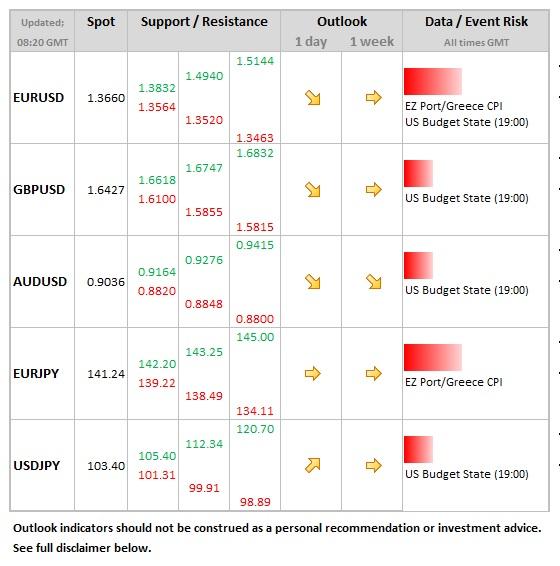

Data/Event Risks

USD: Just the monthly budget statement released at 19:00 GMT this evening, although this is not a release that is likely to impact the dollar.

EUR: Inflation data in both Greece and Portugal released today. Not likely to move the single currency, but Greece and likely Portugal are going to show negative readings, underlining the real problem that the ECB currently has in setting policy for the Eurozone as a whole.

Idea of the Day

After the much weaker than expected US jobs report on Friday, the dollar is on the defensive and once again expectations of a dollar bull run have been undermined. But as always the picture is far from clear, with the weak headline figure (from the survey of firms) contrasted by a strong fall in the unemployment rate (from survey of households). Does this mean the Fed will hold back form tapering again at the end of the month? Probably not in our view. They were as cautious as they could be in the December move and will most likely want to keep the modest tapering momentum going, with another $10 billion reduction in monthly purchases. Remember that the economy is likely to grown with a 3% annualised handle in Q4 and the fiscal clouds have lifted. As the Fed will say, tapering is not tightening, so the stance remains very accommodative. The data also underlines our view that dollar appreciated in Q1 is not going to be dominant with the Fed taking a cautious approach.

Latest FX News

AUD: Moving to 1-month high after US jobs numbers on Friday, up to 0.90 on Friday and finding a further bid during the Asian session today.

EUR: Has remained steady after the US numbers on Friday. What was noticeable was the fact that the euro regained all of the losses after Thursday’s ECB press conference in a short space of time.

JPY: There was further covering of short yen positions during the Asian session, taking the yen to levels last seen 3 weeks ago against the dollar. Once again, the established thinking of the new half year has been undermined by data.

FxPro UK Limited is authorised and regulated by the Financial Services Authority, registration number 509956. CFDs are leveraged products that incur a high level of risk and it is possible to lose all your capital invested. Please ensure that you understand the risks involved and seek independent advice if necessary.

Disclaimer: This material is considered a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. FxPro does not take into account your personal investment objectives or financial situation. FxPro makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any employee of FxPro, a third party or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without the prior permission of FxPro. Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary. FxPro Financial Services Ltd is authorised and regulated by the CySEC (licence no. 078/07) and FxPro UK Limited is authorised and regulated by the Financial Services Authority, Number 509956.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.