Forex News and Events

To everybody’s astonishment, the RBI lowered the benchmark repo rate by 25 basis points to 7.50% via surprise action in an effort to “compensate the delay in fiscal consolidation” and to comply with PM Modi’s budget announcement (!) While the new budget was rather expected to displease the RBI and keep the bank on hold at least until April 7th scheduled policy meeting, the surprise rate cut was all but expected! To summarize quickly, the PM Modi announced four days ago to include the funding of infrastructure to his first full-year budget and did little to decrease subsidies, meaning that his government is not afraid of widening the deficit to fuel growth. In this picture, the higher government spending and softer fiscal consolidation is upright against the central bank’s price stability mandate (government and the CB agreed to fix the target at 4% +/-2%). There is the surprise effect! While the India’s inflation is ranked third among the leading Asian economies (with January CPI at 5.11% y/y), nobody would have expected Rajan to get positioned in the easy-money camp. Apparently, the low energy environment justifies temporary policy deviations both on fiscal and monetary legs. Now that the RBI made its growth-supportive stance explicit, markets do no longer rule out additional rate action at April 7th meeting. The RBI action is now good to strengthen support at 61.7664, Fibonacci 61.8% retracement on May-Dec’14 rise. Especially if the US labor data reinforce Fed-hawks before the weekly close.

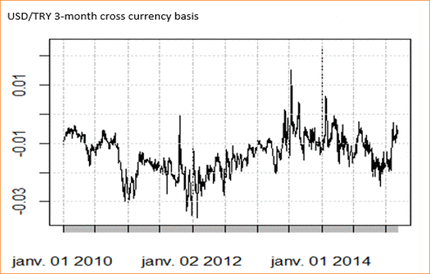

If the USD/TRY hit fresh all-time-high (2.5497) in Istanbul this morning, the move has no wonder something to do with the RBI action. On top of faster-than-expected core CPI fall in December (perfect excuse to fuel President Erdogan and government’s call for lower TRY rates), the RBI’s dovish move reinforced fears that the CBT can only see its refusal-margin collapse! This being said, we see the risk of political pressures increasing as Turkey’s economic situation remains gloomy three months before the general elections. The front-end of Turkey’s sovereign curve remains strongly inverted with the back end of the curve shifting higher as the country risk spills over longer maturities. The FX and money markets therefore are clearly positioned against additional rate action from the CBT, although President Erdogan points CBT Governor Basci as responsible for the economic slowdown! The 3-month cross currency basis hints at decreasing interest in TRY verse USD.

Brazil walks in the opposite direction

The Brazil Central Bank meets today and is expected to increase its Selic rate by additional 50 basis points to 12.75% to curb the inflationary pressures and ease the BRL sell-off on political/fiscal concerns. Despite relatively favorable rates and hawkish BCB stance, the BRL has hard-time attracting long positions. The latest CFTC data shows (as of Feb 24th), the net speculative long positions in BRL futures decreased for second consecutive week (to 4561 contracts) and the downtrend has perhaps strengthened since then. USD/BRL hit fresh 10-year high of 2.9342 yesterday, the 1-month implied volatility advanced to 17.8%. We believe the carry traders are waiting for the tensions to ease before jumping in long carry positions. A correction is certainly underway, yet we call for patience! With the US jobs data due on Friday, the selling pressures in BRL verse USD are expected to remain tight.

Falling interest in TRY verse USD

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.