The German IFO Business Survey Overview

The German IFO survey for October is lined up for release later this Friday at 0800 GMT. The headline IFO Business Climate Index is expected to tick lower to 94.5 from 94.6 previous. Meanwhile, the Current Assessment sub-index is seen falling to 98.0 for October and the IFO Expectations Index – indicating firms’ projections for the next six months – is anticipated to arrive at 91.0 vs. 90.8 last.

As Joseph Trevisani, FXStreet's own analyst explains – “Business sentiments in Europe’s largest economy have fallen to their lowest levels since the financial crisis with the judgement on the current climate reaching the bottom in August and expectations following in September. Germany’s export-driven economy has seen a steep decline in optimism over the past two years that began soon after the start of the China-US trade dispute in January 2018.”

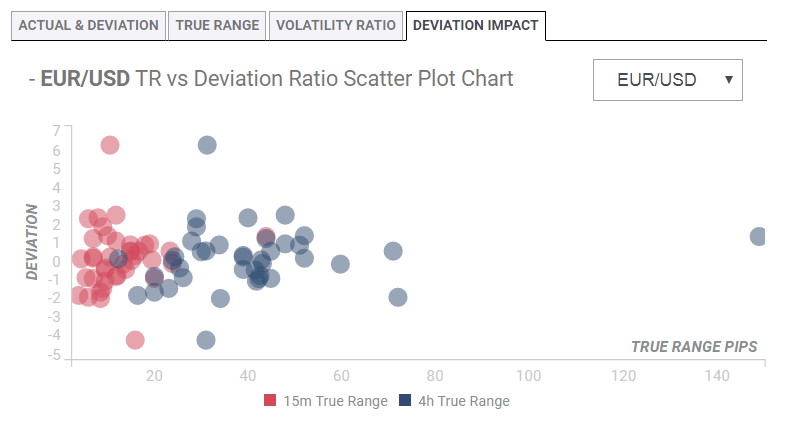

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 9 and 12 pips in deviations up to -1.94 to +2.55, although in some cases, if notable enough, a deviation can fuel movements of up to 34-48 pips in the subsequent four hours.

How could affect EUR/USD?

According to Omkar Godbole, Technical Analyst at FXStreet – “Thursday's bearish outside bar reversal candle indicates the path of least resistance is to the downside. The pair, therefore, risks falling 1.1070 – the support of the ascending trendline on the 4-hour chart. The bearish case would be invalidated if the spot rises above 1.1163. As of writing, the pair is trading in a sideways manner near 1.11 support.”

Key Notes

German October Ifo Business Survey Preview: Indicators predict recession

EUR/USD: On the defensive, eyes German IFO

EUR/USD Analysis: lower low supports a test of 1.1065

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.