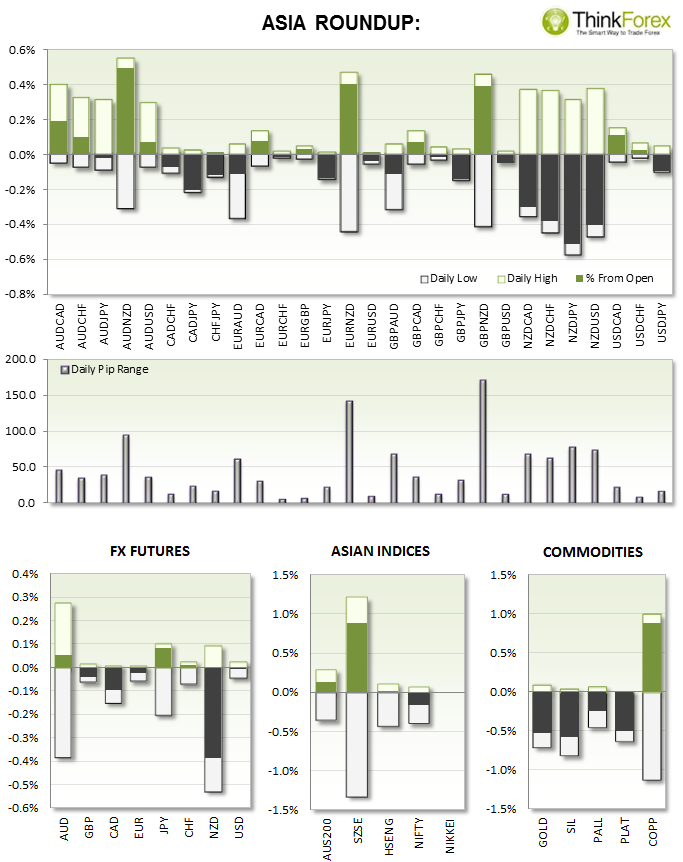

RBNZ hiking rates to 3.5% kicked off the Asia session, but not in a way Kiwi bulls had hoped for

Japan exports fall 2% y/y in June

China PMI at an 18-month high to show stimulus is taking effect

IMF cut US growth expectations to 1.7%

Singapore economy on track to grow 2-4% this year

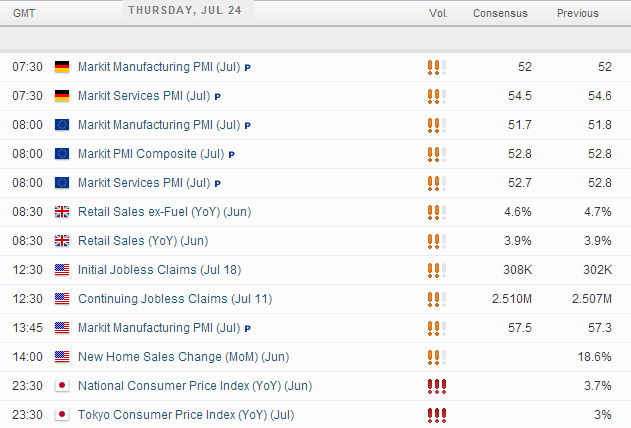

UP NEXT:

Plenty of data to keep traders occupied today with HSBC Flash PMI's accounting for the majority. Being the 'flash' (initial estimate) this tends to have the most impact.

If you start with basic trend analysis and assess EURUSD, then poor PMI data for Eurozone and good PMI data from USD should put another nail in the coffin for Euro bulls and create new lows. Conversely if we see above-expected numbers from Europe you could consider fading at resistance levels and wait for US data to come out (for example), crossing your fingers for good US data.

GBP Retail Sales m/m (not pictured) is expected to edge higher to +0.2% from last month's -0.5%. However the y/y number may grab more attention. Currently expected to maintain 3.9% then 4% or above should be GBPUSD bullish and below 3.8% GBP bearish.

US Employment data presents us with initial jobless claims at 308k this week. Whilst not considered a major market over it is assessed by traders alongside the monthly NFP numbers to provide a broader view of the overall employment market. However if we see significant numbers above consensus expect this to be USD bullish following Yellen's recent comments regarding interest rates being moved higher if the jobs markets continue to impress.

US New Home Sales saw an impressive increase of 18.6% last month; Whilst it is jot expected to maintain this rate of acceleration, falling short of 18.6% isn't necessarily a bad thing as long as it remains above 0% (as this is an increased rate above a previously high rate of change)

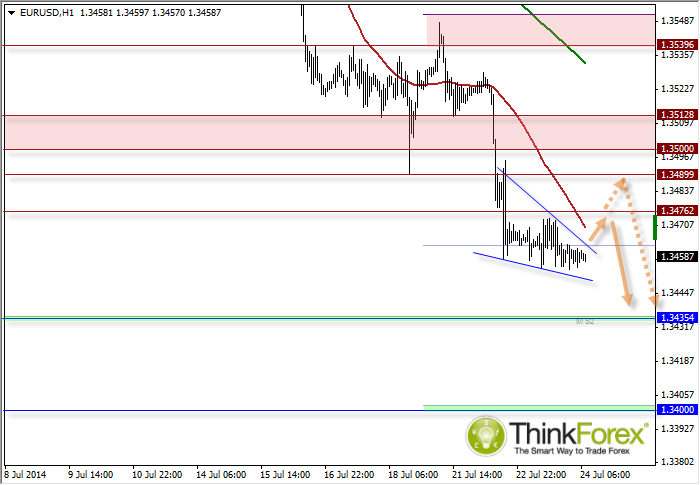

TECHNICAL ANALYSIS:

EURUSD: Quietly awaits today's the data dump

Price is consolidating awaiting tonight's plethora of data and due to the overlapping nature of the recent candles I suspect we may see a pop higher before the bearish trend continues.

That said is PMI data is consistently poor between Eurozone and Germany then we can expect losses to be more direct.

​Either way if you are considering long positions keep in mind the trend is clearly down (so don't outstay your welcome and seek 100 pips moves) and keep in mind the resistance levels which are likely to entice bearish swing traders all the way up to 1.350.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.