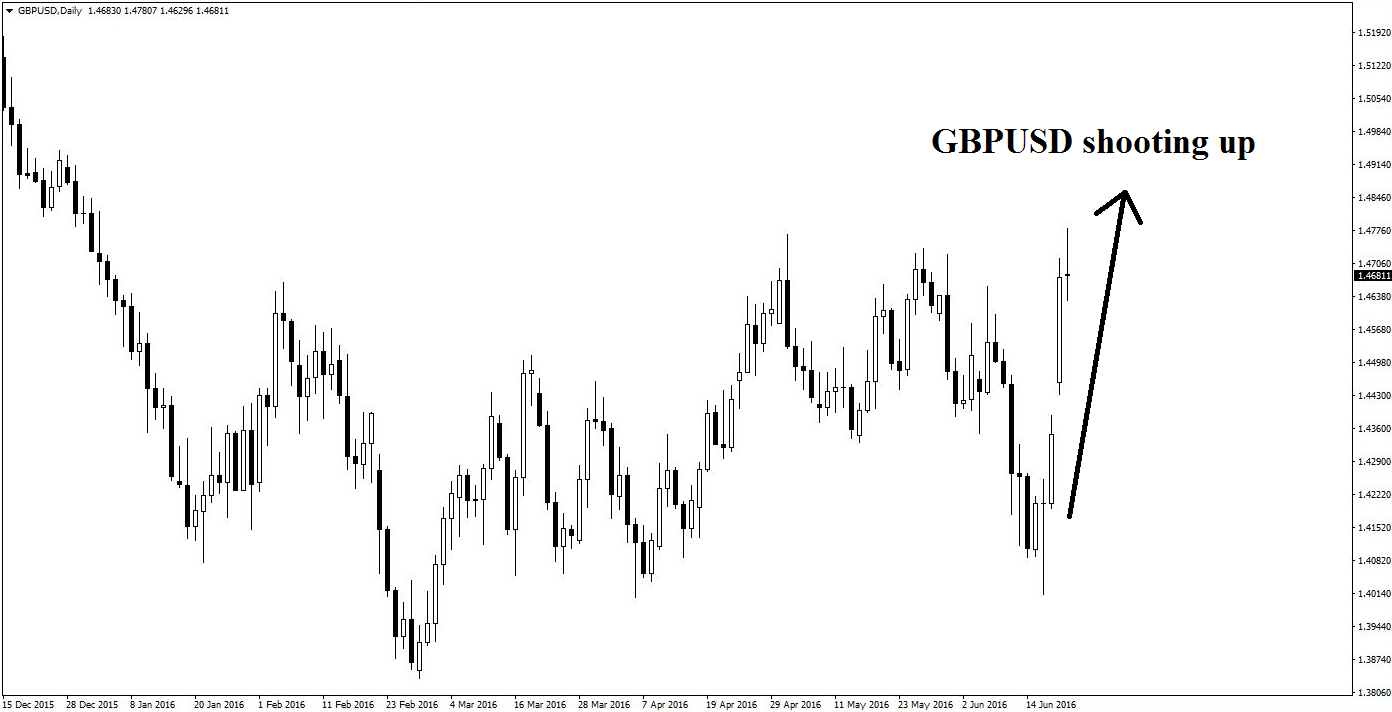

Whilst the UK struggles to find its direction with regard to the EU referendum, the impact of this event is already being anticipated in the markets. The daily chart of GBPUSD shows that long positions have increased dramatically in the past few days, as shown in Figure 1.

Figure 1: Longs on GBPUSD Increasing

For a technical trader looking for trade opportunities, more money is often made when the market is incorrectly positioned for these large-scale events. In other words, if the result occurs counter to expectations, those who have loaded on positions will scramble for the door. If they are correct, GBPUSD may well rise some more, but with less upside as most will already have been positioned for the move. Thus, it makes far more sense to focus on counter-position opportunities.

Ironically, the best opportunities are not where most people seem to be looking – in the Euro and GBP-related currency pairs. GBPUSD, EURUSD and EURGBP are all at levels that are unlikely to provide safe and tradeable turning points. Instead, it may be more profitable to turn one’s attention to the equity and commodity markets.

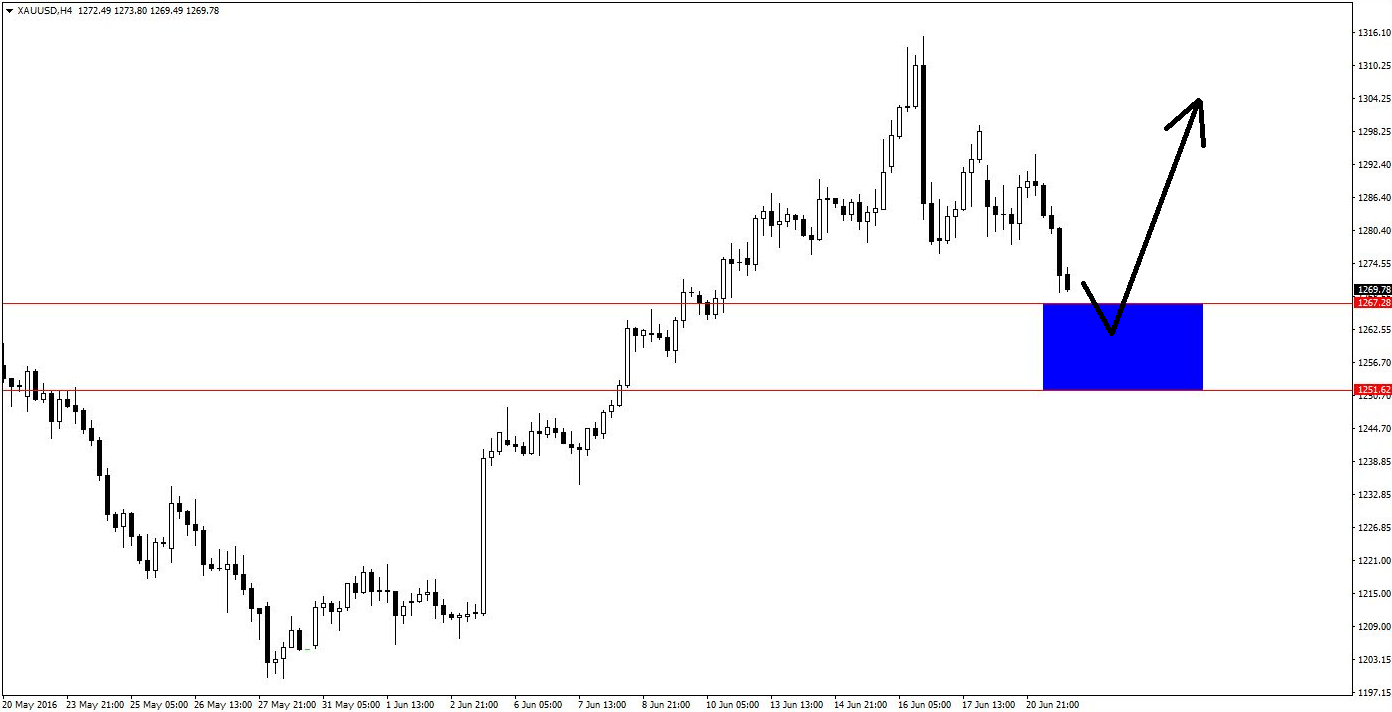

Gold is the first commodity that comes to mind. After its monumental rise at the beginning of the year, it has been moving sideways, and more recently inching off its highs as fears of Brexit apparently fade. Should the result of the referendum be a surprise, there may be a trade to be had as it rallies upwards again. Various forms of analysis suggest that the Blue Box at 1251.62-1267.28 may provide a space for a rally. (See Figure 2 for a potential trade move.) Prices are poised to touch that area right now. Of course, traders should not take the trade just because it is reaching support. It would be better to wait for some sign of momentum reversal to the upside before engaging the trade, as per individual trading plans and requirements.

Figure 2: A Potential Trade Move on XAUUSD’s Four-hourly Chart

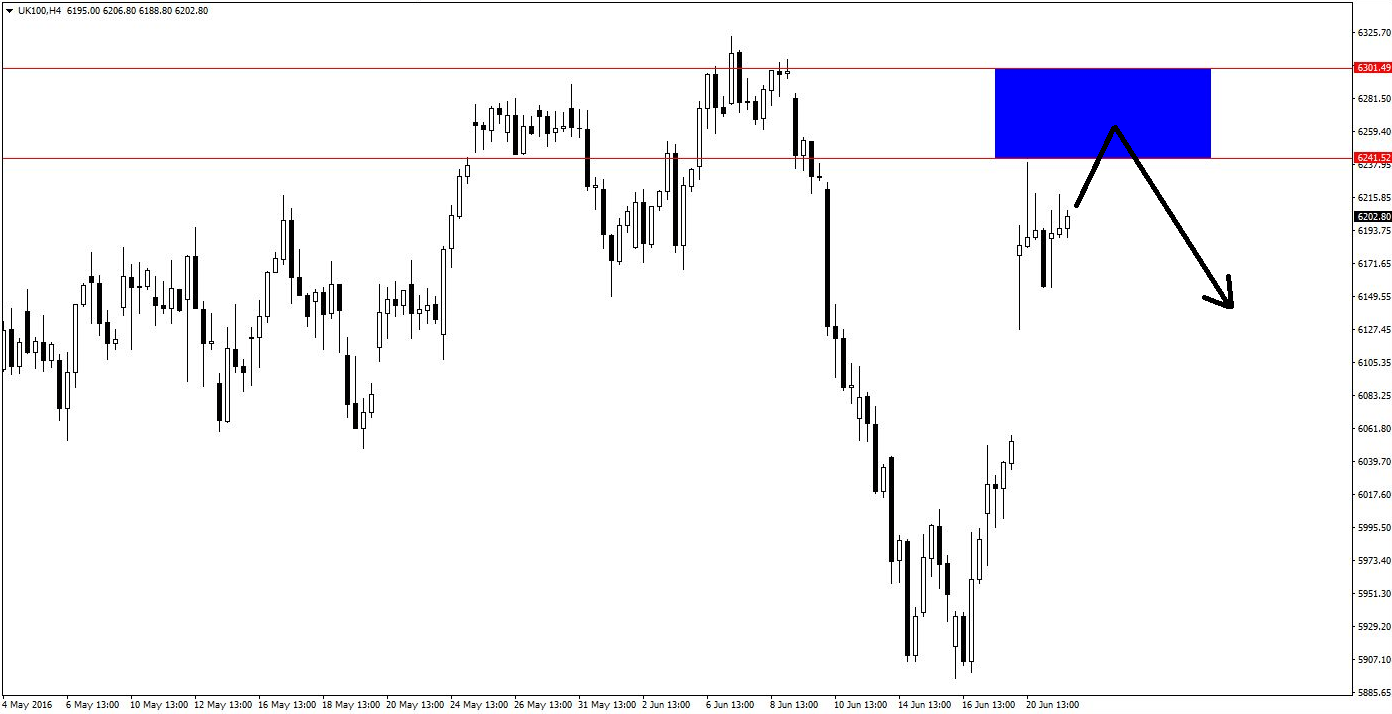

The other suspect on the table is the FTSE100, which has rallied along with GBPUSD, but is at a critical potential turning point, as shown below in Figure 3. The Blue Box is at 6241.52-6301.49.

Figure 3: A Potential Short on the UK100’s Four-hourly Chart, should Momentum Reverse

Both these charts show prices poised to reach into significant areas of support and resistance, which is not surprising given how close the referendum is. As opportunities for profiting from big events go, it must be noted that this one looks less promising to be lucrative, as the lack of technical opportunities on the GBP and Euro currency pairs suggests that the market may well have gotten it right i.e. the UK will be staying in the EU. Even if there is a surprise result, there is likely to be two-way volatility in the markets before they head in the correct direction, so traders should watch out for whipsaws and other such behaviour.

RISK DISCLOSURE: Trading foreign exchange (FX) and contracts for difference (CFD) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in FX or CFDs you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with leveraged trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.