Today's Highlights

Greece 2 weeks from default. PM takes charge of negotiations

Central banks and inflation rule the roost

FX Market Overview

Greece has managed to avoid defaulting on its civil service wage bill but is drawing back funds from embassies and outlying offices to shore up its funds just in case the next salary run in a fortnight makes the government purse a little light. And we know the end-game is in sight for Greek negotiators because the Prime Minister has now become involved in negotiations with creditors. That is clearly crucial if they are only 2 weeks away from domestic default. The highlights for the euro this week will be business and consumer sentiment indices. The forecasts are not good, so unless Greece can sort out its situation with the EU, EC and IMF, (Germany mainly) we will almost certainly see weakness in the Euro later in the week.

Friday's Canadian data was mixed. Manufacturing sales at nearly three times expectations would normally be enough to boost the Canadian Dollar but existing home sales growth was slower in April than in March. The markets decided to sell the Canadian Dollar against a strengthening Pound and we sit towards the top end of the GBPCAD range this morning. This week's inflation data from the UK and Canada should favour the UK, so perhaps we will see further gains in this pair this week.

The Pound has a few hurdles to overcome this week. It starts on Tuesday with UK inflation data which may show a glimmer of expansion after a 0.0% figure last month. We will also get the minutes from the last BOE meeting and public sector borrowing data plus what looks like it might be a very upbeat retail sales report this week. Looked at relative to other economies, the UK still looks like a success story but we are also in a period when new policies from the newly elected majority government could derail the Pound's strength and, if they are hoping to boost exports, it may suit the government to do just that. So beware.

This week's US data diary is pretty bloated. Inflation data is likely to remain in negative territory but the minutes from the last Federal Reserve meeting will be worth a read and the housing market and business sentiment indices are also closely followed. These are just the highlights so it may well be a bumpy ride for the USD over the next 5 days.

Elsewhere, the Reserve Bank of Australia will publish its board meeting minutes and we'll get consumer confidence data from Australia as well. The Aussie Dollar is doing slightly better than its NZ counterparty.

Speaking of which, the Reserve Bank of New Zealand will issue its 2 year inflation forecasts this week. We will also get consumer confidence and credit card spending figures and producer price data. All of which could be overshadowed by any further news of Chinese stimulus measures. So stand by for action.

And you have to feel sorry for the soldier who thought he was getting the Hebrew word for 'strength' tattood on his arm in 2" high letters. The ink was noticed by a chap who could read Hebrew when the soldier was out shopping. When the chap asked him whether he knew what it meant, the soldier proudly said, "Yes it means Strength". "No it doesn't", said the other guy, "it says matzoh". That's a biscuit usually eaten by Jewish people to celebrate Passover. Fancy walking around with the equivalent of 'minced pie' on your arm in massive letters!

Currency - GBP/Australian Dollar

Uncertainty over the plans by the Reserve Bank of Australia are keeping the Australian Dollar is relatively tight ranges. However, the fact that the Sterling – Aussie Dollar rate is hanging at the lower end of its trading range in spite of the Pound's general strength, would suggest there are a number of AUD buyers hanging around in the wings picking up Aussie Dollars on any spikes. It would also suggest that if the Chinese authorities start to stimulate their economy as has been very heavily hinted, the AUD would strengthen rather rapidly. Above $1.92, this is still in an upward channel. Below that level, A$1.90 and A$1.86 would be the targets.

Currency - GBP/Canadian Dollar

The Sterling - Canadian Dollar exchange rate is in an undisturbed upward trend which finds Sterling buyers around the C$1.82 level and Sterling sellers at the top of the range C$1.95. That red top line has topped the market since 2010, so it is pretty solid. It would be a brave trader who bet against it capping the market again.

Currency - GBP/Euro

After the spike to €1.42 in March, the Sterling – Euro exchange rate has been correcting. It has created a short term downward channel between 1.33 and 1.39 and we have been testing the top of that range this week. The UK economy is though in better shape than the Eurozone and the Greece story just refuses to lie down. So there is plenty of scope for further Sterling strength if traders can just overcome their fears of €1.40 levels. From the UK side of things, the new government is in its honeymoon period but that will be over before we know it. I still tend to favour further euro weakness and, whilst we may see a drop to 1.36, that may be the last gasp for the euro before a more substantial Sterling advance.

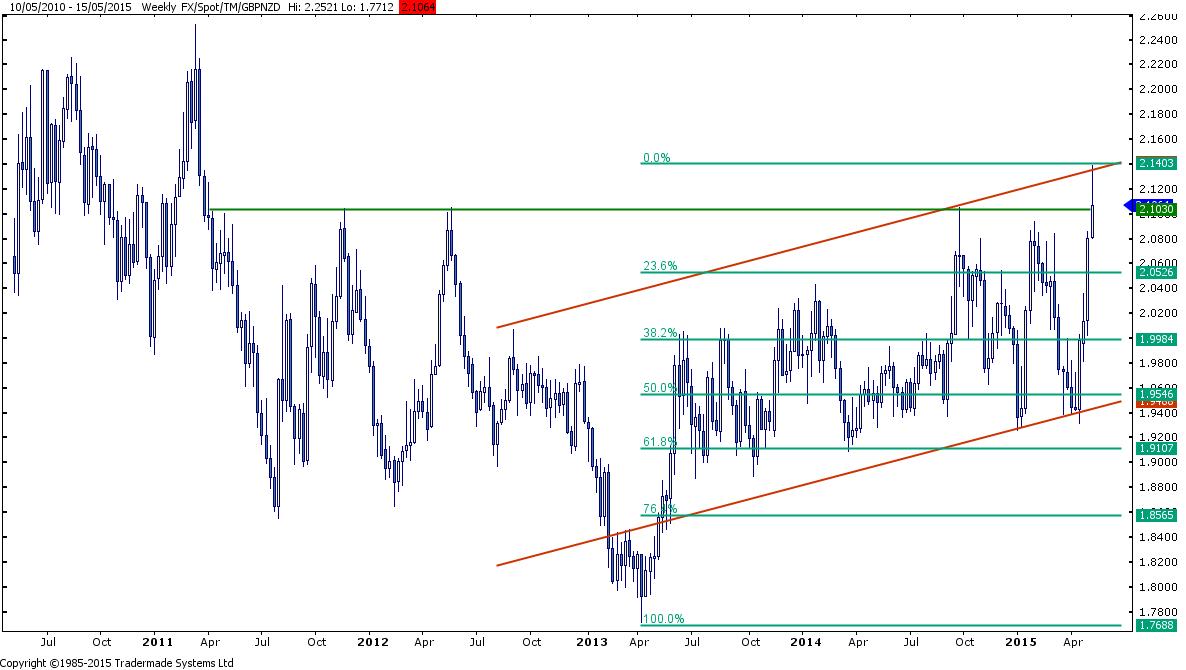

Currency - GBP/New Zealand Dollar

The New Zealand dollar has been hit by suggestions from the Reserve Bank of New Zealand that interest rates may have to fall further and some of the NZ economic data has supported that view. Hence the rally in the Sterling – NZ Dollar rate from 41.93 to 2.14 in just 4 weeks. That took this pair to the highest level we have seen since early 2011 and NZD buyers had a field day. So we are not surprised to see some correction of that rally but NZD buyers who missed the absolute top of the market are still able to access NZD at 2.09 or thereabouts. 4 weeks ago we would have given our right arms for such a rate, hence I am typing with my left hand. Just kidding.

Currency - GBP/South African Rand

The Sterling – South African Rand exchange rate is at levels not seen since the height of the financial crisis in 2008. As you can see from the chart above, this top 'resistance' line has capped this pair ever since the height of the dot.com bubble in 2002. It goes without saying that this is an excellent time to be buying Rand. This rally is partly due to Sterling's strength and partly due to the drop in commodity markets which have such a direct impact on South African exports.

Currency - GBP/US Dollar

April marked a turning point in the Sterling – US Dollar exchange rate. This pair had been in a downward trajectory for 10 months but the recovery in the value of the Pound started in the lead up to the UK general election, the Pound dipped just before the election day itself and the Sterling pushed on again once the majority government was confirmed. On the other side of the Atlantic, some poor US data and hints of delayed US interest rate hikes have hampered the US Dollar. Cable, as the GBPUSD rate is known, is heading towards $1.59; the 50% retracement of the fall from July 2014 to April 2015. Beyond there, the upside could take us to $1.62 but if the Pound stalls, we could fall all the way back to $1.52 without trying.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.