US June CPI Overview

Wednesday's US economic docket highlights the release of the latest consumer inflation figures, due later during the early North-American session at 12:30GMT. The headline CPI is anticipated to remain flat month-on-month (m/m) in June as compared to a modest rise of 0.1% in the previous month, while the yearly rate is expected to have decelerated to 1.6% from 1.8% in May. On the other hand, core CPI - excluding food and energy costs, is predicted to tick higher to 0.2% m/m rate as against 0.1% rise recorded in April, helping the annual core inflation to hold steady at 2.0%.

As analysts at TD Securities explain - “Core inflation should remain steady at 2.0% y/y, reflecting a firm 0.2% m/m advance. We pencil in a 0.2% m/m increase in core services and a flat reading in core goods, which should help buoy core CPI overall.”

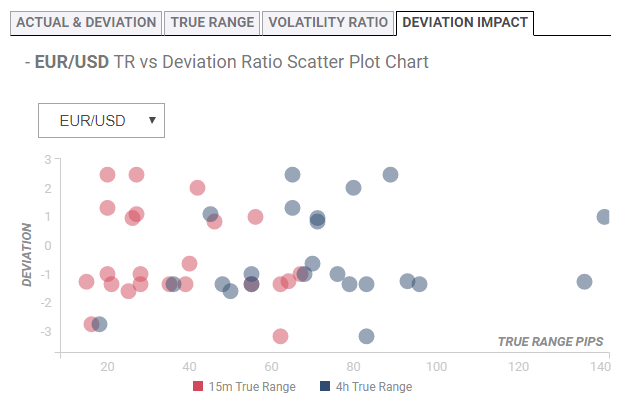

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below and as observed, the reaction in case of a relative deviation of +0.98 to -0.98 in the core CPI print is likely to be in the range of 26-25 pips during the first 15-minutes and could stretch to 55-71 pips in the following 4-hours.

How could it affect EUR/USD?

Market participants will scrutinize the data for clues over the Fed's near-term monetary policy outlook ahead of the next meeting later this July. A 25 bps rate cut is fully factored in and against the backdrop of the Fed Chair Jerome Powell's dovish testimony on Wednesday, a softer than expected reading will be enough to fuel expectations for an aggressive easing cycle in 2019 and exert some additional pressure on the already weaker US Dollar.

Yohay Elam, FXStreet's own Analyst offered his take on the EUR/USD pair and also provided important technical levels to watch for – “The technical picture for EUR/USD has significantly improved. The world's most popular currency has set a higher low at 1.1195 and has crossed above the 50 and 200 Simple Moving Averages on the four-hour chart. Moreover, momentum has turned positive and the Relative Strength Index is on the rise.”

“The 100 SMA at the round number of 1.1300 may serve as resistance but the more significant caps are higher. 1.1320 capped EUR/USD in early July, while 1.1350 served as support in late June. The next lines to watch are 1.1390 and .11410. Some support awaits at 1.1270 which held up EUR/USD last week. It is followed by 1.1235 which held it down earlier this week and by the weekly low of 1.1195,” he added further.

Key Notes

• US CPI Preview: Inflation is secondary

• Powell's Power Play: Fed's five dollar downers – EUR/USD levels to watch

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.