US June CPI Overview

Wednesday's US economic docket highlights the release of the latest consumer inflation figures, due later during the early North-American session at 12:30GMT. The headline CPI is anticipated to remain flat month-on-month (m/m) in June as compared to a modest rise of 0.1% in the previous month, while the yearly rate is expected to have decelerated to 1.6% from 1.8% in May. On the other hand, core CPI - excluding food and energy costs, is predicted to tick higher to 0.2% m/m rate as against 0.1% rise recorded in April, helping the annual core inflation to hold steady at 2.0%.

As analysts at TD Securities explain - “Core inflation should remain steady at 2.0% y/y, reflecting a firm 0.2% m/m advance. We pencil in a 0.2% m/m increase in core services and a flat reading in core goods, which should help buoy core CPI overall.”

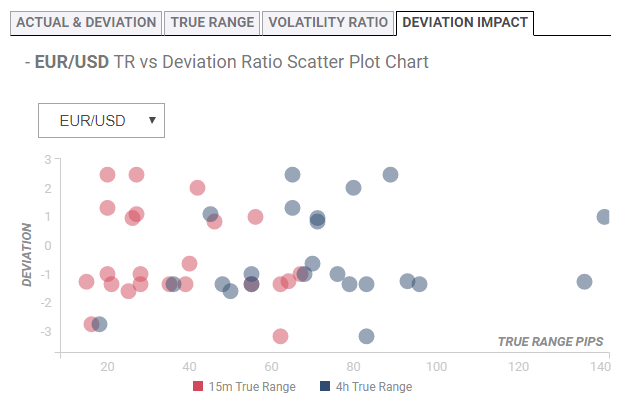

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below and as observed, the reaction in case of a relative deviation of +0.98 to -0.98 in the core CPI print is likely to be in the range of 26-25 pips during the first 15-minutes and could stretch to 55-71 pips in the following 4-hours.

How could it affect EUR/USD?

Market participants will scrutinize the data for clues over the Fed's near-term monetary policy outlook ahead of the next meeting later this July. A 25 bps rate cut is fully factored in and against the backdrop of the Fed Chair Jerome Powell's dovish testimony on Wednesday, a softer than expected reading will be enough to fuel expectations for an aggressive easing cycle in 2019 and exert some additional pressure on the already weaker US Dollar.

Yohay Elam, FXStreet's own Analyst offered his take on the EUR/USD pair and also provided important technical levels to watch for – “The technical picture for EUR/USD has significantly improved. The world's most popular currency has set a higher low at 1.1195 and has crossed above the 50 and 200 Simple Moving Averages on the four-hour chart. Moreover, momentum has turned positive and the Relative Strength Index is on the rise.”

“The 100 SMA at the round number of 1.1300 may serve as resistance but the more significant caps are higher. 1.1320 capped EUR/USD in early July, while 1.1350 served as support in late June. The next lines to watch are 1.1390 and .11410. Some support awaits at 1.1270 which held up EUR/USD last week. It is followed by 1.1235 which held it down earlier this week and by the weekly low of 1.1195,” he added further.

Key Notes

• US CPI Preview: Inflation is secondary

• Powell's Power Play: Fed's five dollar downers – EUR/USD levels to watch

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.