The UK Economic Data Overview

The UK docket has the monthly and the fourth quarter GDP releases today, alongside the trade balance and industrial production, all of which will be published later this session at 0930 GMT.

The United Kingdom GDP is expected to arrive at 0.0% m/m in December while the first readout of the Q4 GDP is seen at 0.2% q/q and 1.4% y/y.

Meanwhile, the manufacturing production, which makes up around 80% of total industrial production, is expected to show m/m growth of 0.1 % in December, up from a contraction of 0.3% recorded in November. The total industrial production is expected to come in at 0.2% m/m in Dec as compared to the previous reading of -0.4%.

On an annualized basis, the industrial production for Dec is expected to have dropped 0.4% versus -1.5% previous, while the manufacturing output is also anticipated to have dropped 0.7% in the reported month versus -1.1% last.

Separately, the UK goods trade balance will be reported at the same time and is expected to show a deficit of £11.800 billion in Dec vs. £12.020 billion deficit reported in November.

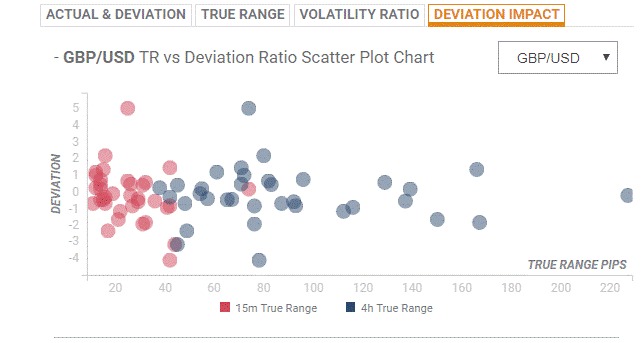

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements in excess of 60-70 pips.

How could affect GBP/USD?

The downbeat UK GDP figures could offer extra zest to the GBP bears, as the Brexit uncertainty continue to undermine the sentiment around the pound.

Haresh Menghani, FXStreet’s Analyst notes: “Looking at the technical picture, the pair has been trending lower along a short-term descending channel and every attempted bounce remained capped at 100-day SMA. The mentioned SMA, currently near the 1.2955-60 zone, closely followed by the channel resistance, around the 1.2975 region might continue to act as immediate resistance levels, above which the pair is likely to surpass the key 1.30 psychological mark and aim towards testing its next hurdle near the 1.3060-65 region.”

“On the flip side, 50-day SMA, around the 1.2900-1.2895 region, might continue to protect the immediate downside, which if broken might turn the pair vulnerable to accelerate the fall towards last week's swing high, around mid-1.2800s, before eventually dropping to test the trend-channel support,” Haresh adds.

Key Notes

Market themes of the Day: UK GDP and the manufacturing output headline

UK data and Brexit eyed, while US team heads to Beijing for more talks

GBP futures: potential rebound on the cards

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.