EUR/USD Price Analysis: Parity at the end of the tunnel?

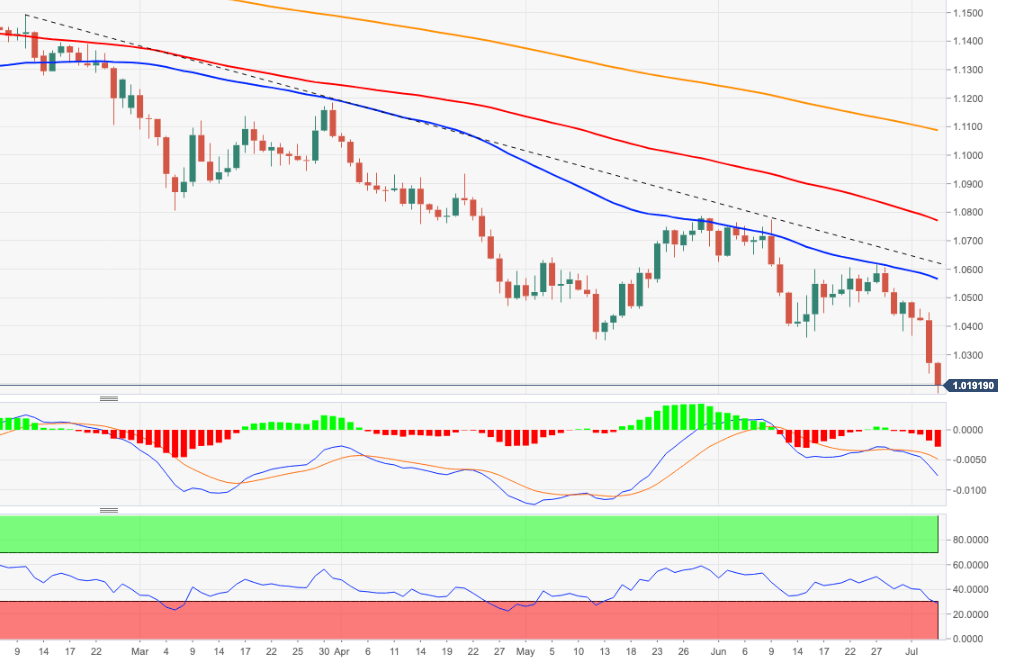

- EUR/USD clinches new lows in the sub-1.0200 area.

- The pair enters oversold territory and could spark a bounce.

EUR/USD loses further ground and drops to nearly 2-decade lows in the 1.0170 region on Monday.

The sell-off in the pair stays everything but abated midweek amidst an increasing negative outlook. Against that, there is a minor support level at 1.0060 (low December 11 2002). The breakdown of the latter should herald a visit to the key parity area.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1085.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.