Good morning from Hamburg and welcome to our latest Daily FX Report. U.S. Intel Corp gave a current-quarter revenue forecast above expectations and said the supply chain was in good shape ahead of holiday season as demand for personal computers recovered.nA global slump in personal computer demand that began with Apple Inc's launch of the iPad four years ago has stabilized in recent months, in part due to companies replacing employees' older laptops. Intel said in a statement on Tuesday that demand for its chips was in good shape.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The Swiss National Bank is about keep its policy for the franc in place until at least 2016 as central bankers in the surrounding euro area loosen policy further. The Swiss central bank set the cap three years ago to ward off deflation after investor concern pushed the franc nearly to parity with the euro. The European Central Bank ́s introduction of a negative deposit rate and announcement of plans to buy asset-backed securities has lifted the franc against the euro in recent months, intensifying speculation that the SNB could again wage currency interventions or enact its own deposit charge. Such an easing of policy within the euro area could send the franc up further versus the euro. It has already climbed 1.6 percent against the common currency so far this year. SNB policy makers have stressed repeatedly they stand ready to take further measures – including negative interest rate – should they beome necessary. The central bank hasn’t intervented in currency markets to defend the cap since 2012. More investors are seeking the dollar as a haven while the global economy shows signs of faltering, causing Fed officials to express concern that its strength will also curb growth in U.S. it has climbed against 29 of its 31 most traded peers this year as the Fed reins in its monetary stimulus measures and the European Central Bank and Bank of Japan talk about expanding their money supplies. The International Monetary Fund sees the U.S. economy expanding 3.1 percent in 2015, versus 1.3 percent in the euro area and 0.8 percent in Japan. The case for further dollar gains may wane if traders continue to see less of a chance the Fed will boost interest rates next year from zero to 0.25 percent range they have been in since 2008. The Bloomberg Dollar Spot Index, which measures the U.S. currency against 10 global currencies, fell 0.8 percent last week, the biggest fall since April.

Daily Technical Analysis

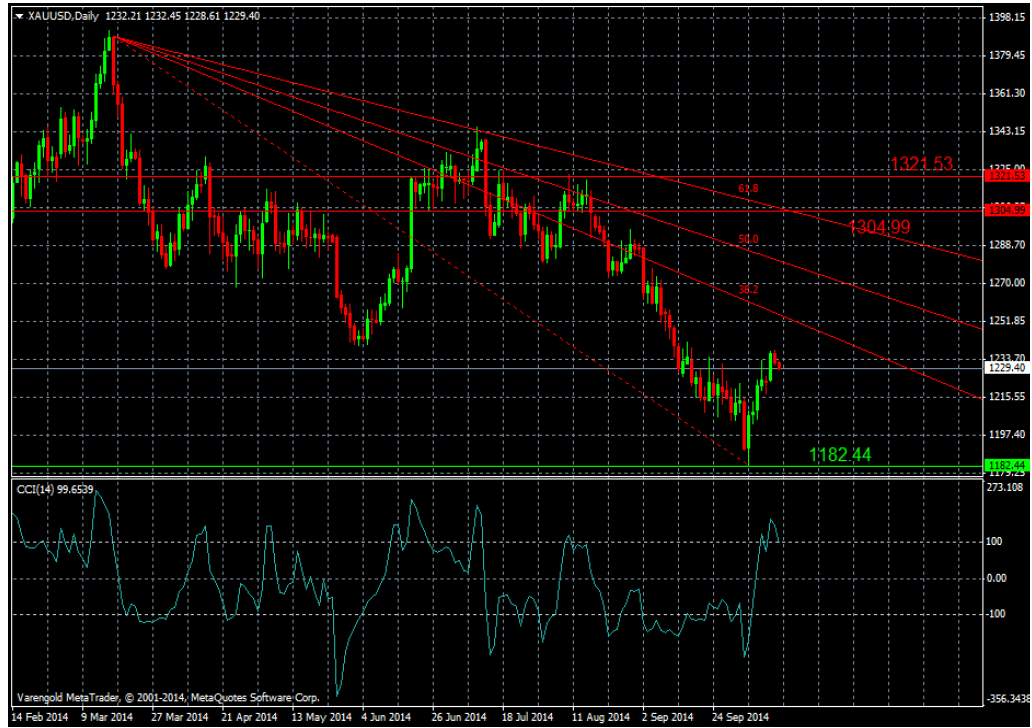

XAU/USD (Daily)

Looking long-term Gold has experienced a high volatility and the price moved to a low at $1182 now. The support line at 1182.44 could rebound the price and stop the downward movement.The CCI is showing that the the pair is highly overbought and a movement to the Center line is likely. The price wasn’t able to break through the highest Fibonacci resistance level (61.8). We have to see how the USD is developing as Gold depends highly on it.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.