Canadian CPI Overview

Wednesday's Canadian economic docket features the key release of consumer inflation figures for the month of April, scheduled to be published at 12:30 GMT. The headline CPI is anticipated to have risen by 0.4% a monthly basis, lifting the yearly to 2.0% from 1.9% previous and reaching target for the first month since December. Meanwhile, the BoC's core CPI is expected to remain flat on a monthly basis but tick higher to 1.8% yearly rate during the reported month

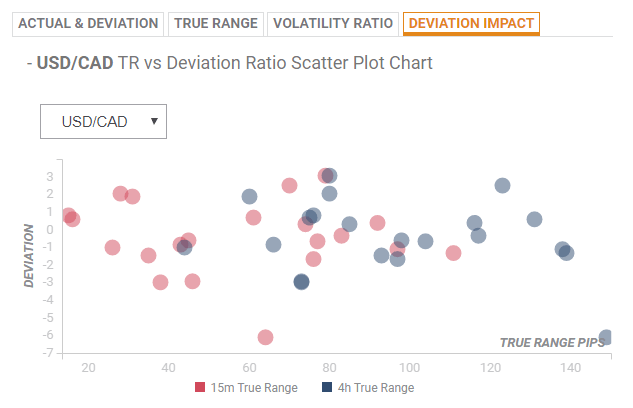

Deviation impact on USD/CAD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction on the pair is likely to be around 43-pips during the first 15-minutes and could get extended to 66-pips in the following 4-hours in case of a relative deviation of -0.86. Alternatively, the reaction to a higher than expected reading, with a relative deviation of +0.68 or higher could be around 61-pips in the first 15-minutes and 75-pips in the following 4-hours.

How could it affect USD/CAD?

Ahead of the important release, the pair was seen consolidating in a range above mid-1.3400s and even a slight disappointment could accelerate the up-move beyond the key 1.3500 psychological mark. A follow-through buying has the potential to lift the pair further beyond April swing highs, around the 1.3520 region, towards its next major resistance near the 1.3565-70 supply zone.

Alternatively, hotter than expected inflation readings should provide a goodish lift to the Canadian Dollar and drag the pair back towards the 1.3410-1.3400 region. A subsequent decline below the 1.3380 horizontal support might prompt some aggressive technical selling and turn the pair vulnerable to accelerate the slide towards testing sub-1.3300 level.

Key Notes

• Canada: Headline CPI likely to firm to 2.0% in April - TDS

• USD/CAD Forecast: Price tinkering with the downside,1.3380 guards run to 38.2% Fibo /1.33 the figure

• USD/CAD consolidates in a range, above mid-1.3400s ahead of US/Canadian macro data

About BoC's Core CPI

Consumer Price Index Core is released by the Bank of Canada. “Core” CPI excludes fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation, and tobacco products. These volatile core 8 are considered as the key indicator for inflation in Canada. Generally speaking, a high reading anticipates a hawkish attitude by the BoC, and that is said to be positive (or bullish) for the CAD.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.