US ISM Manufacturing PMI Overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 14:00 GMT this Wednesday. Consensus estimate point to a modest downtick to 55.00 for April from 55.3 recorded in the previous month and any significant deviation has the potential to trigger some choppy US Dollar price action ahead of the latest FOMC monetary policy update later during the US session.

“With the US economy accelerating to 3.2% annualized growth in the first quarter, hiring strong, consumer and business spending picking up and consumer optimism restored there is every reason to expect purchasing managers to sense the uptick in growth and to sense and act accordingly,” writes Joseph Trevisani - FXStreet's own Analyst.

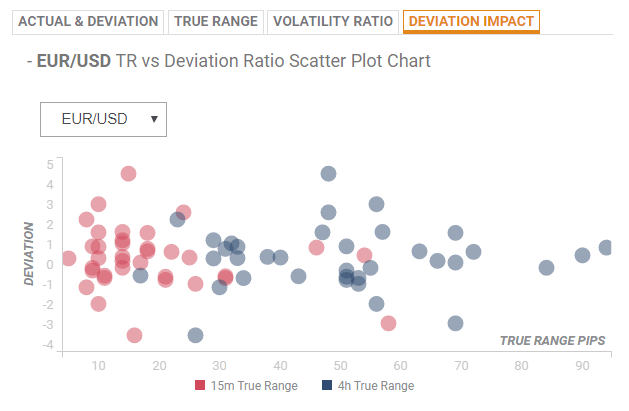

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed, the reaction in case of a relative deviation of +0.52 or -0.69 is likely to be in the range of 11-18 pips in the first 15-minutes and could stretch to around 29-34 pips in the subsequent 4-hours.

How could it affect EUR/USD?

Ahead of the release, Yohay Elam, FXStreet's own Analyst offers important technical levels to trade the major: "The recent high at 1.1230 is the immediate line to watch on the upside and the pair faces further challenges en route to 1.1265 which capped it in late April. The 100 and 200 SMAs are blocking its way. Higher, 1.1325 was a double top in mid-April and towers above.”

“Support awaits at 1.1176 which was the low point in March. It is followed by the initial low of 1.1140 seen in late April before the current 2019 low of 1.1110. Further down, 1.1025 dates back to 2017 and can provide further support,” he added further.

Key Notes

• US Manufacturing PMI, ADP Employment: A coin with two heads

• US: FOMC and ISM manufacturing in focus – TDS

• EUR/USD Forecast: Well-positioned ahead of the Fed, more gains to come?

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.