The UK March CPIs Overview

The cost of living in the UK as represented by the consumer price index (CPI) is due later on Wednesday at 0930 GMT.

The headline CPI inflation is expected to arrive at 0.3% inter-month in March while the annualized figure is seen accelerating 2.0%. The core inflation rate that excludes volatile food and energy items is likely to have ticked 1.9% higher last month.

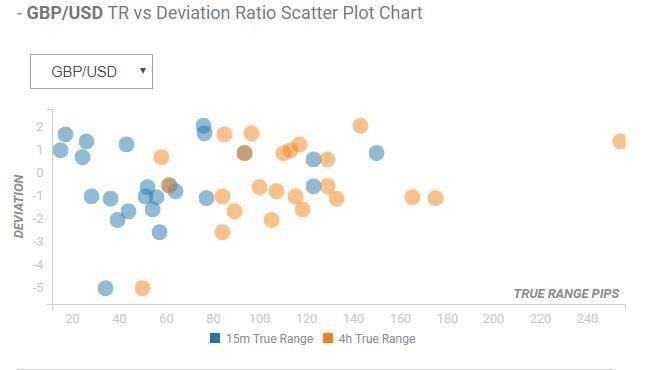

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 120 pips.

How could it affect GBP/USD?

“Despite the recovery, the short-term outlook remains neutral, as the pair is still trapped in a falling wedge - a bullish reversal pattern. A daily close above the wedge resistance, currently at 1.3106, would confirm the bullish reversal and open the doors to re-test of the previous month's highs near 1.3380. The bull breakout looks likely as the demand for GBP put options (bearish bets) has dropped sharply this month. That said, the prospects of bull breakout would weaken if the spot finds acceptance below the March 29 low of 1.2967,” FXStreet’s Analyst Omkar Godbole notes.

Key Notes

GBP/USD Bearish Break Tests 61.8% Fibonacci Support

UK: Headline and core inflation likely to print up to 2.0% in March - TDS

GBP/JPY Technical Analysis: 146.30 continues to be near-term important resistance

About the UK CPI

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD slides to its lowest level since November, eyes 1.2400 ahead of UK jobs data

GBP/USD drifts lower for the third straight day on Tuesday and drops to its lowest level since November 17 during the Asian session. Spot prices trade around the 1.2420 region as traders now look to the UK monthly employment details for a fresh impetus.

EUR/USD falls toward 1.0600 on higher expectations of the Fed prolonging higher rates

EUR/USD continues to lose ground for the sixth successive session, trading near 1.0610 during the Asian hours on Tuesday. The elevated US Dollar is exerting pressure on the pair, potentially influenced by the higher US Treasury yields.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

The week ahead: Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.