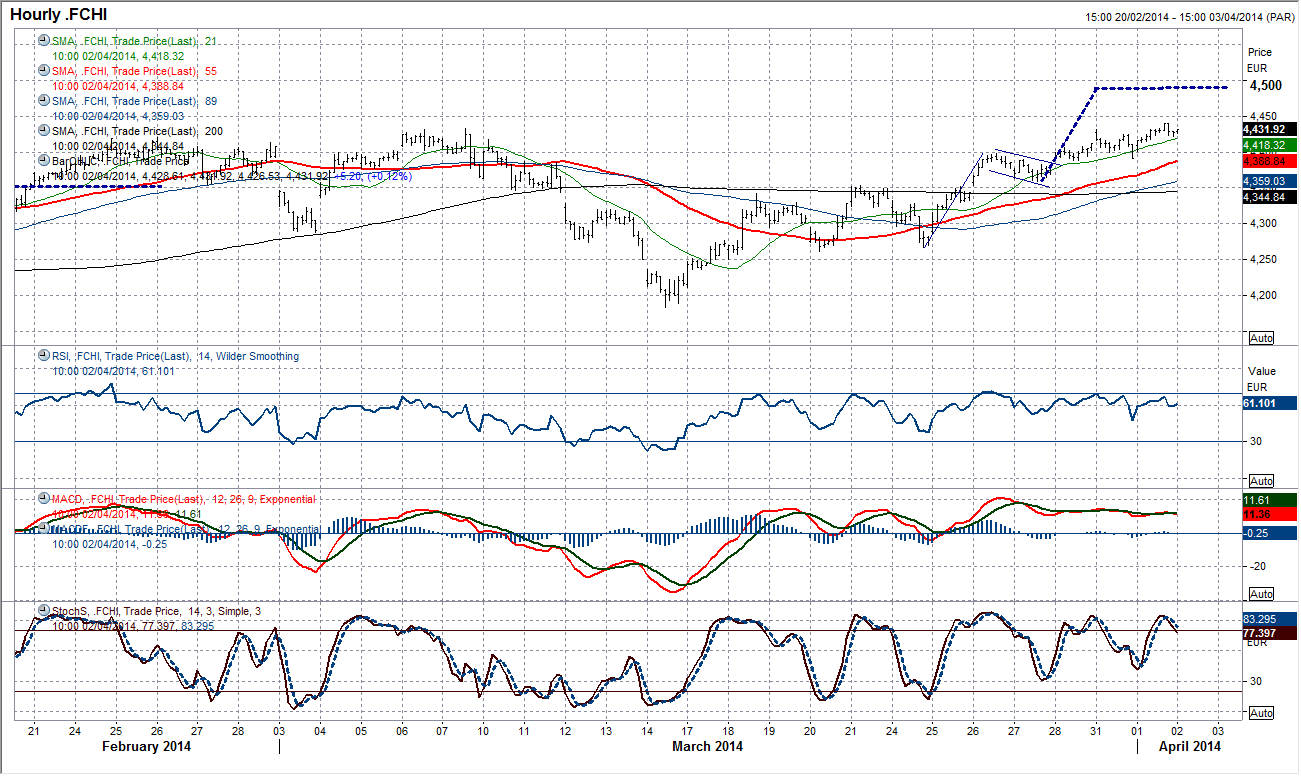

Chart of the Day – CAC 40

Yesterday we saw the CAC 40 breakout above hit its March highs to reach the highest level since August 2008. The index has now achieved 6 straight sessions of higher daily lows and continues to look strong. The momentum indicators are also still showing upside potential in the current move for further gains. The intraday hourly chart shows the 21 hour moving average being used as a decent gauge of support (currently at 4417) whilst the momentum indicators are all in bullish configuration. Expect further upside through yesterday’s high at 4440. There is arguably an upside projection that can be extrapolated from an intraday falling wedge, which gives us a target area of 4490 to consider.

EUR/USD

The Euro continues to make recovery gains, and is now looking at a retest of the old resistance band $1.3824/$1.3832. Daily momentum indicators have turned higher and the outlook is improving. The intraday hourly chart also reflects this with momentum indicators all in bullish configuration now and the rate now using the rising 21 hour moving average as the basis of support at $1.3797. Yesterday’s high at $1.3815 is the first barrier to overcome, however the chart suggests that the next real resistances at $1.3846 and $1.3875 are within site today.

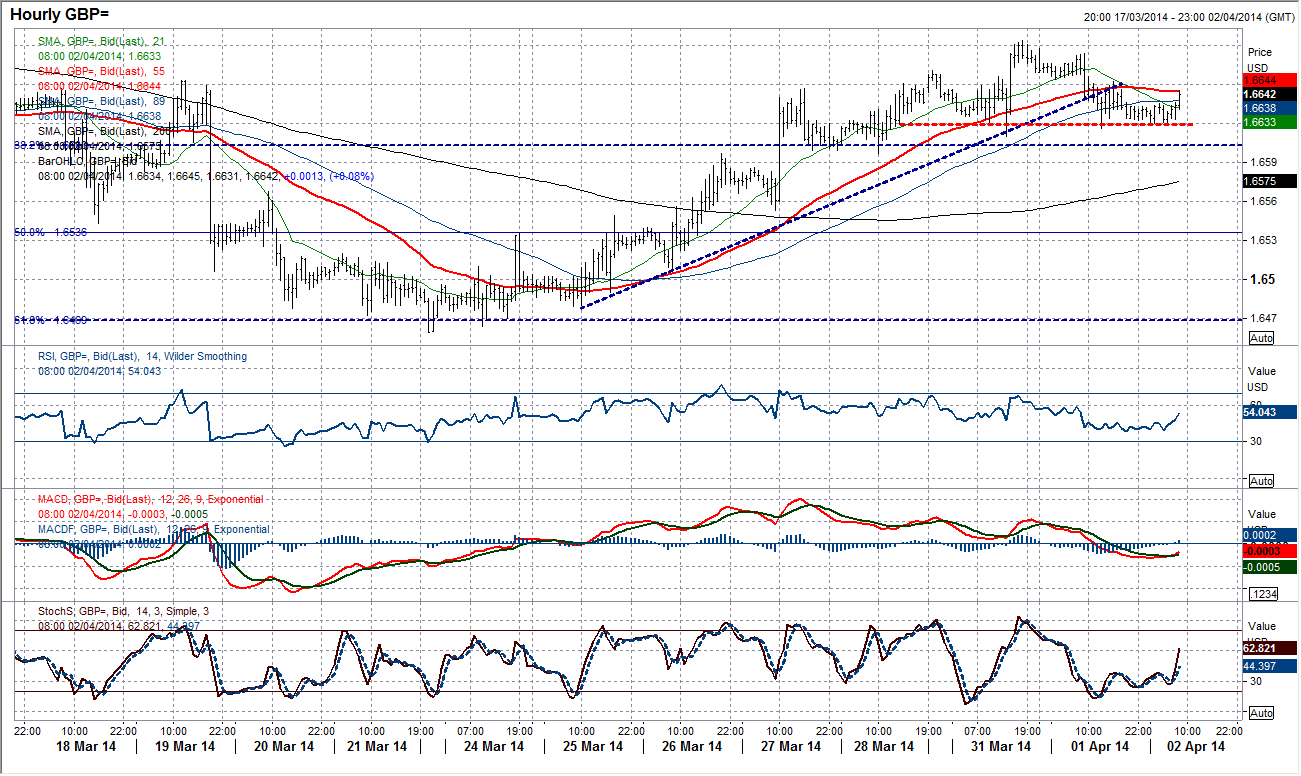

GBP/USD

Even though Cable continues to post higher lows on the daily chart, yesterday saw a slide in the price which now puts it at risk of a top pattern on the intraday chart. Breaking a 6 day uptrend and a fall below the support of the 55 hour moving average which is now threatening to become the basis of resistance at $1.6644 the bullish outlook is being tested. The low at $1.6610 marks the absolute completion of a head and shoulders top pattern, whilst the move would be confirmed on a fall below the 38.2% Fibonacci retracement at $1.6603. The implied target from a top pattern would be $1.6535. However, with this pattern still in the formative stages it would be best to wait for the completion as it could turn out to merely be a consolidation pattern. A move back above $1.6652 would turn the outlook more positive again.

USD/JPY

The strong move higher in Dollar/Yen has hit its intraday falling wedge target at 103.85 and its ascending triangle target at 103.90. The move has also seen the rate push through the key March high at 103.75 to the highest since 23rd January. The price has been gaining consistently now with 4 straight sessions of higher lows. With momentum indicators increasingly strong, the breakout has now opened the next key high at 104.92. The daily chart now suggests that there is good support in the band 102.83/103.75. The intraday hourly chart shows the rising 21 hour moving average still providing the basis of support, currently at 103.64, whilst there is also good support around 103.43. Look to use corrections as a chance to buy.

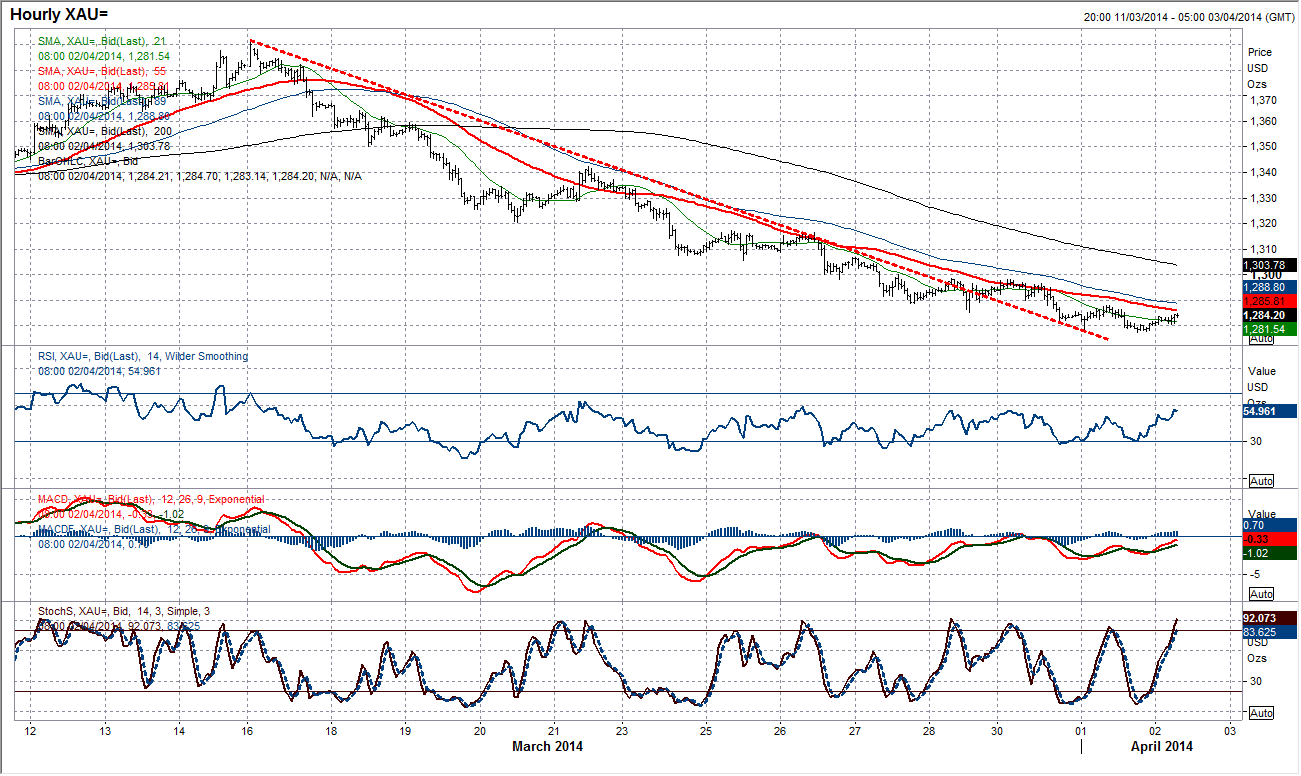

Gold

Although the gold price continues to fall, the decline is becoming ever more gradual with yesterday’s low at $1277.29 coming just under the old neckline support at $1278.01. Although all intraday hourly moving averages are falling in bearish sequence and momentum indicators are in negative configuration, the downtrend that had been the basis of support throughout the sell-off has now been broken and was used as support yesterday. With technical indicators still bearish selling into any rallies still looks to be the best way to play the gold price currently, however, it might be wise to use small positions as the downside potential does not appear to be that great currently and the possibility of a recovery is in its early stages.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.