- NASDAQ: WKHS has jumped by over 6% on Wednesday, extending its uptrend.

- Workhorse Group Inc's commercial electric vehicles have an advantage amid lockdowns.

- R.F. Lafferty analyst Jaime Perez set a price target of $29, which seems modest in some senses.

Workhorse Group Inc (NASDAQ: WKHS) seems to be in the right place at the right time – and investors are taking note. The Ohio-based firm is benefiting from the trend toward electric vehicles – and growing demand for deliveries amid the raging pandemic.

COVID-19 vaccines are coming – but so is winter. As US coronavirus cases, deaths, and hospitalizations continue rising, state governors are imposing new restrictions. Mask-wearing mandates, school closures – and stay-at-home orders – cause consumers to shy away from streets and shopping malls. Cold temperatures also encourage staying at home and ordering deliveries.

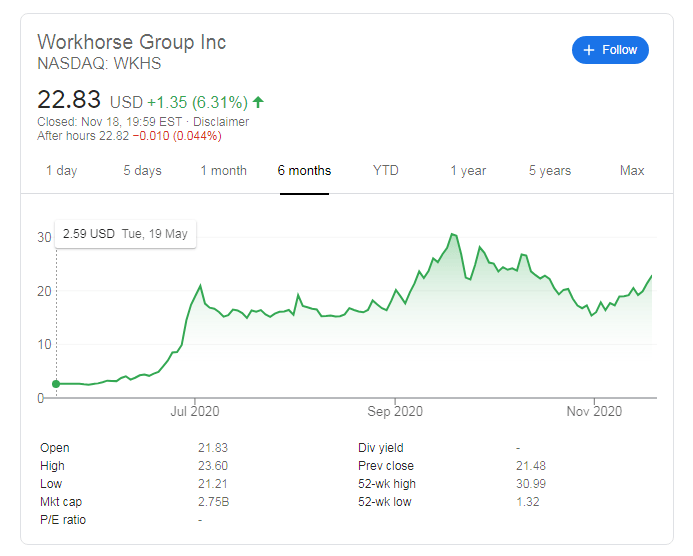

NASDAQ: WKHS shares jumped by 6.31% on Wednesday to close at $22.83. As the chart shows, the current upswing in Workhorse shares is on a moderate slope – not a parabolic one seen in July. The healthy advance could help it extend its gains toward the all-time high of $30.99. an interim target is $26.58, which was a top point in October.

Workhorse Group news

Workhorse's advantage has not been lost on Jaime Perez, an analyst with R. F. Lafferty. Perez initiated coverage of WKHS with a buy rating and an initial target of $29. He stressed that the firm is the current leader in electric commercial vehicles – ahead of Tesla (NASDAQ: TSLA).

Elon Musk's company announced its Cybertruck, but it is still in prototype mode and lacks the vast testing experience that Workhorse has accumulated – five million miles and counting. Another competitor is Ford (NYSE: F) which is dominating America's pickup truck sector and has launched its E-Transit van.

Nevertheless, Workhorse CEO Duane Hughes can probably be pleased with the rating and with his company's stake in Lordstown Motors Corp (NASDAQ: RIDE) run by the same founder, Steve Burns. RIDE has surged by 11.34% on Wednesday and is set to extend its gain, also boosting WKHS shares.

More WKHS Stock Price: Workhorse Group Inc has five reasons to extend its bullish surge

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.