Good morning from a cold and cloudy Hamburg and welcome to our Daily FX Report. On Wednesday the Federal Reserve hinted that a surprisingly strong job market recovery could lead it to raise interest rates earlier than it had been anticipating. The Fed has held benchmark rates near zero since December 2008, but has signaled it would likely begin to move them up some time next year. This decision will depend on further information on the trajectories of economic activity, the labor market and inflation.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

In the second quarter of this year, euro-area growth stagnated in comparison to the quarter before as the region`s biggest economies Germany, France and Italy all failed to expand. Inflation in the euro zone is indeed the weakest in almost five years. Now the balance-of- payments data released this week from the region`s central bank is showing that European investors channeled 167.4 billion euros into overseas equities in the 12 months through June and 178.7 billion euros into offshore debt. These numbers are the largest in terms of financial exodus since August 2008. Moreover, foreign cash has failed to offset these outflows so far. According to the median forecast of more than 50 analysts surveyed by Bloomberg, the EUR will fall to $1.31 by year-end and to $1.28 by the middle of next year. For 2017, analysts even expect a level around $1.20. In contrast to the EUR, the USD is recently experiencing a rally. After the Federal Reserve`s July meeting, which gives investors space for speculation the central bank may increase interest rates sooner than anticipated, the USD strengthened to an 11-month high versus the EUR. It gained 0.5 percent and is now traded at $1.3259 per EUR. It is the strongest level since September 13. The USD also appreciated versus the JPY by 0.8 percent to reach 103.76 JPY per USD. The EUR rose 0.4 percent to 137.58 JPY. Overall, the USD has gained 1.8 percent during the past month what makes the U.S. currency the second-best performer after Norway`s krone of 10 developed-nation currencies tracked by Bloomberg Correlation-Weighted Indexes. The EUR has fallen 0.4 percent and the JPY has declined 0.7 percent.

New Zealand`s currency continues its weak performance during this week and declined to a five- month low on speculation economic growth is waning. The currency dropped for a fourth day against the USD and declined below 84 U.S. cents for the first time since March this year.

Daily Technical Analysis

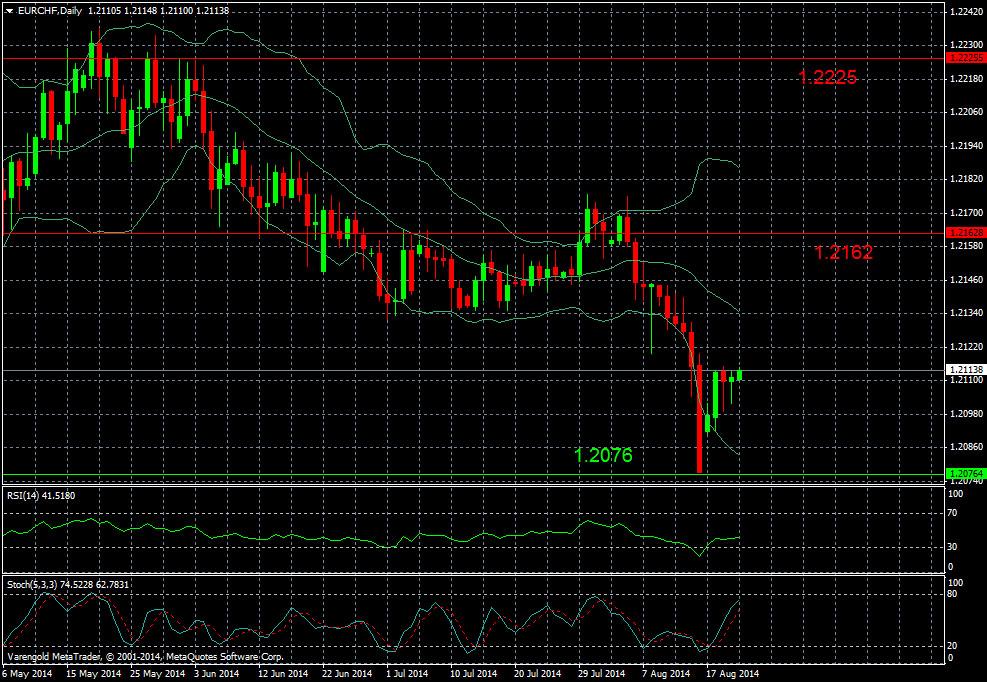

EUR/CHF (Daily)

Since the end of May 2014 the currency pair experienced a downward movement among the lowest line of the Bollinger Bands. After breaking through the resistance level at 1.2162, the EUR sharply declined to reach the support level at 1.2076 where it slightly rebounded. At the moment we see a recovery which, according to the RSI and the Stoch may hold for a while.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.