The UK Economic Data Overview

The UK docket has the August month GDP data publication this Wednesday alongside the releases of the Kingdom’s Trade Balance and Industrial Production, all of which will drop parallelly at 0630 GMT.

The United Kingdom GDP is expected to arrive at +0.5% MoM in August vs. July 0.1% reading. The Index of Services (3M/3M) for August is seen sharply lower at 1.2%.

Meanwhile, the manufacturing production, which makes up around 80% of total industrial production, is expected to stand at 0% MoM in August vs. 0% recorded in July. The total industrial production is expected to come in at +0.2% MoM in Aug as compared to the previous reading of +1.2%.

On an annualized basis, the industrial production for Aug is expected to have dropped to 3.0% versus 3.8% previous while the manufacturing output is seen steady at 6% in the reported month.

Separately, the UK goods trade balance will be reported at the same time and is expected to show a deficit of £12.00 billion in Aug vs. the £12.7 billion deficit reported in July.

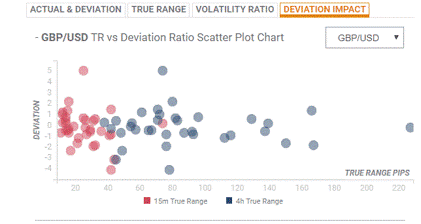

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements in excess of 60-70 pips.

How could affect GBP/USD?

At the press time, the GBP/USD is consolidating its bounce above 1.3600, as the US dollar retreats across the board. The cable remains divided between the hawkish BOE turn and rising Brexit concerns. All eyes remain on the critical UK and US macro releases due later this Wednesday.

Let’s take a look at the key technical levels for trading GBP/USD on the data releases. The pair faces immediate resistance at Tuesday’s high of 1.3638, above which the 1.3650 psychological barrier could be put to test. Further up, the two-week tops of 1.3675 will challenge the bearish commitments.

Alternatively, if the downside resumes, the GBP bears could target the 10-DMA at 1.3586. The next relevant support is seen at the multi-day troughs of 1.3569. The October 6 lows of 1.3543 could be the last line of defense for the cable optimists.

Key Notes

GBP/USD technical bearish trend continuation

US Consumer Price Index September Preview: Inflation averaging, what inflation averaging?

FOMC Minutes Preview: Fed to reiterate taper message, sending the dollar up, stocks down

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.