Next week will be a major week for Monetary Policy based FOREX traders, 4 major currencies will give rate decisions, this article will consider how we should position our forex trades for these events. Of course all of this could be reduced to insignificance if the situation in Ukraine gets worse.

If a flight to safety begins Monetary Policy will be ignored, Forex will flood to the Yen and the USD.

Assuming that the Ukraine situation does not explode, the analysis of this article is strength in the GBP and the CAD, weakness in the AUD and a strength in the Euro that the central bank would really rather not have.

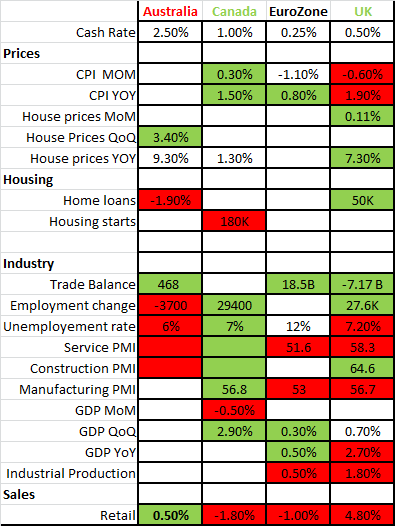

Monetary policy is data driven, if we want to use it to trade forex we need to analyse the data and consider how it might affect the thoughts of the different central banks. February data is summarized in this table.

The table collects together all of the major data releases last month from the 4 economies concerned. All 4 economies are at different positions and their monetary policy will be following different tracks.

We can see straight away that the UK economy is leaving the others behind, even though it missed many of the economist predictions for the month the actual values it delivered were quite extraordinary.

The UK has a booming economy, the Eurozone is close to recession along with the Australian economy. The Canadian economy is somewhere in the middle.

- Tuesday March 4th: Aussie rate decision and RBA Statement.

The Australian economy is slowing on almost every measure. On the 28th Feb the RBA released its Financial Aggregates which showed the growth in money supply significantly below its level 12 months ago, this is probably the biggest single measure of the expansion and contraction of an economy. On Feb 14th the Assistant Governor gave a speech looking at Terms of Trade and The Exchange rate, I explained this concept in my earlier article “RBA: Winners of the currency war 2013” Mr Kent again concluded that the Exchange rate has been two high for two long based on Fundamental analysis and said in his conclusion

“…lower levels of the exchange rate, if sustained, will assist in achieving balanced growth in the economy and bring about a quicker return to trend growth.”

The RBA releases a quarterly statement on Monetary Policy, the next one is not due until May, however, we do get a statement from the governor a few hours after the rate decision. The last statement in early February showed that the bank had a very good feel for how the economy was doing. They predicted a rise in unemployment and continued growth in house prices. It is highly unlikely that the RBA will offer any change to its guidance or to its interest rate.

As long as the exchange rate keeps falling the RBA is unlikely to act. - Wednesday March 5th: Canada rate decision.

Canada’s figures are nearly all green; it has been a very good month for the BoC and the Loonie. The BoC also produces quarterly monetary Policy reports, the next one is due in April. As I reported in my January article “Bank of Canada Monetary Policy by Stealth” these reports had been getting steadily more Dovish, in October they removed any talk of rate hikes and in January added this sentence “the timings and direction of the next change to the policy rate will depend on how new information ….”

The performance of the Canadian economy will have helped the central bank decide which direction rates will change, they will be going up, however the timing is likely to be months not weeks ahead. Expect any commentary to be more hawkish providing a boost to the Loonie. - Thursday March 6th: Bank of England and the European Central Bank.

The Eurozone is the worst performing economy we are looking at and quite rightly has the lowest interest rate.

The UK economy is the best performing and has the second lowest interest rate. This cannot continue for long.

The UK economy is firing on all cylinders, unemployment is falling fast, inflation is holding, every measure of industrial production is higher than every other major economy. Two weeks ago we had the inflation report where Governor Carney accepted all of these points and the GBP went on a tear, 300 pips in a couple of days. It is moving upward again at the moment. Governor Carney does not want to move to early, he will wait until he has to increase rates but that point is coming much sooner than he would like.

This week we had a number of MPC members start to deviate from the party line, this is very unusual in a carney lead bank where people are expected to agree with their boss. One MPC member said he expects a split on the interest rate vote, if that happens then the pound will be back on its upward trajectory.

Wages appears to be the MPC fault line, expect rising wages to bring the first rate rise forward into 2014. The first increase in the minimum wage since 2008, which the UK government said it was considering, might well be the catalyst. The UK has an important round of wage negotiations due in the coming weeks, monitor them closely because the Central Bank will.

Finally we turn to the Euro. What is Draghi to do? The economy did better than expected however it is at very low levels. There is no room to cut the interest rate, it looks like it might be illegal for the ECB to buy securities or perform any QE. The LTRO’s are being paid back by the banks, a taper by stealth, causing the Euro to increase in value making it even harder for the Eurozone economies to get moving. If Draghi can act I think he will.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.