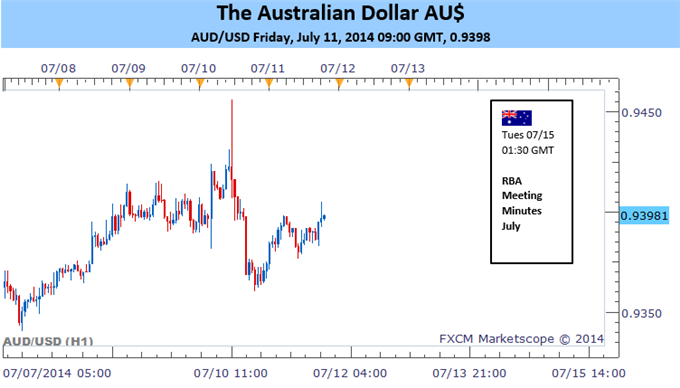

Hourly Chart - Created Using FXCM Marketscope 2.0

Fundamental Forecast for Australian Dollar: Neutral

- RBA Minutes unlikely to shift expectations for a “period of stability” for Australian interest rates

- Yield advantage may continue to offer support to the currency amid low vol. environment

- Strong readings from a slew of upcoming Chinese economic data would bode well for the AUD

The Australian Dollar finished relatively flat for the week despite several bumps along the way. Domestic data presented a mixed bag with soft employment figures offsetting some positive leads from a rebound in consumer confidence and business conditions data earlier in the week. Two key themes are likely to continue to offer the Aussie guidance over the week ahead; policy expectations and risk appetite.

On the policy front the RBA July Meeting Minutes due on Tuesday take center stage amid a light economic docket for the week. The central bank has held steadfast in its rhetoric suggesting a “period of stability” remains the best course for rates over the near-term. Although recent economic news-flow has disappointed relative to expectations, a more material deterioration would likely be required to cause the central bank to shift its stance. In the absence of a dovish tone in the communique, the Australian Dollar may be afforded some breathing room.

The Aussie’s relative yield advantage over its US counterpart continues to offer the currency a source of support. Anemic implied volatility levels suggest traders are pricing in a low probability of a major economic disruption occurring over the near-term. If this environment persists over the coming week, carry trade demand for the AUD could keep the currency elevated.

Additional guidance for the Australian Dollar is likely to stem from a string of top-tier Chinese economic releases including second quarter GDP, Retail Sales, and Industrial Production figures. We have witnessed a turnaround in economic data from the Asian giant over the past month, which has helped alleviate concerns over a further deceleration for growth. A strong second quarter GDP print would be a positive for the Australian economy, via a strong trade link, and would offer a source of support to the AUD. For views on the US Dollar side of AUD/USDequation, refer to the US Dollar outlook available here.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.