Technical Bias: Bullish

Key Takeaways

Australian dollar is trading in the positive territory against the Japanese yen and looks set for more upsides in the near term.

101.80 area can be considered as a buy zone where buyers are expected to appear.

BOJ monetary policy meeting minutes are scheduled for release during the Asian session, which is likely to cause swing moves in AUDJPY.

The Aussie dollar has shown a lot of resiliency against most major currencies recently, raising the case of more upside in pairs like AUDUSD and AUDJPY.

Technical Analysis

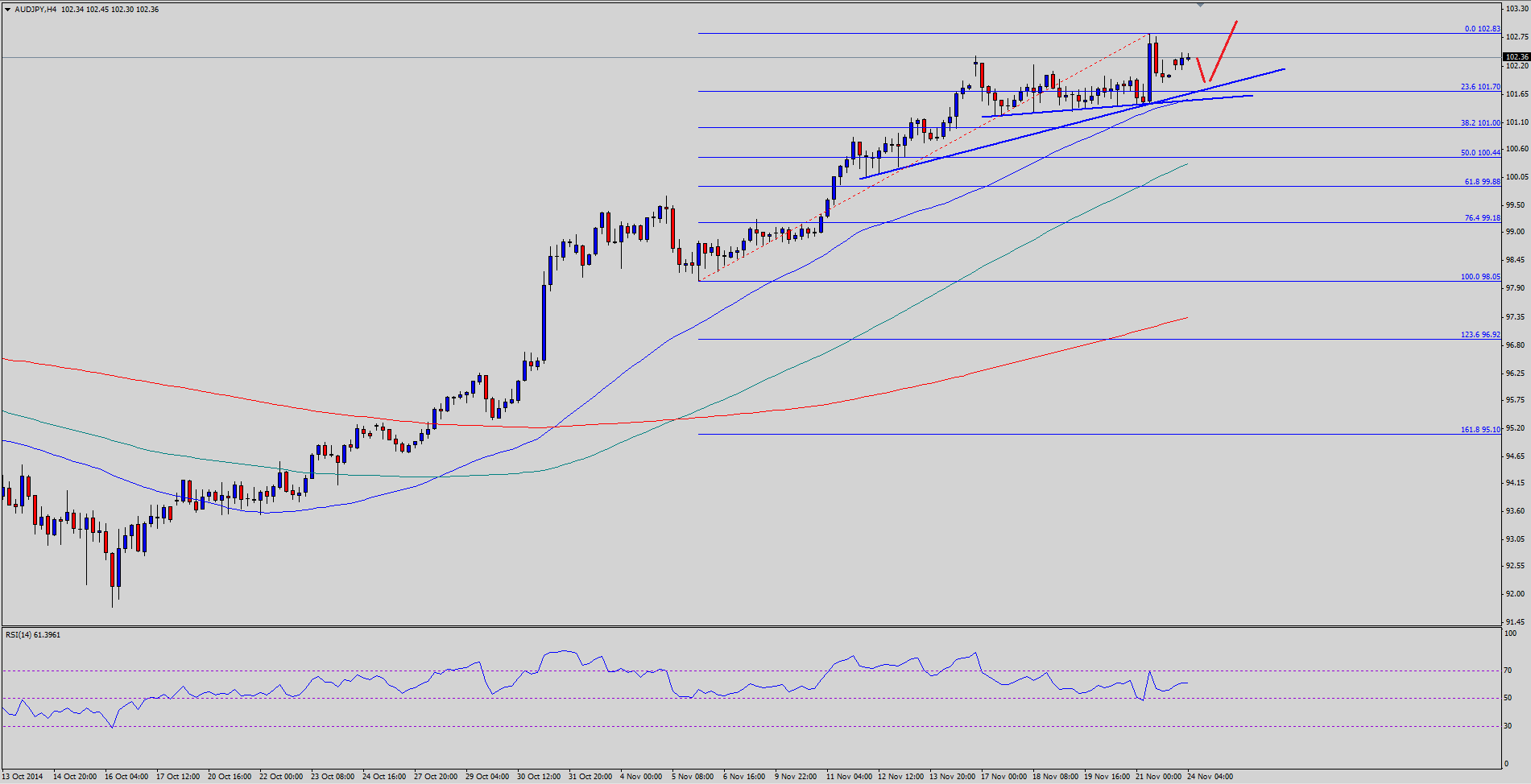

There are a couple of important trend line formed on the 4 hour chart of the AUDJPY pair, which are likely to act as a support for the pair moving ahead. The pair recently climbed towards 102.80 area where it found sellers, and is currently trading lower. There is a chance that the pair might spike lower towards the first bullish trend line, which is also sitting around the 23.6% Fibonacci retracement level of the last leg from the 98.05 low to 102.83 high. Moreover, there is one more bullish trend line, connecting lows sitting just below the first trend line. So, there is a lot of support around the 101.80-60 area where buyers are likely to take a stand. If the pair continues to trade higher from the current or lower levels, then initial hurdle is around the last swing high of 102.83, followed by the all-important 103.00 area.

On the other hand, if the AUDJPY pair breaks the highlighted support zone, then it is likely to head towards the 100 simple moving average (SMA) – 4H, which is around the 50% fib retracement level.

Moving Ahead

There is no major release in Australia in the coming sessions, but in Japan the BOJ monetary policy meeting minutes will be released during the next Asian session. We need to see how the Yen pairs react after the release. Overall, buying dips is a good idea in AUDJPY moving ahead.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.