- Technicals and fundamentals are conflicting in the oil market.

- Tail risks, supply-demand dynamics point to the upside, but technically, the bears are in play below 72.50.

WTI crude oil prices climbed on Thursday, currently trading at $71.81 and higher by 2.2% following a move from $69.88 that reached a high of $72.00.

Expectations of tighter supplies through 2021 has helped the price of oil to continue to recover following a sharp move higher the prior day.

Oil had been pressured a the start of the week after members of the Organization of the Petroleum Exporting Countries and other producers including Russia, collectively known as OPEC+, announced that they would agree on a deal to boost oil supply.

The news that 400,000 barrels per day would be coming on to the market between August to December to meet growing demand sank energy prices momentarily.

The combination of the fear of the spread in the delta variant also hurt the industry.

However, investors rethought the outlook and figured that demand was still set to outstrip supply in the second half of the year.

''Look past the noise, energy markets are set to tighten at a fast clip,'' analysts at TD Securities argued.

''We estimate that the market will remain on a tightening trajectory.''

''We argue that firm demand, hindered shale supply and the cautious monthly increase in supply from OPEC+ should not be enough to prevent a deep deficit in the coming month, fueling stronger prices and tightening spreads.,'' the analysts added.

''Most importantly, US drivers continue to fuel the recovery in energy demand, where mobility restrictions may be less likely to take place. Overall, the data doesn't support the demand fears.''

Meanwhile, US Energy Information Administration data showed that crude inventories in the United States, the world's top oil consumer, rose unexpectedly by 2.1 million barrels last week to 439.7 million barrels, up for the first time since May.

Inventories at the Cushing, hit their lowest since January 2020 last week.

Gasoline and diesel demand, according to EIA figures, also jumped last week.

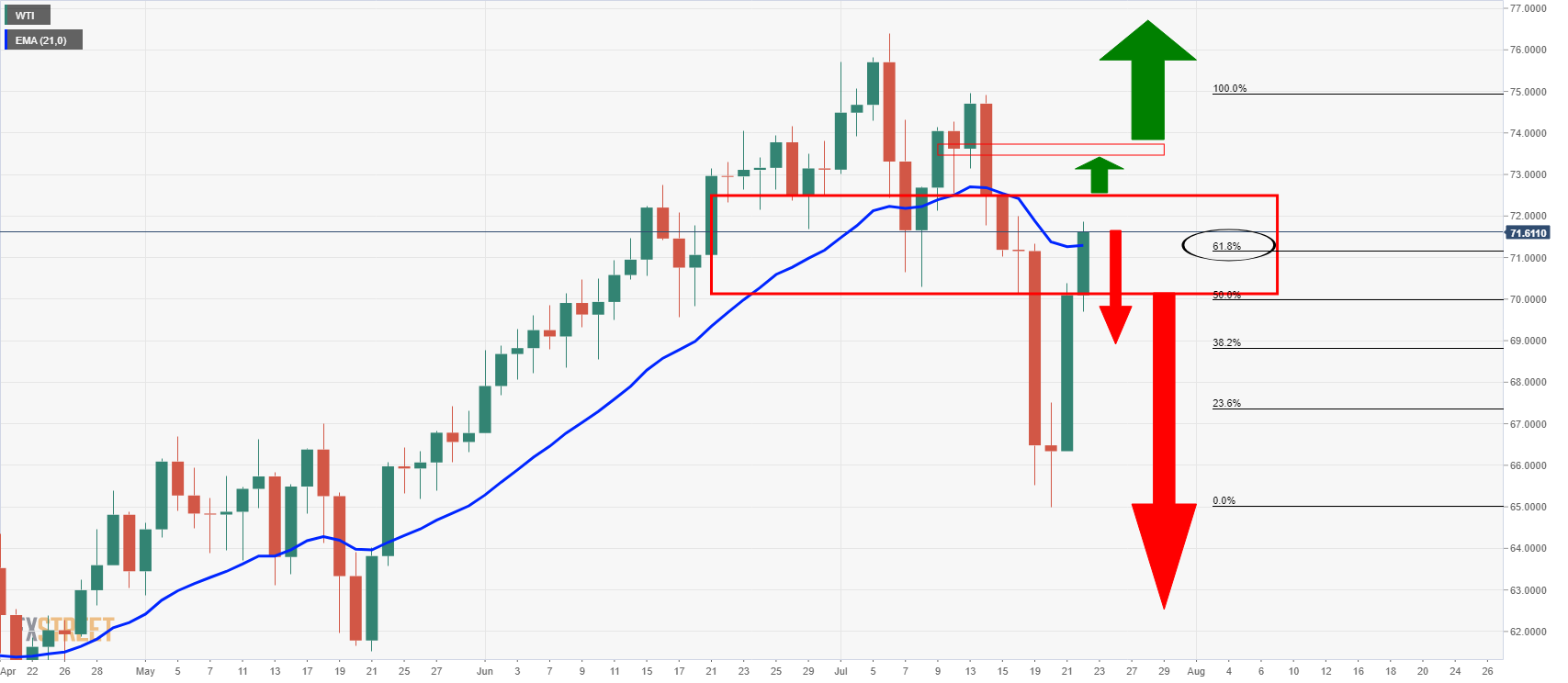

WTI, technical analysis

The price is testing the critical resistance area between 70.20 and 72.50.

The confluence of the 61.8% and 21-day EMA makes for an important price range from which a breakout would be expected to see a sustained upside continuation.

On the other hand, failures here could well lead to a downside extension.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.