Ripple price seems poised for a pullback before XRP resumes its uptrend

- Ripple price is currently showing signs of weakness on various timeframes.

- The cryptocurrency market plummeted briefly but managed to recover almost instantly in the past 24 hours.

Like the rest of the market, Ripple price quickly dipped from $0.681 to $0.56 in a matter of minutes before quickly recovering in the next hour, currently trading at $0.638. It seems that XRP might still be poised for a pullback in the short-term, according to a strong indicator.

Ripple price could drop towards $0.5 before continuing with its uptrend

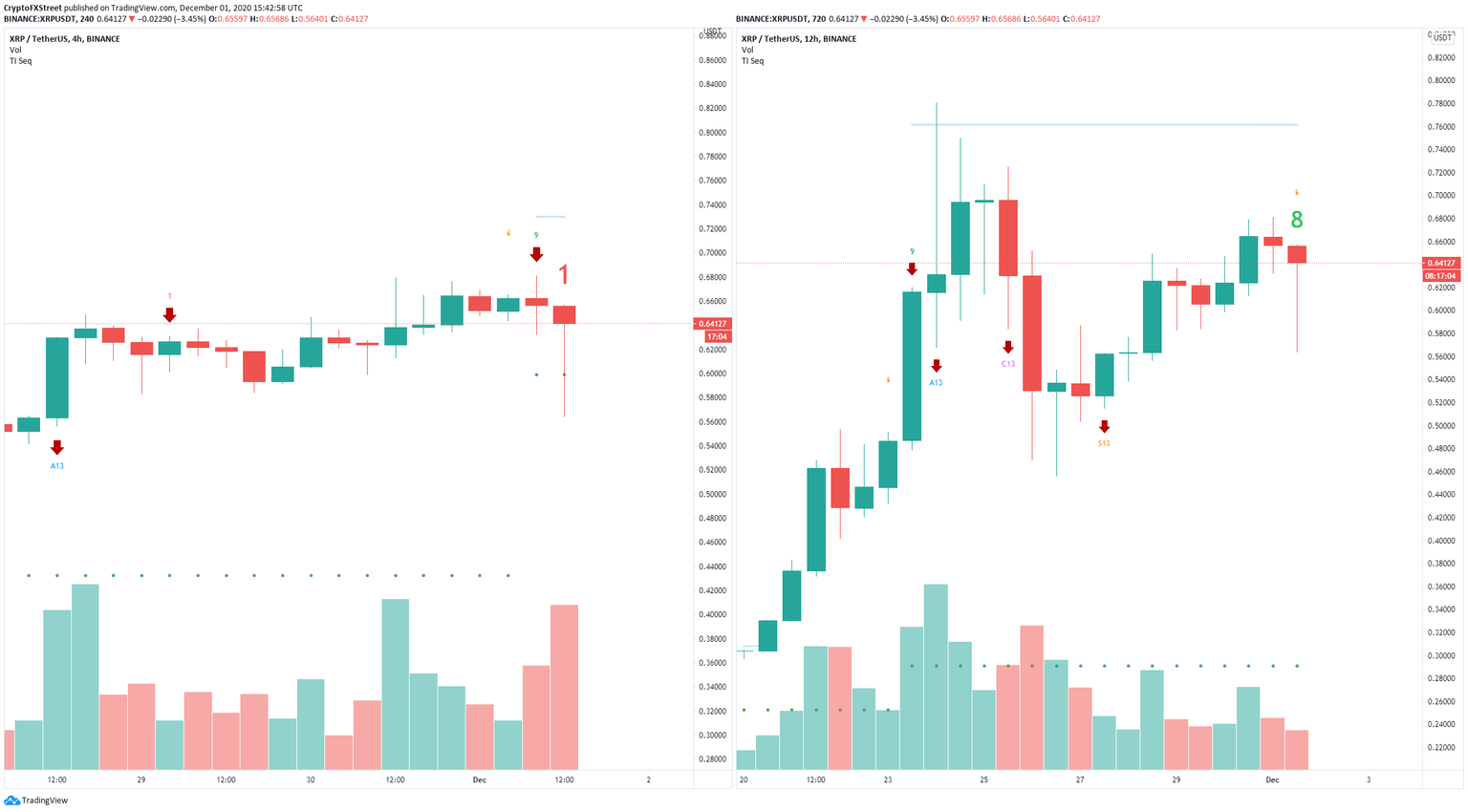

On the 4-hour chart, the TD Sequential indicator has presented a sell signal that has already got some follow-through. Additionally, it is close to posting the same sign on the 12-hour chart within the next eight hours.

XRP/USD 4-hour and 12-hour charts

Validation of the signals could propel Ripple price to the psychological level at $0.60 and as low as $0.47, the 50-SMA on the 4-hour chart. Additionally, it seems that some on-chain metrics have also turned bearish for XRP.

XRP Network Growth chart

The network growth of XRP has declined significantly since its peak on November 24. Although Ripple price managed to recover quite well from its dip to $0.48 on November 26, network growth has remained low.

XRP Holders Distribution chart

On the other hand, the number of whales holding 10,000,000 or more XRP coins has increased in the past 24 hours by three. This statistic has been in a strong uptrend since November 20, indicating that large investors are deeply interested in XRP. If the sell signals are invalidated, we could see Ripple price quickly jump to the 2020-high at $0.78.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.51.33%2C%252001%2520Dec%2C%25202020%5D-637424348385052755.png&w=1536&q=95)

%2520%5B16.51.36%2C%252001%2520Dec%2C%25202020%5D-637424349097458658.png&w=1536&q=95)