Key Takeaways

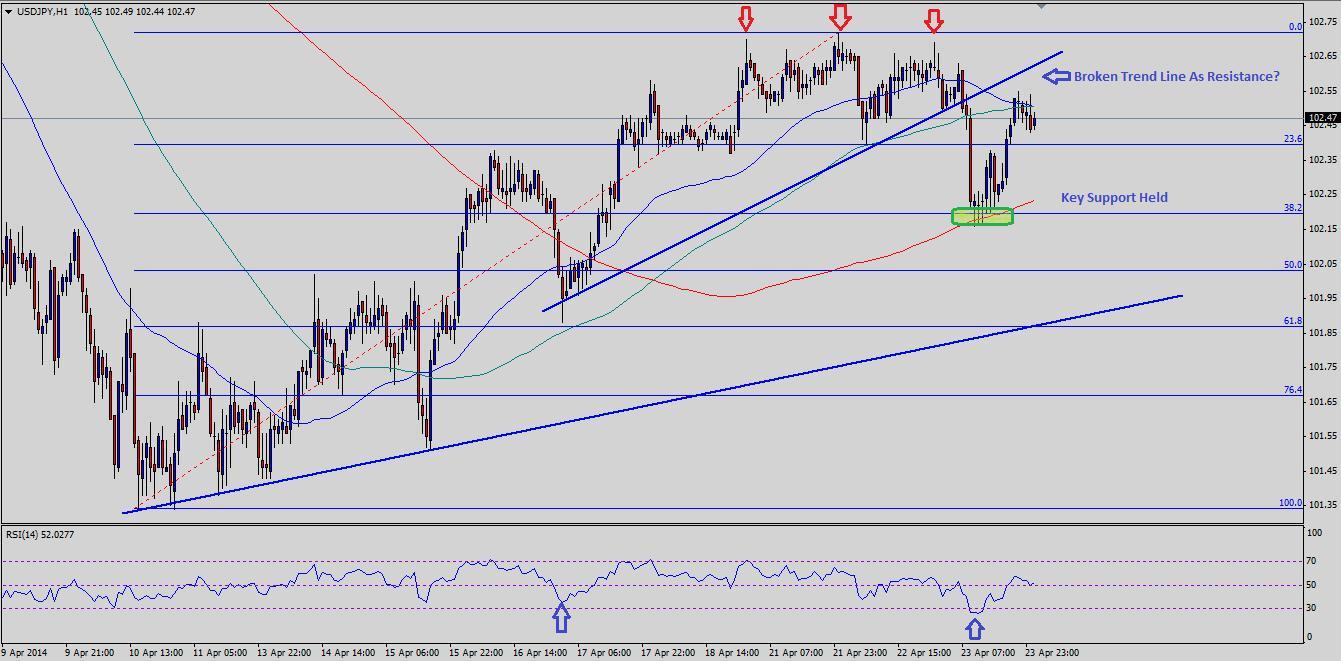

USDJPY breaks an important bullish trend line

Support at 102.00 (50% Fib ext.) and resistance at 102.50 (100 hourly SMA)

US New Home sales plunge 14.5% in March

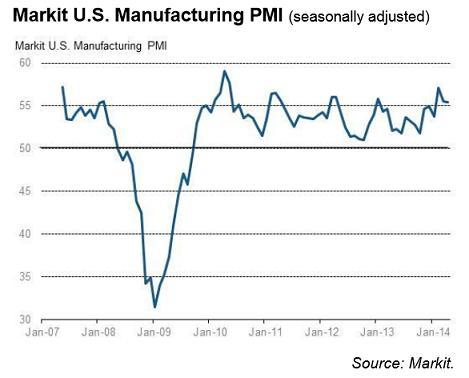

US manufacturing PMI misses forecast of a rise to 56.0

A US dollar rebound against the Japanese Yen may be ended after prices breached an important bullish trend line along with the hourly 100 simple moving average. USDJPY found support around a confluence area of 200 hourly SMA and 38.2% fib ext. at 102.20.

USDJPY downside pressures remain intact. Yesterday’s incoming economic data was disappointing, as the US new home sales in March registered the 3rd biggest monthly drop over the last 20 years.

Technicals

USDJPY traded below a critical short term bullish trend line, as the Japanese yen gained bids against the US dollar. USDJPY traded up and down but failed to climb above the previous high at 102.70. As a result, the sellers took control and breached both 100 and 50 hourly simple moving average. The pair dropped close to 38.2% Fibonacci retracement level of the last major bull wave from 101.30 low to 102.70 high.

There is a minor divergence noted on the RSI, which resulted in a pullback earlier during Asian session. However, the pair was seen struggling around a confluence zone of 100 and 20 hourly SMA.

Fundamentals

Yesterday, the US New Home Sales and manufacturing PMI figures were published by the US Census Bureau and Markit Economics respectively. Sales of new single-family houses in March 2014 were at a seasonally adjusted annual rate of 384,000, according to the report published. This is 14.5 percent (±12.9%) below the revised February rate of 449,000 and 3rd biggest monthly drop over the last 20 years. Moreover, the US manufacturing PMI came in at 55.4, missing expectations of 56.0. The report highlighted that the production rose at the fastest pace for just over three years in April with manufacturers indicated a robust start to the second quarter of 2014.

Looking Ahead

Overall the market sentiment tilted in the favor of more losses in USDJPY. So, as long as the pair stays below 102.70 USDJPY might dip back towards 102.20 level, followed by 101.90 (Next trend line).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.