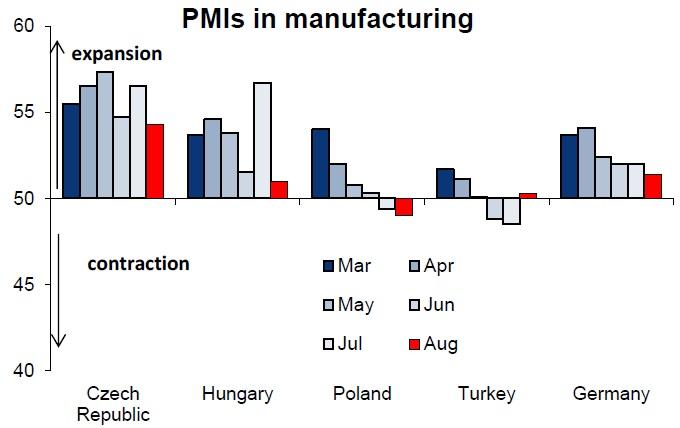

Chart of the Day:

CEE PMIs: Yesterday’s PMI data for August showed a slowdown for all the countries in CEE, with the exception of Turkey, where we saw a slight improvement. The strongest decline in CEE from a month earlier was observable in Hungary; that being said, the gauge is very volatile in Hungary so the current marked decline may not be a good harbinger for the magnitude of a slowdown of economic activity. In Poland, the figure was below 50 points for the second time in a row (further declining by 0.4 points to 49 points), underlining our expectation for a rate cut in Poland later this year. The strongest data came from the Czech Republic, where we saw a level of 54.3 points; this data, however, still means a decline from a month earlier (from 56.5). The intensifying risks of additional sanctions against Russia amid the escalation of tensions in the conflict in Ukraine could cause a further slowdown in CEE economies later this year and also in 2015. A possible further rise of tensions can have ambiguous effects on CEE bond markets: earlier this year, when the crisis in Ukraine escalated, CEE bond markets did not unanimously witness a sell-off, again indicating that the region is heterogeneous. In the meantime, the expected quantitative easing from the ECB should keep Bund yields very low. Overall, we see downward risks to our yield forecasts in CEE.

Traders’ comments:

CEE Fixed income: Trading was slow yesterday due to the US Labor Day. Investors are probably also trepid about taking large positions ahead of the ECB meeting, US Non-Farm payrolls and the announcement of further sanctions against Russia. That said, the fact that CEE fixed income remained relatively stoic in spite of statements out of Ukraine that the country is now practically engaged in open warfare with Russia shows the extent to which expectations of QE in the Eurozone is an overriding factor in asset allocation decision making. In essence, it appears as if investors assume the military fallout from the conflict in Ukraine will be contained whilst the West is willing to accept lower growth via the impact of economic sanctions, compounding already weak growth and inflation dynamics in the Eurozone. At the moment, the parameters are all still in place for lower yields and weaker FX in CEE.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.